KOSPI Falls for Fourth Day, Market Cap Drops Below 2,000 Trillion Won

First Time Since 'Black Monday' on August 5

Samsung Electronics Plunges, Barely Holding 50,000 Won Level

Negative Factors Unlikely to Ease Soon

Valuation Appeal Grows Amid Continued Decline

The KOSPI has fallen for consecutive days, causing its market capitalization to drop below 2,000 trillion won. The KOSPI, which has declined for four straight days, broke the yearly low recorded at the beginning of the year, falling to its lowest level since the start of the year. Samsung Electronics is at risk of falling to the '40,000-won level,' and the KOSDAQ has fallen below the 700-point mark.

According to the Korea Exchange on the 14th, the KOSPI closed at 2,417.08, down 65.49 points (2.64%) from the previous session. This is the lowest closing price of the year, breaking the yearly low of 2,435.90 recorded at the beginning of the year. Over the past four days, the KOSPI has dropped 5.75%. The KOSDAQ also fell for three consecutive days, eventually falling below the 700-point level, closing at 689.65, down 2.94% from the previous day.

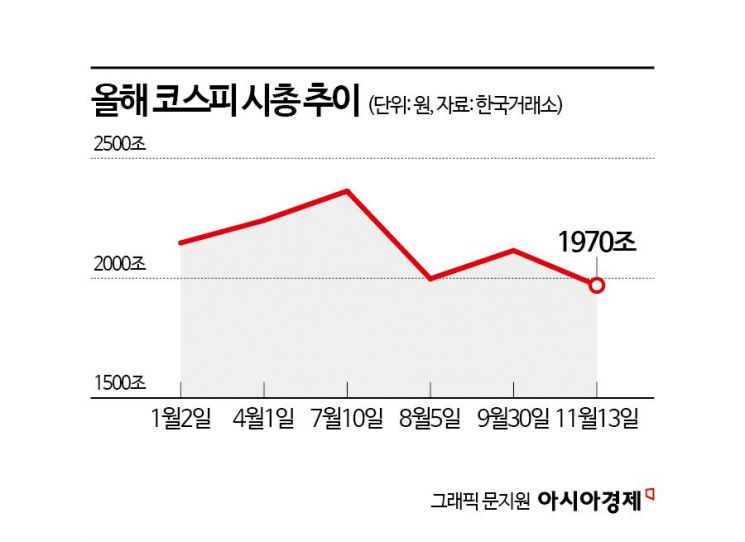

Due to the repeated decline, the KOSPI's market capitalization fell below 2,000 trillion won. The previous day's KOSPI market capitalization was recorded at 1,970.6632 trillion won. This is the first time since 'Black Monday' on August 5, when global stock markets plunged sharply, that the KOSPI market cap has fallen below 2,000 trillion won.

Most of the top market cap stocks performed poorly, with the sharp decline of the leading stock Samsung Electronics driving the index drop and market cap reduction. On that day, Samsung Electronics fell 4.53%, closing at 50,600 won. Samsung Electronics, which has fallen for four consecutive days, dropped rapidly from the 57,000-won range last week to a level where the 50,000-won mark is threatened. Samsung Electronics fell 12% over four days. Its market capitalization also evaporated by more than 40 trillion won, from 343 trillion won to 302 trillion won.

Foreign investors continued their selling trend. Over the past four days, they sold 1.5153 trillion won in the KOSPI market. During this period, Samsung Electronics was net sold by 1.7969 trillion won. Lee Kyung-min, a researcher at Daishin Securities, analyzed, "Foreign investors' massive selling, centered on the KOSPI level-down, is led by semiconductors, especially Samsung Electronics," adding, "While it signifies Korea's representative company and the largest market cap company, it can be seen as the most sensitive stock to external uncertainties due to weakened competitiveness in the artificial intelligence (AI) semiconductor industry." He continued, "During the peak of the earnings season, foreign selling of semiconductors and Samsung Electronics seemed to calm down, but after former President Donald Trump's election, foreign selling intensity increased again."

Concerns following Trump's election, a fragile domestic economy, and disappointment over China's stimulus measures are cited as recent factors behind the stock market weakness. Researcher Lee said, "This decline is believed to have caused the KOSPI level-down due to the simultaneous inflow of concerns about trade disputes triggered by Trump, Korea's fragile fundamentals, and disappointment over China's stimulus measures," adding, "Following Trump's election, expectations for tax cuts and deregulation for U.S. companies have continued, leading to a global capital flow concentrated in the U.S., while foreign demand in Korea, considered a victim country, continues to withdraw."

Although the factors causing the stock market decline are unlikely to be resolved in the short term, there is an opinion that attention should be paid to the increased valuation attractiveness due to the recent decline. Han Ji-young, a researcher at Kiwoom Securities, said, "Unlike previous sharp declines, the fact that Korea's market has shown a lone weakness compared to other countries' markets, which experienced several rallies after the U.S. presidential election, is causing domestic investors to lose confidence," adding, "It is true that it is difficult to resolve a large number of negative factors such as Trump policy uncertainty, disappointing earnings forecasts due to the third-quarter earnings season, and exchange rate burdens overnight, but these negative factors are not new and have already been reflected through stock price adjustments since October, entering a phase where valuation attractiveness has increased, which should be noted."

Researcher Lee also explained, "Since the peak on July 11, the KOSPI's weakness has continued, lowering not only the stock price level but also valuation attractiveness," adding, "The KOSPI's 12-month forward price-to-earnings ratio (PER) is 8.37 times, which is the lowest level except for the yearly low of 8.04 times recorded on August 5, and the price-to-book ratio (PBR) based on confirmed earnings is 0.87 times, reaching the August 5 low level. Samsung Electronics' forward PBR is 0.88 times, marking the lowest since February 2016." He continued, "In other words, the stock price levels of the KOSPI and Samsung Electronics are positioned at levels that have already priced in concerns about the economic downturn in August and past industry and earnings deterioration burdens, so a rebound is fully possible anytime with just a calming of anxiety and easing of uncertainties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.