Reevaluation of Corporate Value upon US Listing Benefits Existing Shareholders

Proposal for Executive Compensation System Including RSUs Triggered by Stock Price Conditions

"Board Reform Essential to Prevent Merger Reattempt"

Activist fund Align Partners Asset Management has proposed the U.S. listing of Doosan Bobcat. Align currently holds a 1% stake in Doosan Bobcat. They also suggested enhancing board independence and shareholder return plans linked to the management’s compensation system.

Lee Chang-hwan, CEO of Align Partners Asset Management, is holding a press conference related to Doosan Bobcat. Photo by Oh Yu-gyo.

Lee Chang-hwan, CEO of Align Partners Asset Management, is holding a press conference related to Doosan Bobcat. Photo by Oh Yu-gyo.

On the 18th, Lee Chang-hwan, CEO of Align Partners Asset Management, held a press conference at the International Finance Center (IFC) in Yeouido, stating, "Doosan Bobcat’s shareholders strongly express the position that the company should be listed in the U.S., its original business base," and added, "Doosan Bobcat’s sales in the U.S. account for 73%, and considering the rapidly growing sales in North America, listing on the U.S. stock market is a natural corporate strategy."

Doosan Bobcat is a U.S. construction machinery company acquired by Doosan Infracore in 2007 for approximately $4.9 billion. It went public through an IPO on the Korean KOSPI in 2016. The offering price was 30,000 KRW. On the 18th, Doosan Bobcat’s closing price was 38,200 KRW. Over 70% of its sales are generated in North America.

"If Listed in the U.S., Value Will Be Reassessed"

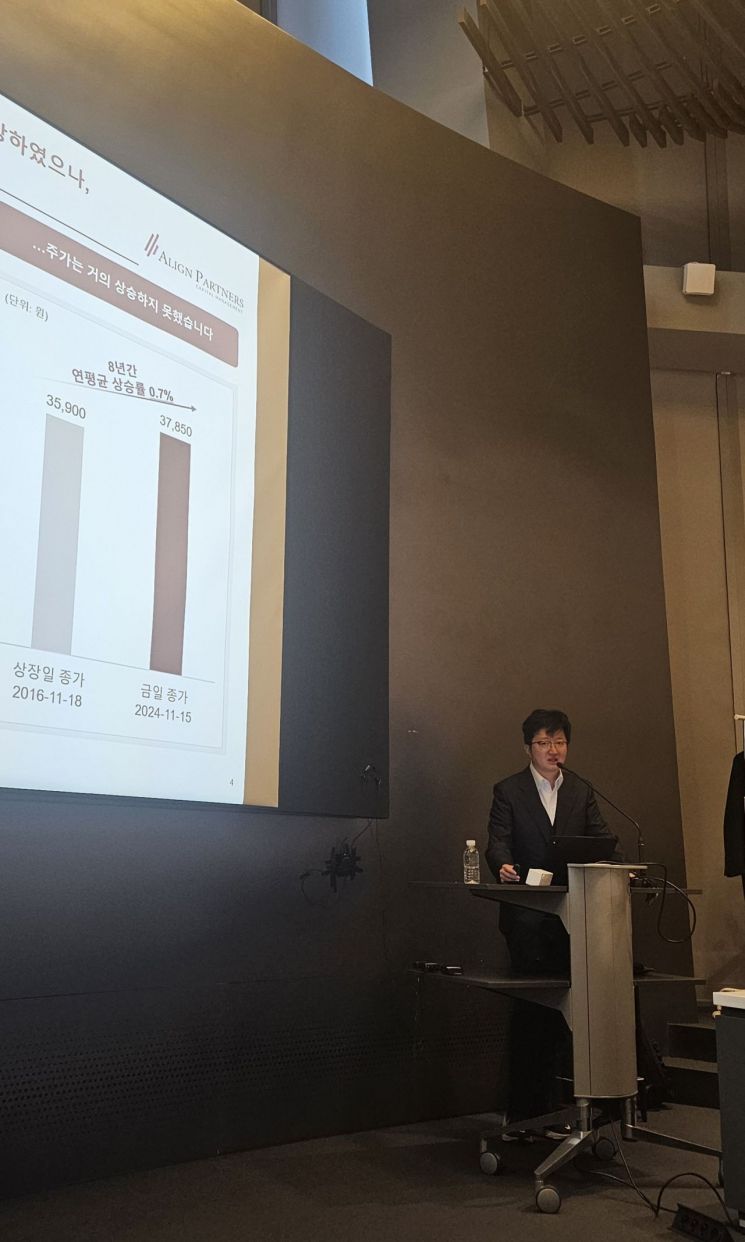

CEO Lee said, "Currently, Doosan Bobcat is listed in Korea, but discussions about U.S. listing have begun in earnest," adding, "Experts expect that if the U.S. listing is realized, more investors will participate and the company’s value will be reassessed." Since the IPO, Doosan Bobcat’s average annual stock price growth rate has been around 0.7%. He said, "Although the company’s management and employees have performed well and generated profits, this has not been adequately reflected in the market capitalization or stock price," and added, "Aligning the company’s main business location with its listing location can increase investor understanding and attract more investors."

According to Align, U.S. institutional investors hold 12.5% of Doosan Bobcat’s shares. Align argues that if the company is listed in the U.S., many more U.S. institutional investors could be attracted, and the market capitalization could increase significantly. CEO Lee said, "If listed on the U.S. market, there will be more U.S. capital and various advantages," and added, "Success in the U.S. market can lead to significant market success in Korea as well."

He analyzed that there are several specific methods for U.S. listing, including dual listing in Korea and the U.S., listing the U.S. subsidiary in the U.S. while delisting the parent company in Korea, among others. In any case, if the U.S. listing is a premise, the company’s value is expected to be significantly reassessed, benefiting existing shareholders. A successful example of a U.S. listing relocation is Ferguson, a British plumbing and heating supplier. After relocating its listing from the U.K. to the U.S., its stock price rose by more than 50%.

"Stock Price-Linked RSU and Others Should Be Considered"

Align also proposed improvements to the management compensation system linked to the stock price. They argue that if such changes are realized, Doosan Bobcat is likely to receive positive evaluations in the capital market.

CEO Lee said, "People have come to realize that stock prices do not rise simply because sales and operating profits increase," and added, "Introducing a management compensation policy linked to value-up performance is necessary so that the management and employees of Doosan Bobcat, who work hard when value increases, can also benefit." He also said, "Many companies in the U.S. evaluate management performance linked to shareholder value and provide compensation largely in stock."

A representative case linking management performance and value-up is the U.S. private equity firm Kohlberg Kravis Roberts (KKR). Whenever the stock price reaches a certain level, management is allowed to sell restricted stock units (RSUs). RSUs are a stock-based compensation system that grants shares to employees free of charge upon meeting specific conditions such as tenure or performance. CEO Lee said, "Motivation is very important, and I think it is a good way to improve the company’s performance in the long term," adding, "At first glance, it might seem impossible to reach the target stock price, but having a goal motivates people to work hard and achieve it."

Board Reform 'Essential' to Prevent Merger Reattempts

Meanwhile, Align also proposed ▲ enhancing board independence and ▲ efficient capital allocation focused on shareholder value. Along with the U.S. listing, they suggested expanding shareholder participation in nominating and evaluating outside director candidates to strengthen board independence, introducing a shareholder nomination system for outside directors, and considering establishing an advisory group for evaluating outside director candidates involving institutional investors.

Align’s analysis is that such board reforms are necessary to fundamentally prevent the 'merger controversy' that occurred at Doosan Bobcat this year. They pointed out that the merger plan between Doosan Robotics and Doosan Bobcat, which caused controversy, was approved in just 30 minutes through a 'rubber-stamp board.' CEO Lee said, "After publicly announcing that a comprehensive stock swap will not be conducted, we need to explore other ways to prevent it in the future," adding, "Since the company or controlling shareholders cannot block the CEO’s recommendations, board independence is crucial."

Additionally, Align suggested that when the price-to-book ratio (PBR) is below 1, it is generally more advantageous to expand capital allocation toward shareholder returns rather than reinvestment. They proposed an efficient capital structure strategy using borrowing costs cheaper than the cost of capital. To this end, Align analyzed that normalizing the shareholder return ratio to 65%, the average level of peer companies, and considering special dividends for capital structure efficiency could be effective.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.