BankSalad, a fintech (finance + technology) company specializing in MyData, has announced that it expects to achieve its first 'monthly profit' within the year.

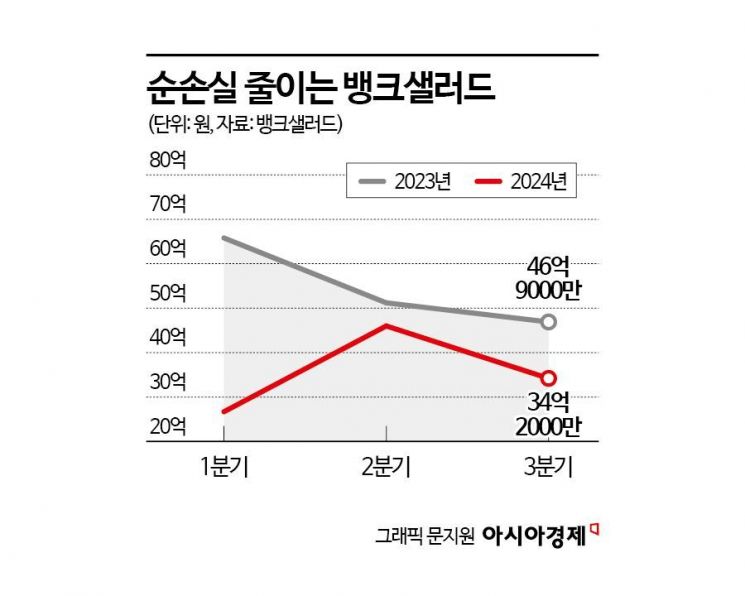

According to BankSalad on the 14th, the net loss for the third quarter of this year was 3.42 billion KRW, a decrease of about 28% compared to the same period last year (4.69 billion KRW). BankSalad had previously improved profitability and reduced losses in the first and second quarters, with net losses decreasing by 60% and 10% respectively compared to the same periods last year. Operating revenue for the same period was recorded at 5.6 billion KRW. This is about three times higher than last year and represents the highest quarterly sales to date.

A BankSalad representative stated, "We continued to improve profitability in the third quarter of this year and expect to surpass the monthly break-even point (BEP) within this year."

The company explained that BankSalad is growing based on MyData infrastructure in the financial and health sectors. In particular, the loan brokerage sector, which led performance improvements last year, grew about sevenfold in one year. BankSalad revamped its loan home page and supported loan coupon services to increase user inflow, securing about 220 loan products including credit loans and mortgage loans from over 70 financial institutions, thereby enhancing product competitiveness.

In the third quarter of this year, insurance brokerage and card brokerage sales increased by 65% and 82% respectively compared to the previous quarter. In the insurance brokerage sector, the health data-based insurance diagnosis service launched at the end of last year contributed to profitability improvements. At the beginning of this year, the company also started an automobile insurance brokerage service. For card brokerage, sales surged as targeting technology was advanced and cashback competitiveness was enhanced.

Furthermore, BankSalad plans to build a sustainable growth model by combining profitability improvements with securing approximately 32 billion KRW in cash assets through Series D funding. The company is working on structural improvements through advertising revenue and sales of non-face-to-face health checkup vouchers.

A BankSalad representative said, "As the only platform that has expanded from finance to the health sector in the MyData competition, we have secured differentiated competitiveness based on unique data technology, and performance improvements are continuously being made. We have secured sufficient growth momentum through business expansion and sales increase this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.