O&M, Profitable Business with High Expectations

Urgent Need to Revitalize Offshore Wind Power and Build Ecosystem

As the domestic offshore wind power market attracts attention for its high potential, global power companies are increasingly entering the operation and maintenance (O&M) market.

According to the industry on the 19th, Siemens Gamesa Renewable Energy (SGRM), the world's number one offshore wind power company, is promoting technological cooperation with Doosan Enerbility in various fields such as ultra-large offshore wind power construction and O&M services. SGRM holds the top market share with a supply record of 21GW in the global offshore wind market and possesses offshore wind power models up to 14MW.

Norwegian state-owned energy company Equinor is advancing an 800MW firefly floating offshore wind power project and a 200MW Donghae 1 floating offshore wind power project in Ulsan. Equinor plans to expand its offshore wind power projects to a total of 3GW domestically in the future. Among domestic companies, not only large corporations such as Doosan Enerbility, TS Wind, and Wind Korea but also specialized companies are participating in various projects.

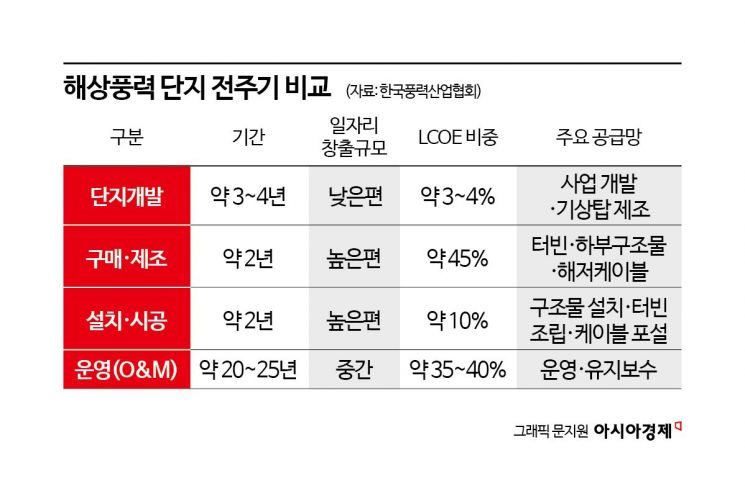

The offshore wind power business covers the entire cycle from project development to manufacturing, installation/construction, and operation (O&M). Among these, the O&M business is regarded as a lucrative sector that can expect profits as high as equipment manufacturing. Since all operations take place offshore, dedicated vessels are required, as well as management systems tailored to offshore wind power, including remote control systems.

According to the Korea Wind Industry Association, the total maintenance cost of offshore wind power is estimated to account for about 35-40% of the LCOE (Levelized Cost of Energy) of the entire offshore wind power generation. LCOE refers to the average cost of all expenses incurred throughout the entire lifecycle of a power plant, from construction to decommissioning.

If it costs 10 billion KRW to build and decommission a wind power complex, up to 4 billion KRW of that is O&M costs. This means companies can earn substantial profits.

The government has set a goal to supply 14.3GW of offshore wind power by 2030, but as of March, the capacity of offshore wind turbines registered with the Korea Power Exchange stands at about 230MW. The wind power industry points out the urgent need to activate offshore wind power and establish an ecosystem. As a catalyst, they are demanding the enactment of the Offshore Wind Power Special Act, which was stalled in the 21st National Assembly.

This law proposes establishing a committee under the Prime Minister to directly oversee all domestic offshore wind power projects and resolve various permits and approvals issues. Currently, to conduct offshore wind power projects, more than 30 permits and approvals must be obtained from ministries such as the Ministry of Trade, Industry and Energy, the Ministry of Oceans and Fisheries, and local governments, in addition to persuading local residents and stakeholders, making project progress difficult.

Lee Hansang, a senior researcher at KEPCO Research Institute, said, "If the Offshore Wind Power Special Act is introduced, the government can design bidding methods and criteria under its leadership," adding, "To activate offshore wind power to the level of policy goals, standards are needed to improve project feasibility, simplify permits, and facilitate smooth coordination of stakeholders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)