33.3% of Net Profit Earned by Overseas Subsidiaries... Higher Proportion than Shinhan

Escaping the Narrow Korean Market with a 2021 Global Network

Future Growth in Asset Management... Focus on Mirae Asset's Global Capabilities

Mirae Asset Financial Group has distinguished itself in global business by earning more than one-third of its net profit overseas.

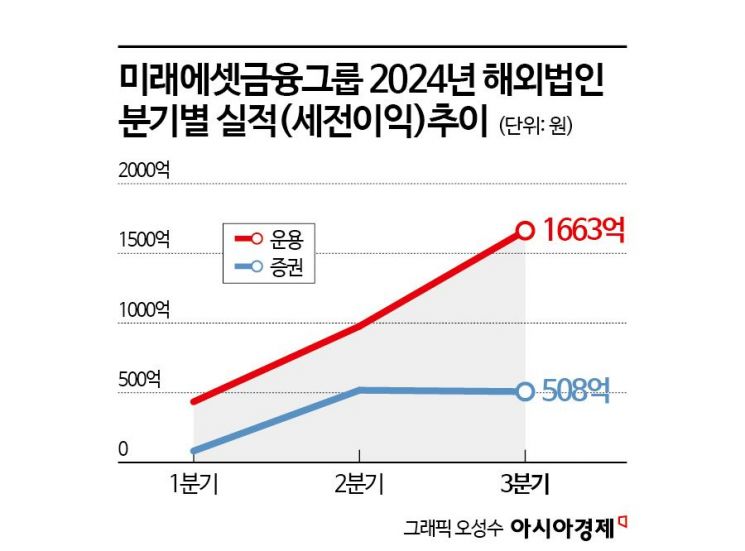

According to the financial investment industry on the 19th, affiliates of Mirae Asset Financial Group, including Mirae Asset Securities and Mirae Asset Global Investments, earned 418.3 billion KRW in net profit from overseas subsidiaries through the third quarter of this year. This accounts for 33.3% of the total net profit (1.2559 trillion KRW) earned abroad.

Among domestic financial holding companies, Shinhan Financial Group, which has the highest overseas sales ratio, recorded overseas sales exceeding 400 billion KRW in the first half of this year, achieving 15% of its total sales from overseas. In terms of overseas sales ratio, Mirae Asset’s figure is more than twice as high.

Mirae Asset’s remarkable growth is also attracting attention from global investment firms. The head of the Korean branch of the world’s largest private equity firm A said, "Among domestic financial investment companies, Mirae Asset Financial Group is the most competitive in global business," adding, "We are closely monitoring Mirae Asset’s global capabilities in asset management."

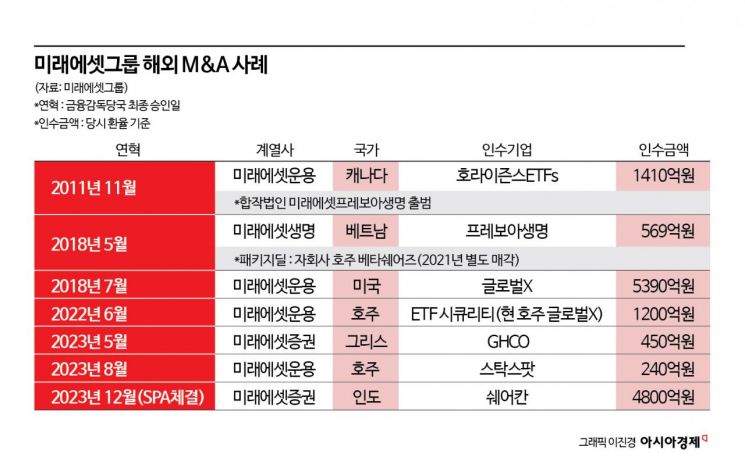

Mirae Asset Financial Group took its first step into overseas markets by establishing an asset management company in Hong Kong in 2003 and has been aggressively pursuing mergers and acquisitions (M&A) in overseas markets. A representative of Mirae Asset Financial Group said, "With the strong will of the owner, we have persistently pursued overseas business for 21 years."

In particular, the group made bold investments in global business through large-scale M&As in the United States, Australia, and India. In July 2018, Mirae Asset Global Investments acquired the U.S. asset management company Global X for 539 billion KRW. Since then, Global X has listed exchange-traded funds (ETFs) on stock exchanges in various countries, serving as a foothold for global territorial expansion.

During the acquisition contract process of the Australian asset manager Securities two years ago, Mirae Asset Global ETFs Holdings in Hong Kong and Global X in the U.S. invested 55% and 45%, respectively. This was the first case of acquiring an overseas asset management company solely with profits earned abroad.

Currently, Securities operates under the name "Global X Australia." In August last year, Mirae Asset also acquired Stockspot, an Australian robo-advisor specialized asset management company, to develop financial products incorporating artificial intelligence (AI)-based services.

Mirae Asset Securities plans to complete the acquisition of the local Indian securities firm Sharekhan Limited for 480 billion KRW within this year.

It was the first domestic securities company to enter the Indian capital market in 2018 and to acquire a local company within five years. Established in 2000, Sharekhan is ranked around 10th in the local industry. Mirae Asset plans to make Sharekhan one of the top five securities firms locally within five years and to focus on aggressively targeting the Indian financial market, which is gaining attention as the "Next China."

Earlier, in May last year, Mirae Asset Securities also acquired GHCO, a European ETF market-making specialist company, through its London branch. Founded in 2005, GHCO provides "on-exchange liquidity provision" services that keep the stock prices of specific ETF items at certain levels through its proprietary system. This allowed Mirae Asset Securities to enter the European ETF market, the second largest in the world after the U.S.

Additionally, Mirae Asset Life Insurance acquired shares of Prevoir Vietnam Life Insurance in Vietnam in May 2018 and launched the integrated corporation Mirae Asset Prevoir Life Insurance. A financial investment industry official said, "Breaking away from the limitations of domestic financial groups, which are confined to 'government-controlled finance' and 'affiliate fund management' roles focused on domestic business, Mirae Asset is spreading its wings through overseas business," adding, "As asset management is gaining attention as a future growth engine, Mirae Asset’s global network will play a significant role."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)