Q3 Operating Loss of 113.4 Billion KRW... Turned to Deficit

Sales Reach 608.3 Billion KRW, Highest Quarterly Record

NHN recorded a loss exceeding 100 billion KRW despite achieving its highest-ever sales in the third quarter of this year. This was due to one-time expenses related to the Timf incident. The company plans to focus on its core gaming business to make a comeback.

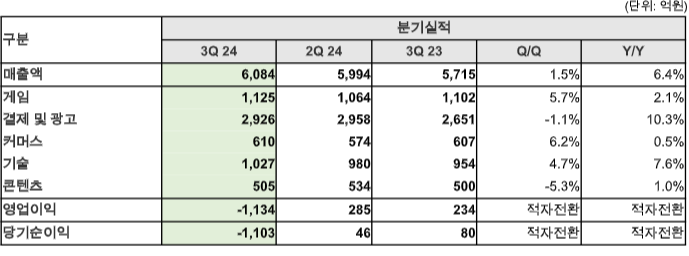

On the 12th, NHN announced that it posted an operating loss of 113.4 billion KRW on a consolidated basis for the third quarter, turning to a deficit compared to the same period last year. Sales increased by 6.4% year-on-year to 608.3 billion KRW.

The operating loss was influenced by the one-time bad debt write-off related to the Timf incident. Excluding this one-time bad debt write-off, the operating profit for the third quarter was 27.3 billion KRW. Sales reached a quarterly record due to balanced growth across all business sectors, including gaming, payment & advertising, and technology.

Jung Woo-jin, CEO of NHN, said during the earnings conference call, "This bad debt write-off is related to Timon and Happymoney Inc., which are undergoing rehabilitation procedures. We will actively respond to the court's requirements and continue efforts to recover the debts in various ways."

Looking at sales by segment, the gaming division recorded 112.5 billion KRW, up 2.1% year-on-year. The overall web board game sales increased by 8.1% year-on-year, boosted by the successful 5th anniversary event of the mobile game ‘Hangame Poker Classic’ and the Chuseok holiday. Notably, the monthly new users of ‘Hangame Poker Classic’ in the third quarter more than doubled compared to the same period last year.

The payment & advertising division achieved 292.6 billion KRW, up 10.3% year-on-year, driven by continuous growth in transaction volume at NHN KCP’s domestic and overseas merchants. In particular, NHN Payco’s corporate welfare solution business saw a 31% increase in transaction volume in the third quarter compared to the same period last year.

The commerce division recorded 61 billion KRW, a 0.5% increase year-on-year, supported by NHN Commerce’s expansion of new brand collaborations in its China business.

The technology division achieved 102.7 billion KRW, up 7.6% year-on-year. NHN Cloud’s sales increased by 22.5% year-on-year due to revenue recognition from its cloud-native consulting business, and NHN Doorey also recorded double-digit sales growth year-on-year as public sector sales expanded.

The content division recorded 50.5 billion KRW, up 1.0% year-on-year. NHN Link saw balanced growth in sports and performance sales, with a 33% increase in sales compared to the same period last year.

NHN plans to focus on expanding sales in the gaming business next year. CEO Jung said, "Next year’s strategy is twofold: diversification and expansion of mid-core genres, and global expansion of web board games. If successfully established in the market, we expect to increase sales by 20-30%."

He added, "The overall market size for web board games is limited to the domestic market. Since stable profits continue to be generated once market share is secured in web board games, we plan to secure global market share."

NHN plans to simultaneously release the mobile and PC versions of Rootshooter’s new title ‘Darkest Days’ in the second half of this year. Additionally, a final test will be conducted at the ‘Steam Next Fest’ in February next year. Furthermore, the subculture genre game ‘Stella Fantasy’ will be renamed ‘Abyssdia’ and is scheduled for release in the second quarter of next year. The company plans to launch a total of eight new titles next year, aiming to achieve significant results in the gaming business.

NHN Payco is currently operating under an emergency management system, accelerating business structure improvements and cost efficiency. To create synergy with its subsidiary NHN KCP, it plans to relocate NHN KCP’s headquarters to the Guro building in the first quarter of next year. It also plans to focus company-wide efforts on core businesses such as coupons and B2B to improve profitability.

NHN Cloud secured the ‘Government-wide Service Integrated Window Cloud Lease Project’ in September and won more than 60% of the total scale of projects related to the National Information Resources Service Daegu Center this year, raising expectations for better performance in future public-private partnership projects.

Additionally, NHN Doorey, based on the first financial CSP stability evaluation in the domestic SaaS industry, is actively responding to financial demand and plans to lead the AI collaboration tool market through its recently launched ‘Doorey AI’.

NHN will maintain dividend levels similar to previous years next year. It plans to repurchase treasury shares equivalent to 3% of the total issued shares and cancel all repurchased shares within the year. Having already repurchased about 31.1 billion KRW worth of treasury shares this year, it will begin an additional repurchase of approximately 10 billion KRW starting today.

CEO Jung stated, "We will focus on profit-centered internal growth across all business sectors through continuous management efficiency improvements throughout the group."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.