Samyang Foods' Decline Nearly Twice as Large as 22% Drop

Disappointing Sell-off Due to Operating Profit Below Market Expectations

Expecting Revenue Growth Resumption from Q4

This year, Nongshim, which had drawn a steep upward curve along with the K-food wave in the first half, has hit its lowest price of the year. The stock price is retreating as operating profits in the second and third quarters fell short of market expectations.

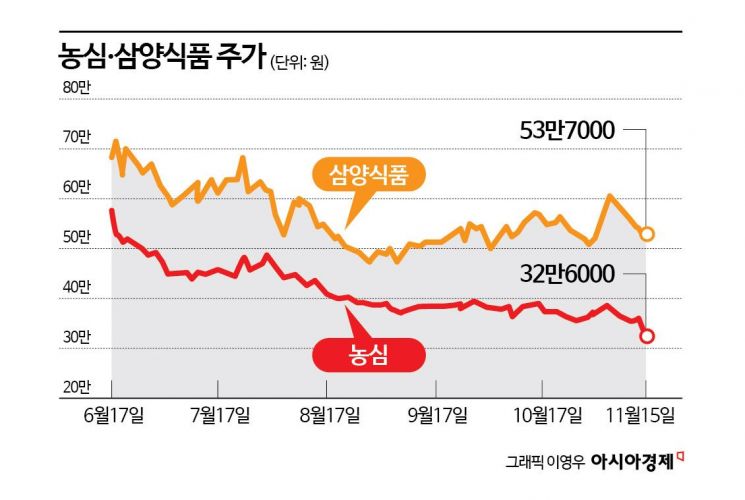

According to the financial investment industry on the 18th, Nongshim's stock price has dropped 43.3% over five months compared to the year-to-date high recorded on June 17. On the 15th, it hit a year-to-date low of 317,000 KRW during intraday trading. Nongshim's decline was particularly steep within the food and beverage sector. During the same period, Samyang Foods fell by 21.7%. The market capitalization gap between Samyang Foods and Nongshim, which had been competing for first and second place in the ramen industry, widened to 2 trillion KRW. As of the closing price on the 15th, the market capitalization of Samyang Foods and Nongshim stood at 4.05 trillion KRW and 1.98 trillion KRW, respectively.

The reason Nongshim, which had a strong defensive stock character with little earnings volatility even during recessions, has retreated over the past five months is closely related to the K-food boom in the first half of this year. Ramen and gimbap gained popularity overseas, raising expectations for improved performance. Thanks to this, Nongshim's stock price rose about 65% in just three months from March to June. Considering the increase in export volume, Nongshim announced large-scale facility investment plans in June and August. In June, it decided to build a logistics center in the Ulsan Samnam logistics complex with an investment of 229 billion KRW to strengthen logistics competitiveness amid export expansion. In August, it revealed plans to establish an export-only factory in the Noksan National Industrial Complex with an investment of 191.8 billion KRW.

As Nongshim continued to announce large-scale investment plans, expectations for performance improvement also grew. However, the second and third-quarter results failed to meet the heightened expectations. In the second quarter, Nongshim recorded consolidated sales of 860.7 billion KRW and operating profit of 43.7 billion KRW. Sales increased by 2.8% year-on-year, but operating profit decreased by 18.7%. Operating profit fell short of the market expectation of 51.3 billion KRW. Due to increased cost burdens and promotional discount events, expenses rose, causing the operating profit margin to drop by 1.7 percentage points (P) compared to the same period last year.

Although there was hope for improvement in the second half of the year, the third quarter also recorded operating profits below expectations. Nongshim posted sales of 850.4 billion KRW and operating profit of 37.6 billion KRW in the third quarter, down 0.6% and 32.5% year-on-year, respectively. Operating profit was 29% below market expectations. Kwon Woo-jung, a researcher at Kyobo Securities, explained, "Nongshim is currently facing somewhat disappointing performance in domestic, North American, and Chinese markets," adding, "The growth rate in the North American market, which had driven growth over the past three years, is slowing."

With results falling short of expectations, securities firms are lowering their target prices for Nongshim. Daishin Securities cut its target price by about 10%, from 530,000 KRW to 480,000 KRW. Kyobo Securities also lowered it from 510,000 KRW to 460,000 KRW, and Korea Investment & Securities reduced it from 540,000 KRW to 450,000 KRW.

However, stock market experts advised that there are still factors that could improve performance next year. Jo Sang-hoon, a researcher at Shinhan Investment Corp., said, "Since last month, Nongshim has been placed on the main shelves at Walmart in the U.S.," explaining, "The shelf size has increased fivefold compared to before." He added, "With the additional operation of a new expansion line in the second factory, the brand lineup is expected to expand," and predicted, "The previously stalled external growth will resume from the fourth quarter of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.