KCCI Releases Report Analyzing 5 Reasons for Inheritance Tax Reform

"Reduces Business Continuity and Economic Dynamism, Increases Double Taxation and Tax Evasion Incentives"

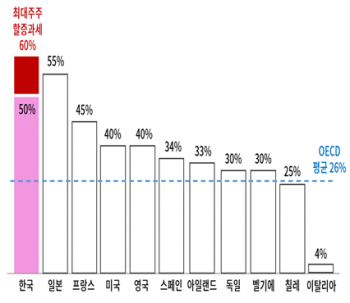

There is a claim that the maximum shareholder inheritance tax rate, which can reach up to 60%, encourages attacks by external speculative capital companies and avoidance of corporate succession. In the process of disposing of shares to bear the high tax rate, the shareholding ratio necessary to defend management rights inevitably decreases, but there are no adequate defense measures. The actual tax rate, which applies a 20% surcharge on shares held by the largest shareholder to the current highest inheritance tax rate (50%), is 60%, the highest level among the Organization for Economic Cooperation and Development (OECD) countries.

On the 18th, the Korea Chamber of Commerce and Industry (KCCI) released a report titled "Five Reasons Why Inheritance Tax Reform is Needed" and urged the National Assembly to promptly reform the inheritance tax system. In July, the government announced a tax law amendment bill that lowers the highest inheritance tax rate from 50% to 40% and abolishes the 20% surcharge on shares held by the largest shareholder, and submitted the bill to the National Assembly.

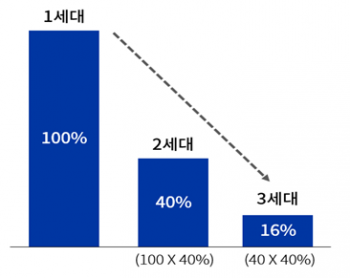

The KCCI pointed out that the high inheritance tax rate acts as a cause that encourages attacks on companies by external forces and induces avoidance of corporate succession. Due to the tax rate reaching up to 60%, the burden of paying inheritance tax increases, and the management's shareholding ratio inevitably decreases as shares are disposed of. The KCCI stated that if the largest shareholder sells shares to pay inheritance tax, the shareholding ratio can fall to at least 40%. According to the KCCI, if the founder (first-generation manager) holds 100% of the shares, the second generation holds 40%, and the third generation holds 16%.

Changes in Executive Shareholding Ratios During Corporate Succession. Provided by the Korea Chamber of Commerce and Industry

Changes in Executive Shareholding Ratios During Corporate Succession. Provided by the Korea Chamber of Commerce and Industry

There is no management rights defense system under the current Commercial Act. This means that managers paying inheritance tax may be exposed to hostile mergers and acquisitions (M&A) or threats from speculative forces. The KCCI emphasized, "As Korea's aging speed is fast and the inheritance tax burden is large, cases of avoiding succession will soon increase," and added, "Instead of viewing corporate succession negatively as merely the inheritance of wealth, it should be seen from the perspective of inheriting technology, jobs, and responsibility."

The KCCI argued that it could hinder economic dynamism, such as weakening corporate investment and restricting stock price support. This is because second-generation and later managers preparing for succession find it difficult to undertake challenging investments due to the need to secure funds for inheritance tax. When stock prices rise, succession costs increase, making it difficult to readily implement stock price support measures.

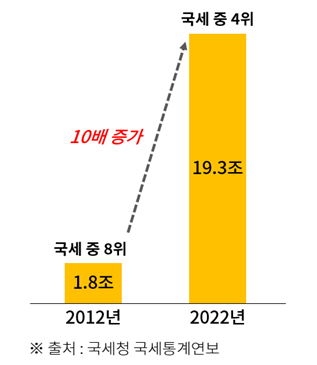

The KCCI pointed out that it also negatively affects tax revenue collection. It stated that the system fails to reflect the increase in asset values over 25 years and gradually imposes a burden on the middle class. Unlike the past when it was imposed only on a very small number of high-income groups, the number of taxpayers has increased due to the rapid rise in real estate values over the past decade. According to the National Tax Service, the number of inheritance tax subjects (deceased persons) nationwide increased by 9,559 (154.2%) from 6,201 in 2012 to 15,760 in 2022 over ten years. The total assessed tax amount increased 9.7 times from 1.8 trillion won to 19.3 trillion won during the same period.

Taxable Inheritance (Decedent), Trends in Total Determined Tax Amount. Provided by the Korea Chamber of Commerce and Industry

Taxable Inheritance (Decedent), Trends in Total Determined Tax Amount. Provided by the Korea Chamber of Commerce and Industry

The KCCI said that the current inheritance tax rate also violates global standards. Korea's highest inheritance tax rate has continuously increased from 45% in 1997 to 50% in 2000. With the largest shareholder surcharge, it reaches 60%. The Group of Seven (G7) countries have either abolished inheritance tax or lowered the highest tax rates. Canada abolished inheritance tax in 1972 and switched to capital gains tax. The United States lowered it from 55% to 35% and fixed it at 40% in 2012.

Among the 38 OECD countries, 24 countries (63%) have inheritance tax. Fourteen countries (37%) either have no inheritance tax or have switched to capital gains tax or other systems. The average highest tax rate among countries with inheritance tax is 26%.

Comparison of Top Inheritance Tax Rates in Major Countries. Provided by the Korea Chamber of Commerce and Industry

Comparison of Top Inheritance Tax Rates in Major Countries. Provided by the Korea Chamber of Commerce and Industry

The KCCI pointed out that excessive inheritance tax rates may increase cases of double taxation and incentives for tax evasion. The current inheritance tax deducts up to 49.5% income tax (including local tax) on the deceased's lifetime income and then taxes the remaining assets again. Even if the spouse pays inheritance tax on the inherited assets, when the spouse dies, inheritance tax is re-imposed on the same assets for the children. This inevitably leads to growing tax resistance due to the possibility of double taxation.

Additionally, the KCCI pointed out that the largest shareholder may be tempted to concentrate orders on affiliated companies with high major shareholder stakes to secure funds for inheritance.

Kang Seok-gu, head of the KCCI Research Department, said, "Imposing the world's highest level of inheritance tax burden on Korean companies forces excessive sacrifice," and added, "It is time to refer to major countries' tax systems to reduce excessive inheritance tax burdens, support corporate competitiveness, and enhance economic vitality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)