Gradual Increase of Equity Ratio Over 3 Years from 2026

Capital Gains Tax Deferred for Landowners' In-Kind Contributions

Risk Weights and Provisions Differentiated by Ratio for Financial Firms

Active Support for Financial Sector's Entry into Long-Term Rental Housing

Establishment of Integrated PF Information System

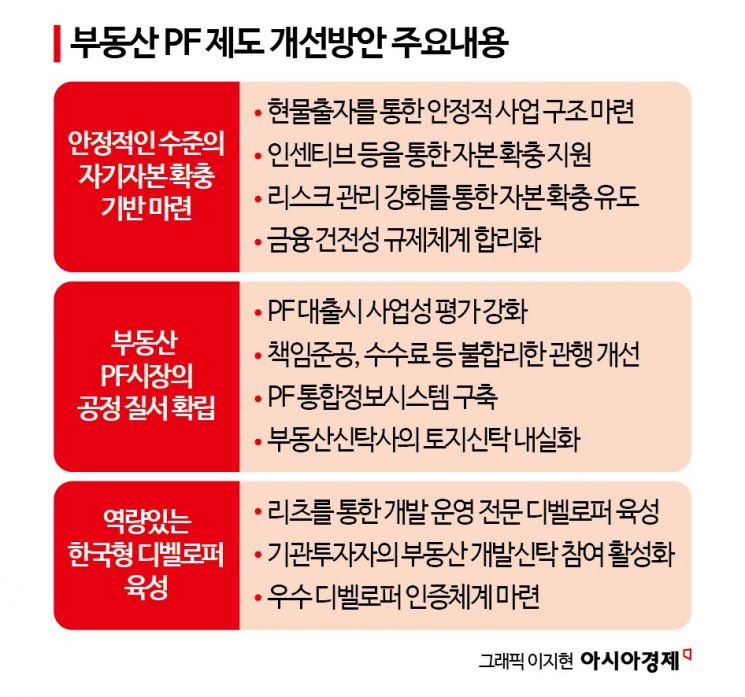

The government aims to fundamentally improve the 'low capital, high risk' structure of the real estate project financing (PF) market, which inevitably emerges as a financial market risk whenever the real estate market contracts, by providing various incentives to encourage an increase in the 'PF equity ratio.'

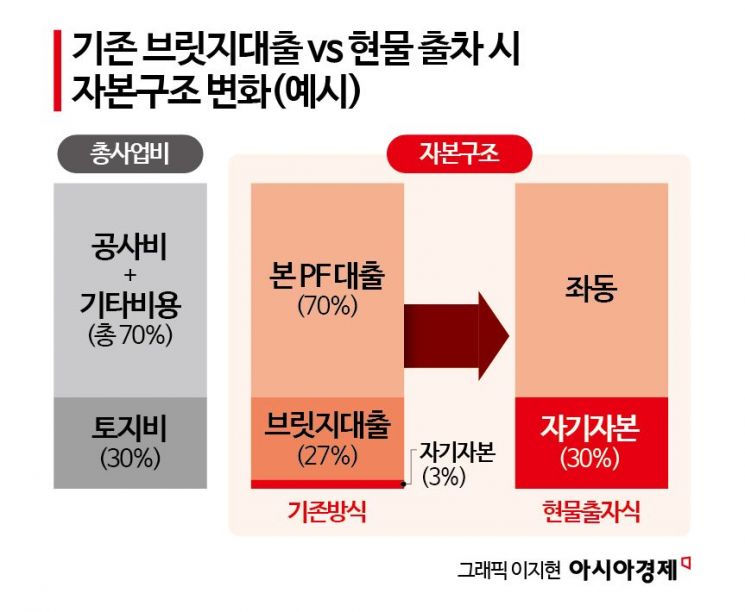

Typically, developers have small equity capital within 5%, making the projects unstable as they proceed by obtaining high-interest loans from savings banks and capital companies through bridge loans starting from land acquisition. The plan is for developers to establish corporations for PF projects and gradually raise the equity ratio to the level of advanced countries (20%) through in-kind contributions such as landowners' contributions. Raising the equity ratio to 20-40% would eliminate the need for bridge loans from savings banks and capital companies.

Projects with higher equity ratios will receive incentives in regulations, land supply, and loans. While granting incentives such as urban regulation exceptions and priority land supply, stable financial institutions like banks, insurance companies, and securities firms will be allowed to increase loan amounts for PF projects with 'high equity ratios' by lowering risk weights and provisioning burdens.

Ownership and investment regulations on real estate will also be relaxed to allow banks and insurance companies to participate in long-term rental housing projects. Currently, financial companies are prohibited from owning real estate for purposes other than business use, and there is a 15% investment limit for subsidiaries, but these restrictions will be lifted. If banks and insurance companies engage in long-term rental housing projects, it is expected to stimulate housing demand and benefit tenants through economies of scale and improved efficiency as rental housing projects grow larger.

On the 14th, the government announced the 'Real Estate PF System Improvement Plan' jointly with the Ministry of Land, Infrastructure and Transport, the Ministry of Economy and Finance, and the Financial Services Commission through a resolution at the morning Economic Ministers' Meeting. Since 70% of the current PF market is residential facilities, the plan aims to achieve both the activation of housing supply and the enhancement of market stability. A Financial Services Commission official explained, "If the in-kind contribution method is established in PF projects and financial companies increase capital investment in projects with high equity ratios, the equity ratio will rise and financial costs will decrease. Especially, if idle land in-kind contributions are activated, it is expected to revitalize the real estate development market and improve housing supply conditions."

The government plans to introduce a measure next year to defer taxation on capital gains when landowners make in-kind contributions of land to PF projects. The core idea is to induce in-kind contributions and change the typical PF project structure from '3% equity + 27% bridge loan + 70% main PF loan' to '30% equity + 70% main PF loan.' Currently, idle land in major metropolitan areas amounts to about 70 million square meters, and the plan is to induce some of this land to be contributed in-kind, thereby reducing project costs leading to lower sale prices and increasing PF project stability. If the equity ratio is high, PF guarantee fees will also be discounted through internal rule revisions at the Korea Housing Finance Corporation (HF).

The government also plans to grant special exceptions such as floor area ratio and public contribution relief for development projects where developers not only complete sales and construction but also manage and operate the projects integrally through high equity ratios. The current liquidation structure after sales and construction has lower incentives for capital expansion and has faced issues such as vacancies compared to advanced countries' business models that continue through operation. Based on the 'Real Estate Development Project Management Act' to be established in the first half of next year, 'urban regulation exceptions' will be granted.

The Financial Services Commission emphasized that the core of this system improvement is 'inducement' rather than 'regulation.' A Financial Services Commission official said, "Strengthening regulations is meaningless in the current situation where PF loans are shrinking," and added, "We will focus on naturally guiding the market to advance while monitoring the real estate market and economic conditions." To this end, a task force will be formed in the first half of next year to discuss specific implementation plans. A sufficient grace period will be provided before enforcement, and the new standards will apply only to new loans after implementation. Existing loans will continue to follow current standards.

The government also announced plans to nurture Korean-style developers. The core idea is to provide priority purchase rights for public land with excellent locations to developers capable of both development and operation through REITs, encouraging stable development and operation. Additionally, professional rental management will maximize real estate asset value and contribute to regional revitalization. A government official explained, "We will foster comprehensive real estate companies capable of 'development + operation + finance' from small-scale developers," and added, "REITs will be required to publicly offer at least 30% of their shares so that the public can also participate as shareholders."

Gradual Induction of Equity Ratio to '20%' by 2028... Differential 'Provisioning' According to Ratio

The government will activate a roadmap to gradually raise the equity ratio starting in 2026. The ratio will be increased stepwise to 10% in 2026, 15% in 2027, and 20% in 2028, with incentives applied differentially at each stage.

The key incentive proposed by the Financial Services Commission is 'differentiation of risk weights and provisioning.' For example, for PF projects with an equity ratio exceeding 20%, the current general provisioning burden of 0.9% will be reduced. Conversely, projects with low equity ratios will face increased provisioning burdens. Risk weights will also be applied differentially according to the equity ratio. A Financial Services Commission official explained, "Having a low equity ratio does not mean investment is impossible. Rather, it is to induce careful evaluation of whether the project feasibility is sufficient to bear the burden of provisioning and risk weights."

PF-related regulatory systems, which differ by financial sector, will also be reorganized. Regulations on risk weights and provisioning, large credit exposure limits, and real estate exposure limits by sector will be reviewed to implement the 'same function - same regulation' principle. For mutual finance and Saemaeul Geumgo, the introduction of an equity ratio regulation (20%) currently applied only to savings banks is under consideration. However, specific ratios will be decided after further discussions considering the characteristics of each sector.

Rationalization of the Practice of Responsible Completion Obligations

Additionally, a task force to improve the practice of responsible completion will be launched in the first quarter of next year. Currently, the reasons for extending responsible completion differ among construction contracts, PF loan contracts, and trust contracts, causing confusion. The government plans to unify these and rationalize the scope of damages for non-fulfillment of responsible completion.

The obligation of responsible completion for trust companies will be significantly reduced to avoid unlimited responsibility, greatly strengthening risk management for trust companies. The government will limit the land trust acceptance limit to within 100% of the trust company's equity capital and revise the net capital ratio (NCR) regulation for business operations. In particular, the financing methods for land trusts by trust companies will be diversified. Currently, most rely on borrowing, but going forward, equity investments from institutional investors will be allowed to enhance stability. Trust companies will be able to raise up to 15% of project costs but will only be able to receive equity investments from institutional investors.

An integrated information system will also be established to enhance transparency in PF projects. The plan is to systematically manage all information related to PF projects from permits to loans and sales status to proactively identify risks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.