Global PEF Offices Move from China to Korea Amid Funding and Withdrawal Barriers

Private Loans Expand for Korean Firms Facing Bank Regulations and Stock Market Slump

Contrary to the neglected domestic stock market, foreign private equity fund (PEF) managers are accelerating their entry into Korea. It is expected that they will expand their presence by increasing private lending to domestic companies that have no place to raise funds due to strengthened bank loan regulations and stock market stagnation.

According to the investment banking (IB) industry on the 20th, following the opening of a Seoul branch by the US-based PEF Apollo, the UK-based PEF ICG (Intermediate Capital Group) is also planning to establish an office within the year.

Recently, Apollo opened a branch in the International Finance Center (IFC) in Yeongdeungpo-gu, Seoul, appointing former Samsung Securities Vice President Lee Jae-hyun as the head of Korea. Since 2006, Apollo has expanded its presence across Asia, entering markets such as Tokyo, Sydney, Hong Kong, Mumbai, and Singapore.

ICG is also planning to separate its Korea team from its Hong Kong office and open a Seoul office within the year. ICG is a global asset management firm headquartered in London, UK, with total assets under management (AUM) reaching $68.5 billion (approximately 95 trillion KRW). It is recognized as a reputable manager in the global market for alternative investments and private lending.

Global PEFs Blocked from Investing in China Are Nesting in the Korean Market One After Another

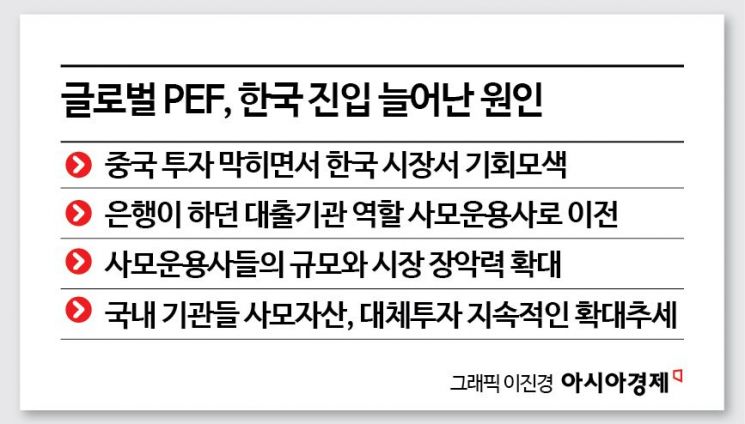

A CIO of a domestic A pension fund said, "These PEFs have already received significant capital from Korea, but recently they have been moving actively," adding, "As investments in China have been blocked in the Asia-Pacific region, they seem to be looking for opportunities in Korea, which still has various favorable conditions."

As Korea grows into the third largest market in Asia after China and Japan, global PEFs are actively establishing offices directly in the Korean capital market. They are seeking opportunities in the Korean market instead of China, where capital investment and recovery have become difficult.

Starting with Blackstone, the largest US PEF manager, EQT Partners, a PEF of the Swedish Wallenberg family, has also opened an office in Korea. US-based firms such as Pretium Partners, Nuveen Asset Management, Orchard, and UK-based financial firms like Man Group and Coller Capital have also established a presence in Korea. Existing entrants such as Kohlberg Kravis Roberts (KKR), Carlyle, TPG, Bain Capital, CVC, and Affinity Equity Partners have increased their investment personnel in their domestic offices and corporations.

Korean Companies with No Place to Borrow Money Reach Out to Foreign PEFs

This also reflects the fact that as Korean companies face difficulties in smooth financing in financial and capital markets, the demand for loans is shifting toward the private lending market, thereby increasing the scale and influence of global PEFs.

A CIO of domestic B pension fund explained, "The continuous growth of the private asset market is closely related to the trend of credit risk reduction due to bank regulations," adding, "As loans previously provided by banks are transferred to private fund managers, their scale and market influence are growing."

The strengthening and expansion of Korean organizations by global PEFs is not only for discovering investment opportunities targeting Korean companies but also for fundraising marketing purposes. This is because entities such as the National Pension Service, Korea Investment Corporation (KIC), Teachers’ Pension, and Saemaeul Geumgo have emerged as major players in the global market.

The CIO of B pension fund said, "Although the Korean stock market clearly has an ostracized atmosphere, on the contrary, the demand for private assets and alternative investments continues to increase, so foreign managers (GPs) see Korea as a major demand market," adding, "Domestic institutional investors are steadily increasing their private asset, that is, alternative investment allocations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.