Closing Down Despite Announcing 10 Trillion Won Share Buyback

"Foreign Investor Supply More Important Than Share Repurchase"

Earnings Momentum Drives Supply and Demand

Competitiveness Recovery by 2025 Is Key

Samsung Electronics fell for two consecutive trading days despite announcing a 10 trillion won share buyback plan. Even executives who purchased shares before the buyback announcement are now facing potential losses.

According to the Korea Exchange on the 21st, Samsung Electronics closed at 55,300 won, down 1.78% (1,000 won) from the previous trading day. On that day, Samsung Electronics started with a decline (opening price 56,100 won) and the drop widened, pushing the price down to the 55,000 won range. Foreign and institutional investors sold shares as soon as the market opened, driving the stock price down. Foreign investors and institutions sold 68.71 billion won and 15.498 billion won worth of shares, respectively.

Samsung Electronics announced a 10 trillion won (0.84% of common shares) share buyback plan on the 15th. This is the first time in six years since 2018 that Samsung Electronics has decided to repurchase its shares. Of the 10 trillion won, 3 trillion won will be used to buy back shares from November 18 to February 17 of next year.

Samsung Electronics closed at 49,900 won the day before the buyback announcement, which caused the KOSPI index to wobble. On the day of the buyback announcement alone, the stock surged 7.21% to close at 53,500 won. On the next trading day, the 18th, it rose another 5.98% to close at 56,700 won, but then fell for two consecutive trading days from the 19th, sliding down to 55,300 won.

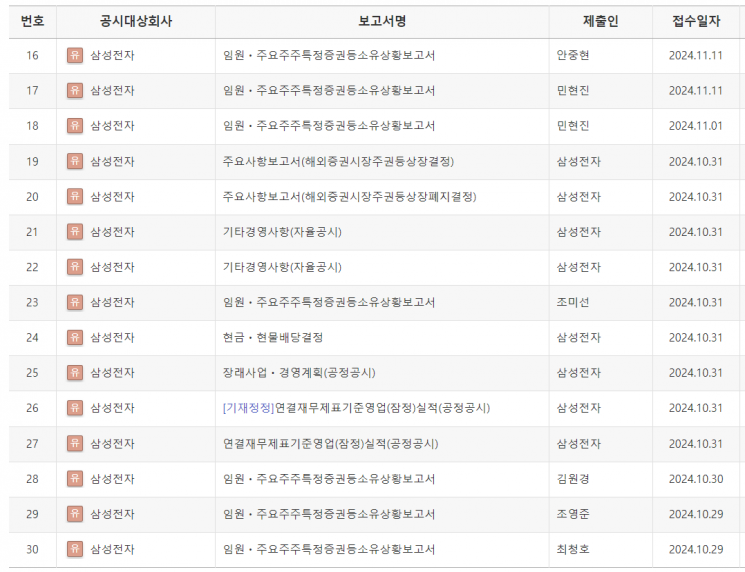

As a result, Samsung Electronics executives who purchased shares before the buyback announcement are now facing potential losses. On the 11th, Samsung Electronics disclosed in the 'Report on Ownership Status of Executives and Major Shareholders' that Vice President Shin Hyunjin, Executive Director Park Cheolwoong (SET Division), Executive Director Choi Cheolhwan (DS Division), and Executive Director Lee Jaeho (DX Division) had purchased Samsung Electronics shares.

Vice President Shin had no shares before but bought a total of 980 shares on the day of the buyback announcement. Of these, 500 shares were acquired at 53,500 won each, and the remaining 480 shares at 53,800 won each. Executive Director Park had no shares but purchased 1,001 shares on the day before the buyback announcement (the 14th) at an acquisition price of 51,100 won.

Executive Director Choi newly acquired 39 preferred shares and 181 common shares on the 12th, increasing his common shares to 582 after the purchase. The average acquisition prices for preferred and common shares were 53,400 won and 54,600 won, respectively. Executive Director Lee held 83 shares of Samsung Electronics and bought 20 shares on the day of the buyback announcement, increasing his holdings to 103 shares. His acquisition price was 50,300 won, the lowest among recent buyers.

The market expects the stock price direction to be influenced by earnings momentum. Without earnings improvement, there is no incentive for foreign investors to participate. Kyungbeom Ko, a researcher at Yuanta Securities, said, "The November 2014 share repurchase was driven by a market surprise momentum, and since 2016, share repurchases have been influenced more by foreign investor demand and earnings momentum." He pointed out, "Significant stock price increases accompanied the six share buyback processes conducted since April 2016." He added, "In other words, the impact of earnings momentum, such as the semiconductor supercycle, was greater than the share repurchase issue."

Youngmin Ko, a researcher at Daol Investment & Securities, also analyzed, "While the share repurchase decision may strengthen short-term stock price rebounds and downside rigidity, the upside is expected to be limited in a trading range until meaningful signs of fundamental recovery are confirmed." He emphasized, "The most important aspect in 2025 will be confirming clues for the recovery of core competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.