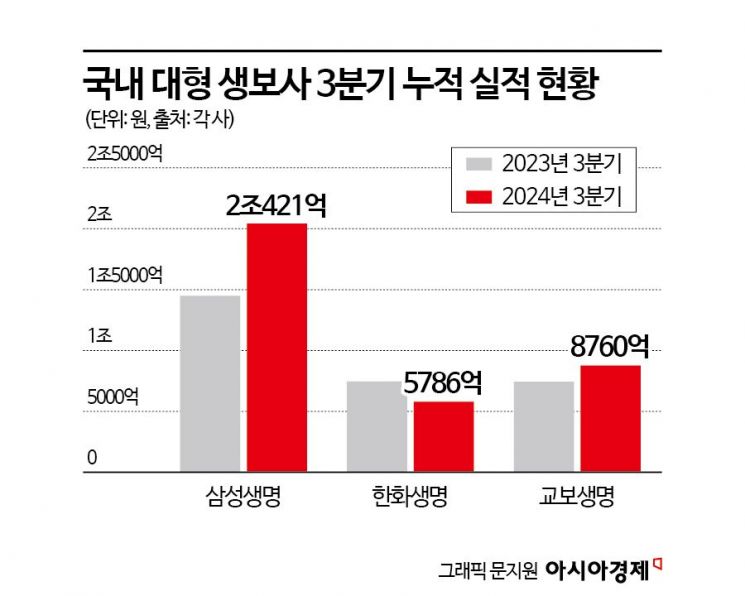

Samsung Life Insurance Q3 Cumulative Net Profit 2.0421 Trillion KRW... Up 40.8% YoY

Hanwha Life Insurance 578.6 Billion KRW... Down 22.8%

Kyobo Life Insurance 876 Billion KRW... Up 17.8%

The performance of major life insurance companies in the third quarter of this year showed mixed results.

According to the Financial Supervisory Service's electronic disclosure system on the 15th, Samsung Life Insurance recorded a consolidated net profit attributable to controlling shareholders of 673.6 billion KRW in the third quarter of this year, an increase of 41.6% compared to the same period last year. On a cumulative basis for the third quarter, it earned 2.0421 trillion KRW, up 40.8%.

The cumulative insurance profit and loss for the third quarter recorded 1.1866 trillion KRW, a 4.6% decrease compared to the same period last year. During the same period, investment profit and loss increased by 128.7% to 1.2615 trillion KRW. The expansion of non-interest income due to investment diversification influenced the strong performance.

As of the third quarter, the held CSM secured 13 trillion KRW through new contract CSM inflows and efficient management of held contracts. A Samsung Life Insurance official explained, "We expanded the proportion of health CSM to 62% by improving the competitiveness of health product coverage and actively responding to the senior and simple insurance markets," adding, "The cumulative new contract CSM for the third quarter was 2.4807 trillion KRW."

Kyobo Life Insurance also posted solid results. Kyobo Life's third-quarter net profit increased by 4436.84% year-on-year to 258.6 billion KRW. On a cumulative basis for the third quarter, it achieved 876 billion KRW, up 17.8%.

The insurance profit and loss for the cumulative third quarter increased by 46.3% year-on-year to 545.9 billion KRW. During the same period, investment profit and loss decreased by 2.49% to 845.4 billion KRW.

Up to the third quarter of this year, cumulative CSM reached 5.9219 trillion KRW through the expansion of new contracts and efficient management of held contracts. A Kyobo Life Insurance official explained, "Insurance profit and loss improved due to reduced costs related to loss-bearing contracts and increased actual gains from insurance payments and business expenses," adding, "Investment profit and loss maintained a stable level as evaluation gains increased in general account profit recognition bonds and stocks and beneficiary certificates due to interest rate declines."

Hanwha Life Insurance struggled in both quarterly and cumulative results. Hanwha Life's third-quarter net profit decreased by 15.6% year-on-year to 23.2 billion KRW. On a cumulative basis for the third quarter, it recorded 578.6 billion KRW, down 22.8%.

The insurance profit and loss for the cumulative third quarter was 713 billion KRW, a 17.9% decrease compared to the same period last year. Investment profit and loss was 195.7 billion KRW, down 7.2%.

The cumulative CSM as of the third quarter was 9.1297 trillion KRW. The third-quarter new contract CSM recorded 542 billion KRW, supported by the expansion of high-profit general protection product sales. A Hanwha Life Insurance official stated, "We built a lineup of high-profit general protection products and continuously expanded the organizational scale to achieve new contract growth," adding, "We plan to enhance sales capabilities in response to the expanding influence of corporate insurance agencies (GA) and continuously launch new products to increase the company's value in the long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)