52-Week Highs from Major Shipbuilders to Equipment Suppliers

Concerns Over Surge Pressure and Next Year's Order Decline Persist

"Shipbuilding Industry Under Structural Growth... Potential for Further Rise"

Shipbuilding stocks are showing strength, boosted by the supercycle in the industry and the added effect of Donald Trump’s election as U.S. president. Securities firms analyze that due to the long industrial cycle characteristic of shipbuilding, investment horizons should be extended, and although temporary fluctuations may occur, the overall industry trend remains in an upward cycle.

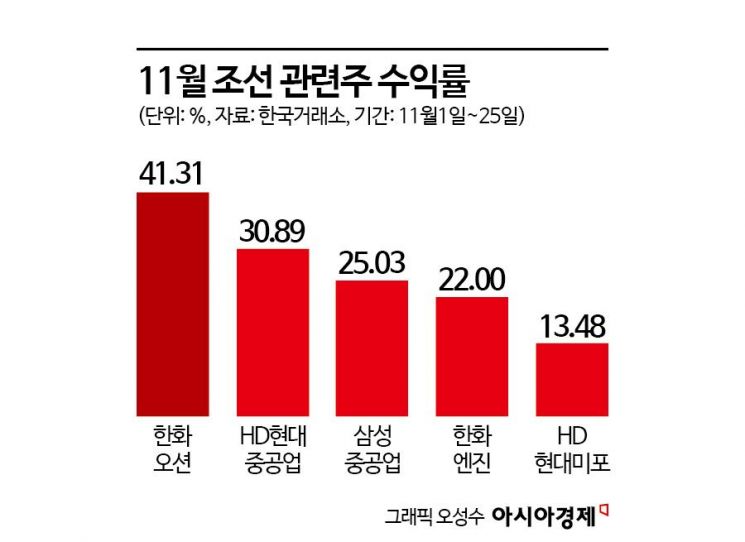

According to the Korea Exchange on the 26th, Hanwha Ocean closed at 37,750 KRW, up 41.31% since the beginning of this month. Other stocks such as HD Hyundai Heavy Industries (30.89%), Samsung Heavy Industries (25.03%), Hanwha Engine (22.00%), and HD Hyundai Mipo (13.48%) also rose. Notably, large shipbuilders including Samsung Heavy Industries and HD Hyundai Heavy Industries, as well as ship equipment suppliers like Hanwha Engine, Dongsung FineTec, and Sungkwang Bend, all simultaneously hit 52-week highs the previous day. Since Trump proposed cooperation with the Korean shipbuilding industry on the 7th, these stocks have firmly established themselves as 'Trump beneficiary stocks.'

While some market participants express concerns about the recent sharp rise in shipbuilding stocks, securities firms assess that it is not yet a level to worry about significantly. Youngsoo Han, a researcher at Samsung Securities, stated, "This year’s rise in shipbuilding sector stock prices has mostly been accompanied by upward revisions in earnings estimates," adding, "From a valuation perspective, the burden is not as large as expected."

Han also emphasized the need for a long-term investment perspective in the shipbuilding sector. He said, "Because shipbuilding has a long industrial cycle, once it enters a boom period, the direction of the industry does not change easily," and "Most companies have already secured orders for more than three years, so external variables are unlikely to have a significant impact on performance in the near term."

Some have pointed out that orders for container ships from the three major domestic shipbuilders will sharply decline next year, but this is not considered a major concern. Seunghan Han, a researcher at SK Securities, explained, "China aggressively expanded its production capacity (CAPA) this year, dominating the global container ship market, which has eliminated delivery time advantages," and added, "Among container shipping companies, large-scale dual-fuel (DF) container ship orders remain from HMM, YangMing, and Evergreen, and given the friendly relationships with these companies, the three domestic shipbuilders have a high likelihood of securing these orders."

Han also mentioned that shipping companies that have not secured eco-friendly vessels still have the possibility of ordering eco-friendly container ships. He noted, "Due to the nature of container ships, they are sensitive to environmental regulations from the International Maritime Organization (IMO). If the mid-term regulatory measures agreed upon at the Marine Environment Protection Committee (MEPC) meeting scheduled for April next year are stricter than market expectations, global shipping companies may continue to place orders for eco-friendly vessels to build green fleets," adding, "Since the first half of next year is expected to be the commercialization period for ammonia-powered ship engines, speculative orders to secure slots (shipbuilding space) for ammonia-powered container ships may also occur."

While additional short-term stock price increases could cause volatility, attention should be paid to the fact that the shipbuilding industry itself is maintaining a massive upward trend. Kyungjae Wi, a researcher at Hana Securities, forecasted, "With the advent of the liquefied natural gas (LNG) ship era, the domestic shipbuilding industry will ride a long-term upward trend," and "The arrival of the bulk carrier cycle will act as a factor that eases competition intensity with China." He added, "Volatility may increase due to minor concerns, but at the same time, the potential for price rises will grow with even small opportunities," concluding, "Based on operating leverage effects and structural changes in the industry, the cycle’s direction will be upward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)