Analysis of Collection Period for Construction Receivables of the Top 5 Construction Companies

In the third quarter of this year, among the top five domestic construction companies, Samsung C&T, Daewoo Engineering & Construction, and DL E&C experienced an increase in the collection period for construction costs. Due to the economic downturn caused by rising construction costs and high interest rates, even large construction companies seem to be facing significant difficulties in collecting construction payments.

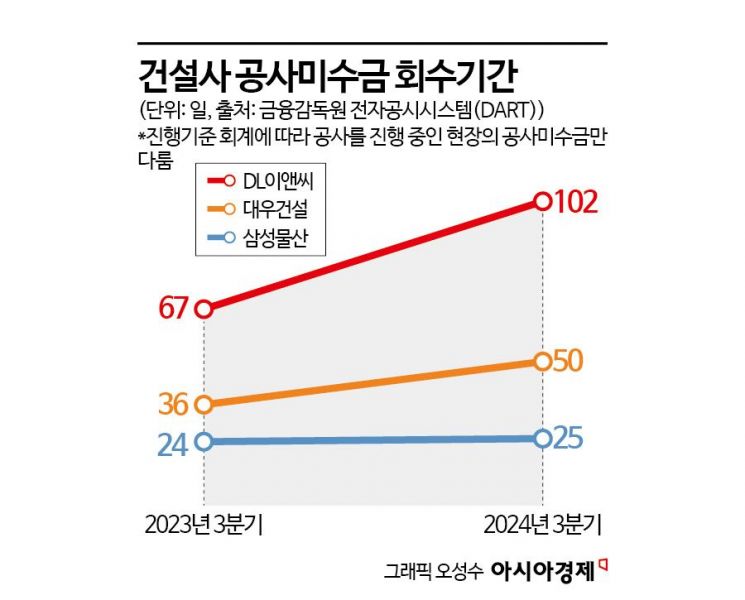

DL E&C Construction Receivables Collection Period Increased from 67 Days to 102 Days

According to an analysis of sales generated from construction sites (contracts with sales exceeding 5% year-on-year) and construction receivables for the third quarter of this year and the third quarter of last year, disclosed on the Financial Supervisory Service’s electronic disclosure system (DART) on the 25th, the collection period for construction receivables at ongoing sites lengthened for Samsung C&T, Daewoo E&C, and DL E&C.

DL E&C took 102 days to collect construction receivables in the third quarter of this year, which is more than a month longer than the 67 days recorded in the third quarter of last year. This means that even though construction was performed in the third quarter of this year, payment for it was not received within the same quarter. Daewoo E&C’s collection period increased from 36 days to 50 days, and Samsung C&T’s from 24 days to 25 days during the same period.

Construction receivables refer to the construction payments that a construction company has not yet received despite having performed contracted work. These are recognized as accounts receivable, representing money earned but not yet collected. Since accounts receivable are included in sales, changes in the collection period for construction receivables are generally gauged by the increase or decrease in receivables relative to sales.

For example, if a construction company recorded sales of 10 billion KRW and construction receivables of 2 billion KRW in the third quarter of this year, the collection period for construction receivables would be calculated as 92 days (the length of the quarter) divided by 5 (sales of 10 billion KRW / receivables of 2 billion KRW), resulting in 18 days.

Construction Sales Decline Leads to Longer Construction Receivables Collection Period

Although the collection periods for construction receivables increased for these construction companies, the reasons varied slightly.

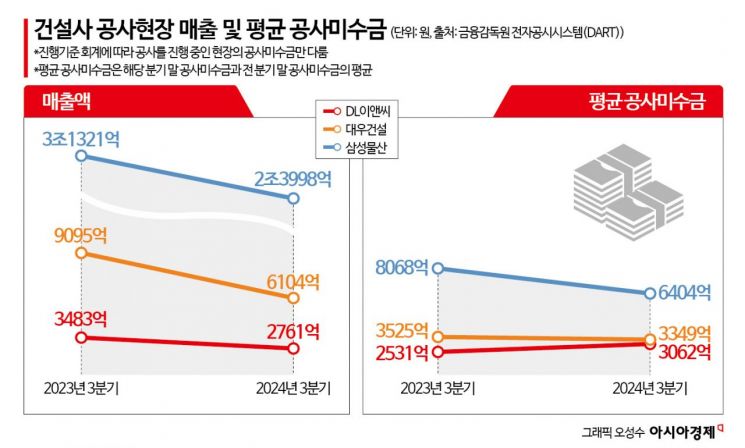

DL E&C’s collection period lengthened due to an increase in construction receivables. DL E&C’s receivables rose from an average of 253.1 billion KRW in the third quarter of last year to 306.2 billion KRW in the third quarter of this year, marking a 21.0% increase year-on-year.

In contrast, Daewoo E&C (352.5 billion KRW → 334.9 billion KRW) and Samsung C&T (806.8 billion KRW → 640.4 billion KRW) saw a decrease in the scale of construction receivables. However, the collection period increased because the decline in sales was more significant. Daewoo E&C’s sales dropped by 32.9% from 909.5 billion KRW in the third quarter of last year to 610.4 billion KRW in the third quarter of this year, while construction receivables decreased by 5.0% during the same period.

Samsung C&T also experienced a larger decrease in sales compared to construction receivables. Sales from construction sites in the third quarter of this year were 2.3998 trillion KRW, down 23.4% from 3.1321 trillion KRW in the same period last year. Construction receivables decreased by 20.6% (from 806.8 billion KRW to 640.4 billion KRW) during the same period.

At Daewoo E&C, the highest average construction receivables were recorded at the Iraq New Port Phase 1 construction site, contracted in August 2021, with 61.5 billion KRW. Sales generated from this construction decreased from 235.4 billion KRW in the third quarter of last year to 95.3 billion KRW in the third quarter of this year. The progress rate stands at 72.4%.

Samsung C&T accumulated the most construction receivables at a site nearing completion. The average construction receivables in the third quarter of this year at the Display and Semiconductor Production Process (FAB) Phase 3 new construction site in Pyeongtaek, Gyeonggi Province, contracted in October 2021, amounted to 182.5 billion KRW.

Park Cheol-han, a research fellow at the Economic Finance and Urban Research Division of the Korea Construction Industry Research Institute, said, "Although construction costs have recently increased, companies could sustain profits by increasing sales, but as the construction market downturn continues, sales are falling and profits are decreasing. Large construction companies have more resilience than small and medium-sized firms and can endure to some extent, but the decline in sales from construction sites will make future financing through financial institutions more difficult."

Meanwhile, Hyundai Engineering & Construction’s collection period for construction receivables at ongoing sites shortened from 54 days in the third quarter of last year to 27 days in the third quarter of this year. Hyundai Engineering also reduced its collection period from 36 days to 28 days during the same period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.