This Is the First Data Center Investment by the Government Employees Pension Service

National Pension Service Specifies Data Center in Asset Manager Recruitment Conditions

Foreign Firms Already Entered... FI Supply Share Approaching 90%

Data centers are emerging as a new investment opportunity for domestic pension funds and mutual aid associations. The investment focus is diversifying away from offices, which have dominated the commercial real estate market.

According to the financial investment industry on the 20th, the Korea Local Government Officials Mutual Aid Association (Haengjeong Gongjehoe) recently decided to invest approximately 130 billion KRW in the Ansan data center development project. This is the first time the institution has invested in a data center, and it is also unusual that the investment is a project investment rather than a blind fund (raising capital without specifying the investment target). The National Pension Service, which is selecting a real estate core platform fund manager for the first time in six years (with a total scale of 750 billion KRW), has specifically identified data centers as an investment target.

Foreign Firms Took the Lead... Korean Pension Funds Follow

The project that Haengjeong Gongjehoe has decided to invest in is the "CamSquare Ansan Data Center" development project. It is a project to build a data center with five underground floors and seven above-ground floors, totaling 27,000 pyeong (approximately 89,256 square meters) of gross floor area, on a 13,340.6 square meter (about 4,000 pyeong) site in Seonggok-dong, Danwon-gu, Ansan, Gyeonggi Province, located in the Banwol-Sihwa National Industrial Complex. The total project cost is about 1 trillion KRW. The participation of Haengjeong Gongjehoe is said to have accelerated the project significantly. Construction is scheduled to start in December, with completion targeted for 2027.

In the case of the National Pension Service, among various conditions set for selecting a real estate fund manager, the first mentioned investment target was the "New Economy," with data centers being the foremost. As domestic pension funds and mutual aid associations have consecutively invested or plan to invest in data centers, the market is responding with speculation that there may be a shift in the previously conservative real estate investment trend. Unlike foreign firms that have actively entered the data center market about four years ago, domestic pension funds have mainly focused on investing in Grade A office markets. Representative examples include Singapore’s sovereign wealth fund, the Government of Singapore Investment Corporation (GIC), and the Canada Pension Plan Investment Board (CPPIB), both of which have already invested in domestic data center projects.

Market Size Growing 10% Annually... Direct Beneficiary of the 'AI Revolution'

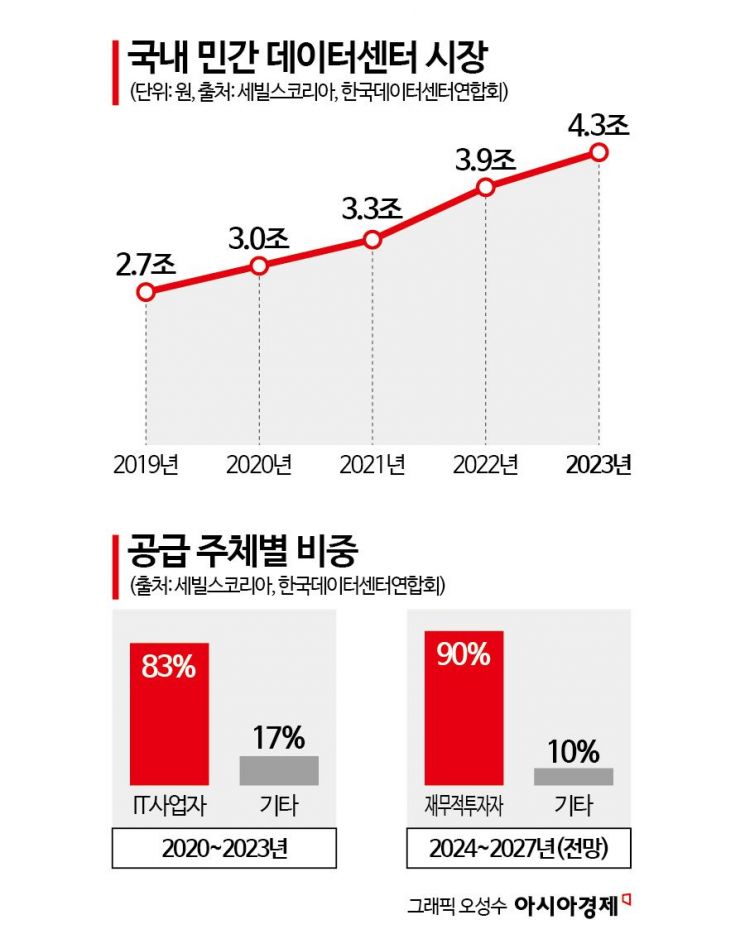

Institutional investors, both domestic and international, are opening their wallets for data centers. This is confirmed by statistics. According to Savills Korea, a global real estate services firm, from this year through 2027, 90% of data center supply is being developed by financial investors (FIs). This is a complete turnaround from the past when IT service providers such as telecom companies led the market. From 2020 to 2023, 83% of the supply was led by IT service providers. The data center market is also growing rapidly. Based on private sector data, the market size increased from 2.7 trillion KRW in 2019 to 4.3 trillion KRW in 2023, with an average annual growth rate exceeding 10%.

The reason data centers are attracting attention is due to the surge in data usage driven by the "AI revolution," and the expectation that demand will increase further during periods of interest rate cuts. Even amid a sluggish domestic stock market, the stock prices of three power equipment companies (Hyosung Heavy Industries, HD Hyundai Electric, and LS ELECTRIC) are performing well due to increased power demand from AI data centers. Park Jun-woo, team leader of the Alternative Securities Investment Department at Aegis Asset Management, said, "Data centers, which are expected to see explosive demand growth due to the global AI industry expansion, are the most notable investment sector in the commercial real estate market. Securing suitable sites is not easy, making supply difficult, which also means there is significant potential for rent increases, making it attractive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.