Entering a Super-Aged Society Next Year... Untapped Senior Housing Industry

Insurance Companies and Large Corporations Focus on Business Expansion Amid Market Growth Potential

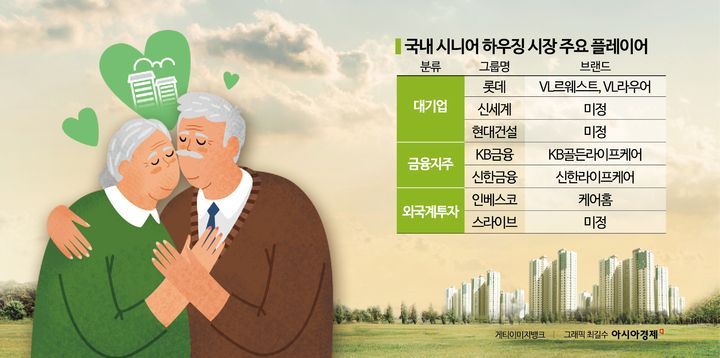

In the domestic senior housing market, emerging as a new growth sector amid aging population, fierce competition is underway among three major players: foreign specialized investment firms, insurance companies affiliated with domestic financial holding groups, and large conglomerates with expertise in construction and hotel operations.

Foreign Major Investment Firms Begin 'Cash Bomb' Investments in Domestic Senior Housing Market

According to the financial investment industry on the 13th, Invesco, a U.S. asset management company ranked in the top 10 by assets under management, recently completed the establishment of a fund for domestic nursing and care facilities in partnership with HHR Asset Management, a domestic real estate specialized asset management firm.

Previously, Invesco established 'Care Operation,' a senior specialized operator, jointly with CareDoc, a senior total care specialized company, to spend on the domestic senior housing market. Invesco plans to secure a leading position in the domestic senior housing market by participating as a major investor in the fund raised by domestic asset manager HHR Asset Management. Currently, their investments include Care Home Songchu Forest Branch located in Jangheung-myeon, Yangju-si, Gyeonggi-do, and CareDoc Care Home Baegot New Town Branch located in Baegot New Town, Siheung-si, Gyeonggi-do.

Invesco plans to rapidly expand investments through cooperation with domestic asset managers and senior specialized institutions. A senior official from HHR Asset Management stated, "We plan to add about 20 to 30 more projects in the future." He explained, "Lotte is currently leading the way in the Korean senior housing market, and now foreigners are starting to show interest. This business also applies the 'economies of scale' principle, where operating multiple locations lowers costs, and branding like an apartment increases trust."

Thrive, a U.S. senior living specialized company, recently decided to partner with GH Partners, a Korean corporate rental company, in the Korean market. Through a joint venture, they will provide management services in the Korean senior housing industry. GH Partners is one of Korea's largest multifamily asset management companies, managing over 19,500 rental apartment units nationwide as of the second quarter of this year. Founded in 2008, Thrive has developed, owned, and operated senior living facilities worldwide worth over $2.5 billion (approximately 3.5 trillion KRW).

Financial Holding Group-Affiliated Insurance Companies 'Knock' on Market Growth Potential Backed by Financial Power

Korea is the fastest aging country in the world. By next year, the proportion of the elderly population aged 65 and over is expected to exceed 20% of the total population, entering a super-aged society. However, the senior housing industry is not keeping pace with the speed of aging. This is why real estate developers, construction companies, asset management firms, and insurance companies are actively pioneering the senior living market.

For example, at the end of last year, Marsten Investment Management partnered with real estate developer STS Development to establish a fund for senior housing development. The plan was to raise at least $150 million (approximately 210 billion KRW) from Asian investors, creating the first healthcare real estate private equity fund. The first silver town opened in the domestic asset management industry was the senior housing in Pyeongchang-dong, Jongno-gu, Seoul, developed by Aegis Asset Management in collaboration with KB Golden Life Care. Aegis plans to develop two more silver towns in Seoul in the future.

Recently, insurance companies affiliated with financial holding groups have identified the silver industry as a future growth area, and the related market is expected to grow rapidly. Among them, KB Life Insurance and Shinhan Life Insurance are actively moving to supply senior housing. KB Golden Life Care, a KB Financial affiliate, successfully operated Wirye Village in 2019 and opened Seocho Village in 2021. Shinhan Life is also expanding its senior business through its affiliate Shinhan Life Care. NH Nonghyup Life Insurance, Samsung Fire & Marine Insurance, and Kyobo Life Insurance are also reportedly considering expanding their silver town businesses.

Conglomerate Affiliates with Construction and Hotel Operation Expertise Also Eyeing the Market

Senior housing is also a field attracting attention from conglomerate affiliates with expertise in hotel and construction operations. The most prominent players are Lotte Group’s Lotte Construction and Lotte Hotel. Lotte Construction entered the senior housing market early. In May last year, Lotte Construction launched the senior town 'VL Le West' in Gangseo-gu, Seoul. The senior complex 'VL Lower' developed last year in the Osiria Tourist Complex in Gijang-gun, Busan, also received high attention. Shinsegae Group affiliate Shinsegae Property declared its entry into the senior residence business, and Hyundai Construction recently signed a strategic business agreement with Shinhan Life Care to develop senior housing models.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.