Lotte Group to Hold Regular Board Meeting on 28th

Promotion of Executive Director Shin Yu-yeol Draws Attention

Leadership Changes Expected Mainly in Underperforming Affiliates

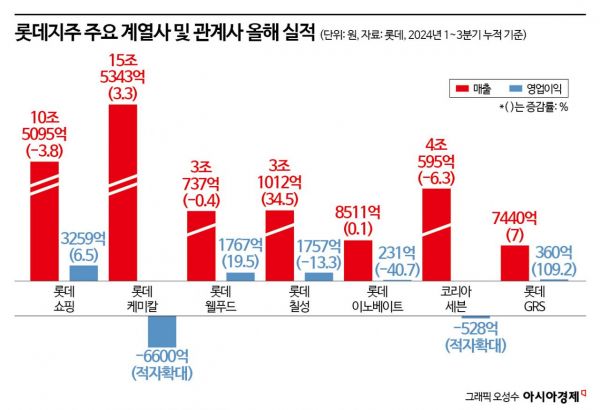

Attention is focused on the background of Lotte Group's decision to reduce investment in its new healthcare business ahead of this year's regular personnel appointments. With liquidity crisis rumors emerging due to the sluggish performance of its core affiliates in the chemical and distribution sectors, the group has initiated an earlier-than-usual regular executive reshuffle and organizational restructuring, leading to expectations that this personnel move will emphasize 'reform' to overcome the crisis.

According to Lotte Holdings on the 26th, each affiliate of Lotte Group will hold a board meeting on the 28th to carry out regular personnel appointments. The biggest focus of this personnel move is whether Shin Yu-yeol, Executive Director and eldest son of Shin Dong-bin, Chairman of Lotte Group and third-generation heir, will be promoted. This comes as the eldest son and daughter of Shin Dong-won, Chairman of Nongshim, were promoted this year, marking the full-scale start of third-generation management, and GS Retail also saw a generational shift with Heo Seo-hong, the fourth-generation owner and Head of Management Strategy SU (Vice President), being promoted to CEO.

However, Lotte is reducing the scale of investment in new businesses as it faces financial difficulties severe enough to spark liquidity crisis rumors this year. According to the Financial Supervisory Service's electronic disclosure system, Lotte Holdings announced in a corrected disclosure yesterday that it will reduce the funds planned for investment in Lotte Healthcare last October to 30 billion KRW. This is a 40% reduction from the originally decided investment amount of 50 billion KRW.

Previously, Lotte Holdings planned to pay 30 billion KRW and 20 billion KRW in installments last year and this April, respectively. However, Lotte Holdings delayed the second payment and announced the reduction of investment funds through the corrected disclosure.

Lotte Healthcare is a wholly owned subsidiary of Lotte Holdings established in April 2022 for the new healthcare business. Last year, Lotte Healthcare launched 'Cazzle,' a health management platform recommending personalized supplements to individuals, expressing its ambition to gain an edge in the digital healthcare market, but its performance was disappointing.

Cazzle faced difficulties after its launch amid allegations of technology theft from a healthcare startup. The company's sales last year amounted to about 800 million KRW. Excluding the sales of its subsidiary, Teragen Health, a genetic testing specialist with sales of 750 million KRW, Lotte Healthcare's standalone sales were around 86 million KRW. Due to poor performance and questions about business viability, Lotte Holdings appears to be slowing down its healthcare business through this disclosure.

Earlier this year, Chairman Shin Dong-bin stated in an interview with Japanese media, "We will focus on new businesses and boldly sell off underperforming ones," adding, "For businesses that do not improve even after several years, it might be better for employees if we entrust them to other companies," calling for a strong structural reform.

Therefore, there are many expectations that the upcoming regular personnel appointments will involve a merit-based system targeting underperforming affiliates. This comes amid the recent emergence of 'Lotte Group liquidity crisis rumors' in the form of unofficial reports and the spotlight on underperforming affiliates such as Lotte Chemical's corporate bond issues. The business community expects a larger scale of personnel changes at Lotte this year compared to the past. Since the liquidity crisis rumors originated from affiliate underperformance, performance is likely to be a key indicator in this personnel move.

Particularly, the future of heads of affiliates whose terms expire in March next year is drawing attention. These include Lee Dong-woo, CEO of Lotte Holdings; Lee Young-gu, CEO of Lotte Wellfood; Kang Sung-hyun, CEO of Lotte Mart & Super; Nam Chang-hee, CEO of Lotte Himart; and Kim Joo-nam, CEO of Lotte Duty Free, all of whom are approaching the end of their terms. Lotte Duty Free has been experiencing prolonged sluggishness due to weak demand from China, high exchange rates, and high inflation. Lotte Himart is also underperforming due to domestic demand weakness and competition with e-commerce.

Meanwhile, Lotte Group postponed the investor relations meeting originally scheduled to be held in Yeouido on the 28th to the afternoon of the same day when the regular personnel appointments will take place.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)