KOSDAQ-listed company Gwangmu announced on the 15th that it achieved a cumulative net profit of 130 billion KRW for the third quarter of this year. The company compensated for the performance gap caused by the chasm (temporary demand stagnation) with non-operating income. The efforts to enhance cash generation through management efficiency have shown results. In the second half of the year, Gwangmu plans to improve financial stability and reserve surplus cash as funds for additional facility expansion and mergers and acquisitions (M&A) in preparation for future market recovery.

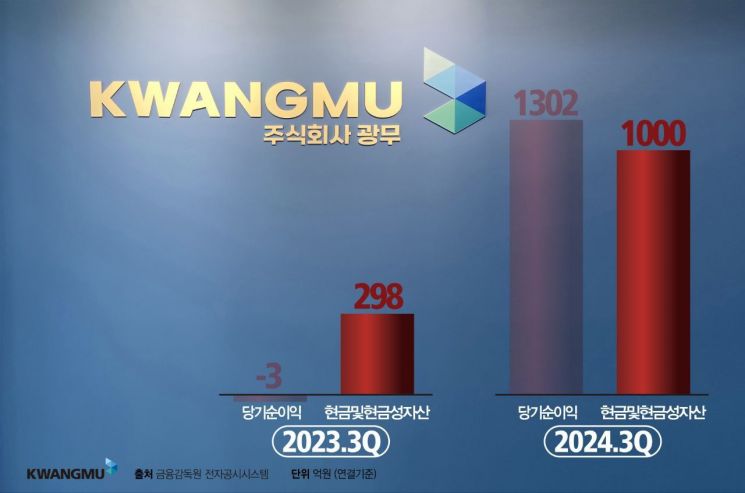

Gwangmu reported a cumulative net profit of 130.2 billion KRW on a consolidated basis for the third quarter, turning profitable compared to the same period last year, the company said on the 15th. Sales during the same period amounted to 4.4 billion KRW.

Gwangmu explained that strengthening non-operating income, such as gains from TRS derivative product evaluations, in anticipation of slowed sales and operating profit due to the chasm effect since the beginning of the year, was effective. Additionally, overall management efficiency improvements, including internal controls, contributed to the increase in net profit.

This is a markedly different financial strength compared to two years ago when the company posted net losses in the hundreds of millions KRW. The current ratio rose from 210.2% at the end of 2022 to 560.4% at the end of the third quarter this year. Despite capital expenditures (CAPEX) at the Jecheon plant this year, cash holdings increased, reducing net borrowings. Consolidated cash and cash equivalents rose 236.2% from 29.8 billion KRW at the end of the third quarter last year to 100 billion KRW at the end of the third quarter this year.

Gwangmu plans to focus on management in the second half of the year, prioritizing facility expansion, logistics infrastructure development, and network advancement for next year's business rather than growth this year. The company will also simultaneously pursue qualitative growth in its core businesses of Network Integration (NI) and System Integration (SI). With the revitalization of the sales organization atmosphere through the reorganization of sales channels, it is expected that the growth momentum for next year can gain traction based on cash liquidity. The secured cash reserves will be used for facility investment and M&A funding.

A Gwangmu official stated, “With the foundation for sustainable growth in place, we expect to maintain the net profit trend not only in the second half of this year but also next year. We will adjust the pace of investment by timing the improvement of the secondary battery market and aim for both quantitative and qualitative growth through efficient project management.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.