Company Donates 84% of Treasury Shares to Newly Established Foundation

Chairman Chung Mong-won and Major Shareholders Hold Only 31% Stake

Market Voices Opposition... Academia Warns of "Concerns Over Breach of Fiduciary Duty"

"If you want to give back to society, sell your personal shares and cancel the treasury shares."

Shareholders' dissatisfaction exploded as HL Holdings, led by Chairman Chung Mong-won, announced that it would donate about 470,000 treasury shares, approximately 84% of the treasury shares acquired to enhance shareholder value, to a newly established foundation free of charge. Since Chairman Chung's stake is only 31%, there are concerns that the treasury shares were used like personal assets in preparation for a management rights dispute. Criticism also arose that the company recorded a large loss in the third quarter and that the book loss is inevitable, which goes against the government's 'value-up (corporate value enhancement) policy.'

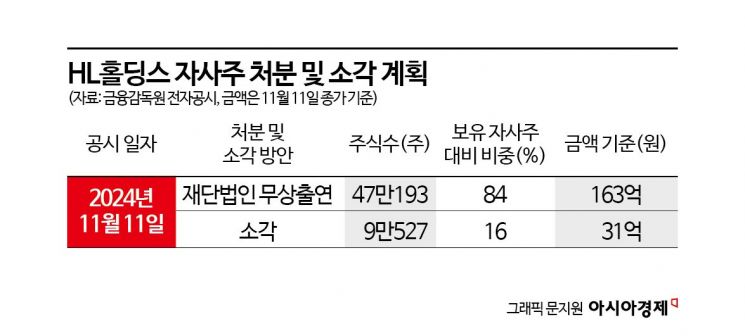

According to the Financial Supervisory Service's electronic disclosure on the 19th, HL Holdings resolved at a board meeting on the 11th to donate 471,193 treasury shares, which is 84% of the 560,720 treasury shares held in kind, to a newly established foundation free of charge. The company plans to cancel only 90,527 treasury shares, which account for the remaining 16%. When converted to cash, the approximately 470,000 treasury shares donated to the foundation correspond to about 16 billion KRW based on the closing price on the 18th. This means that a loss of about 16 billion KRW will be recorded when the donation is actually made. In this case, the company's overall profit decreases, causing earnings per share (EPS), or the value per share, to fall. This directly contradicts the 'shareholder-friendly policy to enhance shareholder value' stated when the company acquired treasury shares twice in 2020 and 2021.

Typically, companies transfer treasury shares to foundations because they can be used as friendly shares of controlling shareholders in management rights disputes. Treasury shares do not have voting rights, but when transferred to a foundation, the voting rights are restored. Chairman Chung Mong-won, the largest shareholder of HL Holdings, holds 31.58% including related parties. Other major shareholders include VIP Asset Management (10.41%), Baring Asset Management (6.59%), and the National Pension Service (5.37%). The shareholding ratio of shareholders other than the largest shareholder is relatively high. The market also speculates that the recent increase in shares by Chairman Chung's two daughters, the third generation owners, is related to defending management rights. Chairman Chung's eldest daughter, Chung Ji-yeon, and second daughter, Chung Ji-soo, each purchased 0.6% of shares on the market in January this year, increasing their stakes to 1.14% each.

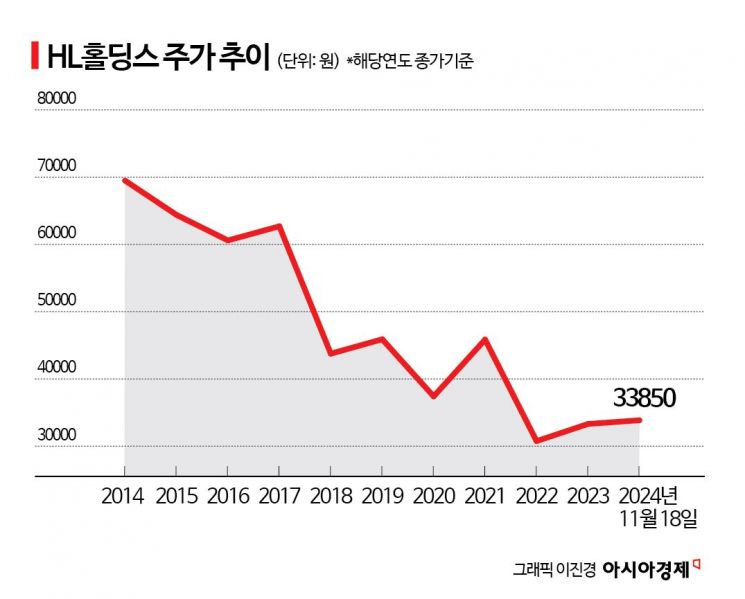

The background to the shareholders' explosive dissatisfaction with this treasury share donation to the foundation lies in concerns about 'damage to shareholder value.' As of the 18th, HL Holdings' stock price was 33,850 KRW, about half of the closing price of 69,500 KRW at the end of December 2014. The stock is also undervalued. HL Holdings' price-to-book ratio (PBR) for 2024 stands at only 0.30. A PBR below 1 means the current stock price is cheaper than if the company were to liquidate all its assets and exit the business. This is far below the KOSPI index (0.85) and KOSPI 200 (0.84). Especially, the third quarter this year showed earnings shock-level results. The third quarter consolidated net loss attributable to controlling shareholders was 22.9 billion KRW, significantly below the securities market estimate of 10.8 billion KRW. The cumulative net income attributable to controlling shareholders from the first to third quarter also sharply declined to 30 billion KRW, darkening the stock outlook.

In this situation, individual shareholders gathered in Naver stock discussion rooms expressed a flood of complaints. Institutional investors such as VIP Asset Management and Baring Asset Management also share concerns. They are considering ways to convey their opinions through shareholder letters and private meetings. A financial investment industry official said, "While the government emphasizes value-up policies, it is regrettable that only the defense of major shareholders' equity and increasing their share value are being focused on," adding, "Decisions to protect the value of minority shareholders should also be considered." Kim Min-guk, CEO of VIP Asset Management, said, "It is unfortunate to be powerless to prevent the company's incomprehensible decisions despite being the second-largest shareholder."

There are also calls for outside directors, who are supposed to check major shareholders and management, to express their opinions more actively. Since the scale of this treasury share disposal amounts to about 16 billion KRW, a cautious approach was necessary. A professor who requested anonymity said, "It is bittersweet that companies seem to be using such methods due to a lack of means to defend management rights," adding, "Since this may involve the disposal of important assets, directors need to make careful judgments." Another professor pointed out, "This is a typical and traditional method to protect control," and said, "The foundation donation does not align with the original purpose of acquiring treasury shares and could even be considered breach of trust."

An HL Holdings official responded to these concerns by stating, "The foundation will not exercise voting rights for at least five years after its establishment, and specific matters will be discussed by the foundation's board and reflected in the articles of incorporation," adding, "It is regrettable that the original intent of establishment has been misinterpreted." The official further explained, "The acquisition of treasury shares itself is aimed at enhancing shareholder value, and establishing a nonprofit foundation for systematic social contribution is expected to enhance intangible corporate value and long-term shareholder value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.