New Share Issue Price Raised from 36,350 KRW to 52,400 KRW

Total Public Offering Amount Increased by Over 40 Billion KRW

Existing Shareholders Expect 100% Profit on Subscription

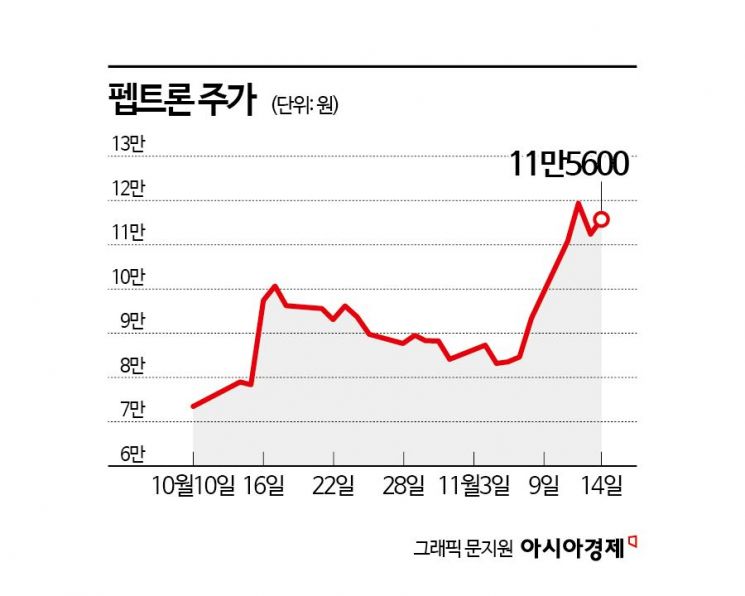

Amid continued sluggishness in the KOSDAQ market, Peptron's stock price hit an all-time high after signing a joint research agreement with the U.S. pharmaceutical company Eli Lilly. As the stock price continued to rise, the amount of funds to be raised through a rights offering also increased. Peptron, expecting to raise more funds than initially planned, even set aside a contingency fund.

According to the Financial Supervisory Service's electronic disclosure system on the 15th, Peptron finalized the new share issuance price at 52,400 KRW. This is 44.2% higher than the first issuance price of 36,350 KRW, issuing 2.64 million new shares. The public offering size increased from the original 96 billion KRW to 138.3 billion KRW.

Peptron's stock price rose 89.5% in just over a month since the first issuance price was set on the 7th of last month. Considering that the KOSDAQ index fell 12.4% during the same period, the return relative to the market reached 101.9 percentage points.

On the day the first issuance price was finalized, Peptron announced that it had signed a technology evaluation contract with Lilly for a sustained-release platform lasting over a month. Since the news that Peptron's Smart Depot platform technology would be applied to Eli Lilly's peptide-based drugs, the stock price has been on an upward trajectory. Although the KOSDAQ index has been declining continuously this month, Peptron's stock price has maintained an upward trend independent of the domestic stock market.

Thanks to this, Peptron revised its fund usage plan due to the higher final issuance price. Peptron announced plans to use the raised funds for 65 billion KRW in facility investment and 31 billion KRW in operating expenses. With the increased fundraising scale, 55 billion KRW was allocated for operating expenses, and the remaining 18.3 billion KRW was set aside as a contingency fund.

As of the first half of this year, Peptron held 713 million KRW in cash and cash equivalents, but continued to operate at a loss due to ongoing R&D investments. With the increased funds raised beyond expectations, the company now has more financial flexibility. The company explained that the 18.3 billion KRW contingency fund is allocated to prepare for incidental costs during new facility installation or additional sample manufacturing costs during the R&D process.

Choi Ho-il, Peptron's largest shareholder and CEO, faces increased burden in subscribing to new shares. He plans to subscribe to only about 50% of the 215,007 new shares allocated to him. The payment amount increased from 3.9 billion KRW based on the first issuance price to 5.6 billion KRW based on the final issuance price. Previously, on the 21st of last month, CEO Choi sold 173,000 shares from his holdings through a block deal (off-market large-volume sale). The sale price per share was 89,770 KRW, securing 15.5 billion KRW.

After completing the capital increase, CEO Choi's shareholding ratio will decrease from 8.37% to 7.14%. Although the decline in shareholding ratio may affect management control, Peptron protects management rights to a certain extent through its articles of incorporation. Article 40 of the articles, titled 'Director's Remuneration and Retirement Benefits,' stipulates a "golden parachute" system that pays 20 times the retirement allowance based on the length of service if the CEO is dismissed during their term due to a hostile takeover or merger.

Given that the current stock price has surpassed 110,000 KRW, the subscription rate by existing shareholders is expected to be high. The new shares will be listed on the 4th of next month. If the current stock price level is maintained until the new shares become tradable, investors can expect a return of around 100%. If there are unsubscribed shares in the existing shareholder subscription, a public offering will be conducted for general investors from the 18th to the 19th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.