Domino's Pizza Acquires 3.6% Stake, Full Corporation Purchases 1% Stake

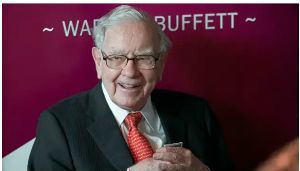

Warren Buffett, chairman of Berkshire Hathaway, who has been continuously increasing cash holdings, is drawing attention by purchasing shares of Domino's Pizza (restaurant chain) and Pool Corporation (swimming pool equipment company), which have lagged in the stock market this year.

According to Berkshire Hathaway's 3rd quarter (July-September) 13F report (quarterly report for institutional investors with over $100 million in assets) disclosed on the 14th (local time), the company purchased 1.28 million shares of Domino's Pizza stock (approximately $549 million) and 404,057 shares of Pool Corporation stock (approximately $152 million) during this period. These amounts correspond to 3.6% and 1% stakes in the respective companies.

This is a newly disclosed holding while the company is accumulating record cash reserves. In May, Buffett commented on holding cash, saying, "I will not spend cash unless I think it is a way to make a lot of money," which raised concerns that Buffett might be preparing for a downturn.

Amid this, when news broke that Buffett was making new investments in these two companies, investors cheered. The stock prices of Domino's Pizza and Pool Corporation rose about 8% and 6%, respectively, in after-hours trading that day.

Domino's stock price has only risen 5.53% this year, falling short of the S&P 500 index's 25% increase. Pool Corporation's stock price even dropped 7.90%, experiencing underperformance in a year when the three major New York stock exchanges hit record highs. The financial media MarketWatch explained, "Domino's Pizza struggled due to reduced spending by low-income groups, and Pool Corporation faced difficulties due to deteriorating consumer sentiment."

Meanwhile, Berkshire revealed in its 3rd quarter earnings report released on the 2nd that the company's cash holdings increased by about 15% to $325.2 billion compared to the previous quarter ($276.9 billion). Berkshire also continued net stock sales during the quarter, including selling $34.6 billion worth of Apple shares.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.