Jensen Huang: "Expedite Approval for Samsung AI Chip Usage"

Industry Focuses on Context and Impact of Statement

"Also Collaborating with TSMC," Samsung's Shift Recognized

Full Competition with SK Hynix Expected Once Supply Begins

"16-Layer+ HBM Will Spark Process Technology Battle"

Jensen Huang, CEO of Nvidia, has drawn industry attention with his statement about expediting approval for the use of Samsung Electronics' artificial intelligence (AI) memory chips. This is being regarded as his most proactive and specific comment regarding Samsung products recently.

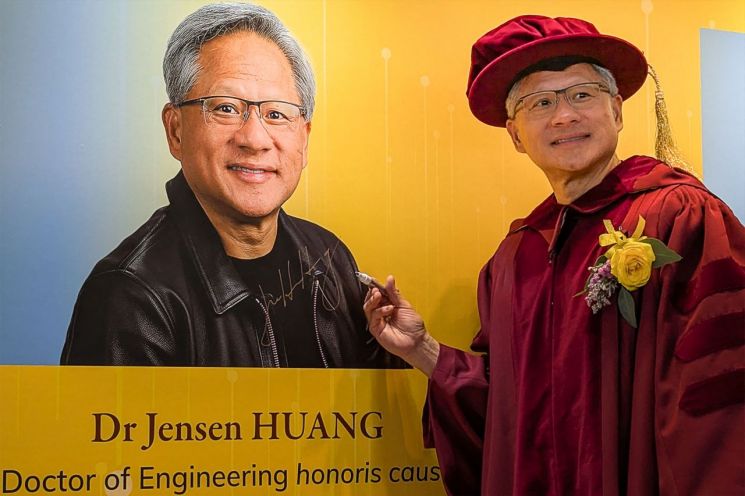

According to foreign media including Bloomberg, Huang said in an interview with Bloomberg TV on the 23rd (local time) after attending the honorary doctorate degree ceremony at the Hong Kong University of Science and Technology, "We plan to proceed with approval for Samsung Electronics' AI memory chip supply as quickly as possible." He added that they are considering receiving both the 8-stack and 12-stack versions of Samsung's 5th generation high-bandwidth memory (HBM) 3E, which are currently under verification. Huang's remarks came about eight months after he mentioned at the annual developer conference ‘GTC 2024’ held in San Jose, USA, in March that he was "testing Samsung's HBM and has high expectations," and personally signed the HBM3E 12-stack product displayed at the booth.

His comments are attracting attention because they contrast with recent evaluations of Samsung Electronics. The industry had been pessimistic about the possibility of Samsung supplying HBM3E to Nvidia. The qualification test, reportedly ongoing for over a year, had stalled with no clear completion date, and there were rumors of disagreements between the two sides over product yield and heat dissipation issues. Recently, after the Q3 (August to October) earnings announcement, Huang showed a cold attitude by mentioning memory suppliers such as SK Hynix and Micron during the conference call, but not Samsung Electronics.

Huang's specific mention of Samsung in this interview is closely related to changes beginning to appear within Samsung. In particular, Samsung's decision that if the customer desires, HBM can be produced not by Samsung itself but in cooperation with competitor TSMC through foundry (semiconductor contract manufacturing) is widely seen in the industry as having opened the negotiation deadlock with Nvidia.

Samsung's foundry had intended to apply gate-all-around (GAA) technology starting from the 3nm (1nm = one billionth of a meter) process but fell behind in customer acquisition competition due to yields not meeting expectations. Currently, there is a large gap in market share compared to world No.1 TSMC. As of Q2 this year, TSMC holds 62.3% and Samsung Electronics 11.5%. Samsung appears to have judged that by utilizing TSMC foundry, concerns about yield can be alleviated and customers reassured.

Experts emphasize that if Samsung supplies HBM3E to Nvidia, it signifies the start of a direct confrontation with SK Hynix. Since both companies share the same customer, Nvidia, their products of the same type are likely to be directly compared in terms of performance and technology. Nvidia’s situation, with large-scale production and sales of Blackwell scheduled from Q4 this year, seems to have triggered competition between the two companies. The industry believes Nvidia aims to diversify the HBM supply system, which SK Hynix had monopolized, and induce competition to gain an advantageous position in price negotiations.

The competition between Samsung Electronics and SK Hynix is expected to intensify with HBM3E and continue through the 6th generation HBM4. SK Hynix targets mass production of HBM4 in the first half of next year. Not to be outdone, Samsung Electronics is also focusing on HBM4 development, led by the newly established HBM development team in July.

Kyunghee Kwon, a research fellow at the Korea Institute for Industrial Economics & Trade, said, "Huang’s recent remarks likely stem from the judgment that increasing the number of HBM suppliers is advantageous for Nvidia," adding, "After Samsung’s supply, the HBM competition will be a battle over which company’s process technology can stack DRAM in higher layers more precisely and yield better results, assuming products will exceed 16 stacks in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)