Costs for Ukraine Recovery and Reconstruction: South Korea Ranks 14th After the US, EU, and Japan

Only Three Domestic Construction Companies Operate Local Branches in Ukraine

"Securing Local Government Funding Expected to Be Challenging, Careful Review Needed"

As the possibility of an early end to the Russia-Ukraine war increases, expectations for domestic companies' participation in reconstruction projects are also rising. Although footholds are being established through agreements with local governments, concerns have been raised that domestic companies' achievements in entering the local market are relatively low and South Korea's amount of grant aid is small, indicating the need for continuous attention from both the government and companies.

On the 24th, the Construction Industry Research Institute announced in its trend briefing "Prospects for Ukraine Reconstruction Projects and the Competitiveness of Our Companies" that since the Russian invasion, South Korea ranked 14th in the international community's costs related to Ukraine's recovery and reconstruction (financial support + humanitarian aid), following the EU, the United States, Germany, the United Kingdom, Japan, and others.

Since 2022, the government has continuously pursued activities to create conditions for participation in local reconstruction projects with the Ukrainian government agencies and the international community. To facilitate the entry of South Korean public and private companies and their participation in projects, memorandums of understanding (MOUs) have been signed with the governments of both countries or third countries. Ukraine is expected to continue receiving support projects in four key areas as a priority cooperation country for South Korea's official development assistance (ODA). The key cooperation areas mentioned in the government's announced "Ukraine National Cooperation Strategy" are transportation, industry, health and sanitation, and public administration.

According to Engineering News-Record, looking at the activities of global construction companies (in the construction sector) in Ukraine over the past 10 years, GS Engineering & Construction carried out construction activities in 2020-2021. In the engineering sector during the same period, Dohwa Engineering was active in 2020, Dohwa Engineering and Yushin in 2021 and 2022, and Dohwa Engineering alone in 2023. Additionally, the share of Ukraine in the total overseas orders of South Korean companies is only 0.03% (316.8 million USD, 25 cases).

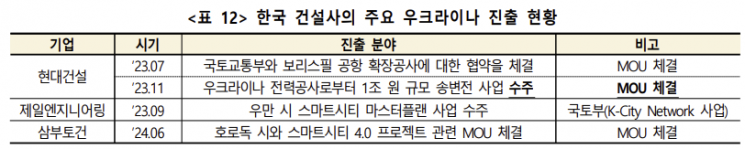

Although domestic companies are pushing forward activities to establish footholds in Ukraine, most are limited to signing MOUs. It was reported that Hyundai Engineering & Construction won a transmission line project worth 1 trillion KRW from the Ukrainian Power Corporation in November last year, but in reality, it was an MOU signing. According to the Construction Industry Research Institute, only three construction companies operate local branches, including Hyundai Engineering & Construction, which newly established a local branch last year, Dohwa Engineering, and Dongmyung Technical Corporation.

The Construction Industry Research Institute explained, "Upon reviewing the status of South Korean construction companies' entry into Ukraine mentioned in materials published by recent consulting firms, it was confirmed that some projects were signed as MOUs rather than actual contracts," adding, "Compared to competitors from Turkey, China, and others, domestic companies have relatively low achievements in Ukraine, so they are currently pursuing a series of activities such as establishing footholds through MOUs with local and third-country companies and local governments (public institutions) to secure competitiveness."

The Construction Industry Research Institute pointed out that continuous interest and efforts from both the public and private sectors are necessary for participation in post-war reconstruction projects. It stated, "Reconstruction projects promoted based on grant aid funds are likely to involve construction companies from the donor countries, and companies from the U.S. and EU are expected to take the lead," adding, "Since South Korea's support amount is not large, the projects available for participation in the short term are expected to be limited."

The institute also noted, "However, when multiple reconstruction projects are simultaneously promoted in the future, a sudden surge in demand and supply disruptions for construction labor and materials may cause rapid increases in construction costs, which could become a cost burden for participating construction companies," and "There is a shortage of skilled personnel (up to 40%) among local construction companies, and even if the war ends, the shortage of skilled workers and construction laborers is expected to persist for a considerable period."

The Construction Industry Research Institute also recommended thorough investigations before entering Ukraine, citing precedents in past reconstruction projects in Iraq and Libya where construction was halted or unpaid receivables occurred due to financing issues or local political instability.

It pointed out, "Although Iraq and Libya are oil-producing countries, they faced difficulties in securing funds, so local governments, which did not have strong financial capacity even before the war, are expected to struggle to secure their own funds for reconstruction projects," and "If a ceasefire agreement rather than a formal end to the war is signed between the two countries, there is a possibility that martial law will continue to be enforced, leading to internal political issues such as the non-holding of elections."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)