Sales excluding CJ Logistics 4.6204 trillion KRW...1.1%↓

Expansion of K-Food in North America, Europe, Oceania

"Global content collaboration...to raise Bibigo awareness"

Direct transactions with Coupang to resume in Q4, Lunar New Year gift effect expected

CJ CheilJedang has succeeded in expanding the new territory of K-food in North America, Europe, and Oceania with dumplings and pizza. However, it faced severe domestic demand slump and received a disappointing performance report for the third quarter. CJ CheilJedang aims for a performance rebound in the fourth quarter, supported by the rapid sales of Lunar New Year gift sets and the resumption of direct transactions with Coupang.

On the 12th, CJ CheilJedang announced that its sales for the third quarter of this year reached 4.6204 trillion KRW, a 1.1% decrease from 4.6734 trillion KRW a year ago. Operating profit for the same period was 276.4 billion KRW, maintaining a similar level to 275.3 billion KRW in the previous year. This excludes the performance of its subsidiary CJ Logistics. Including CJ Logistics, sales amounted to 7.4143 trillion KRW, and operating profit was 416.2 billion KRW.

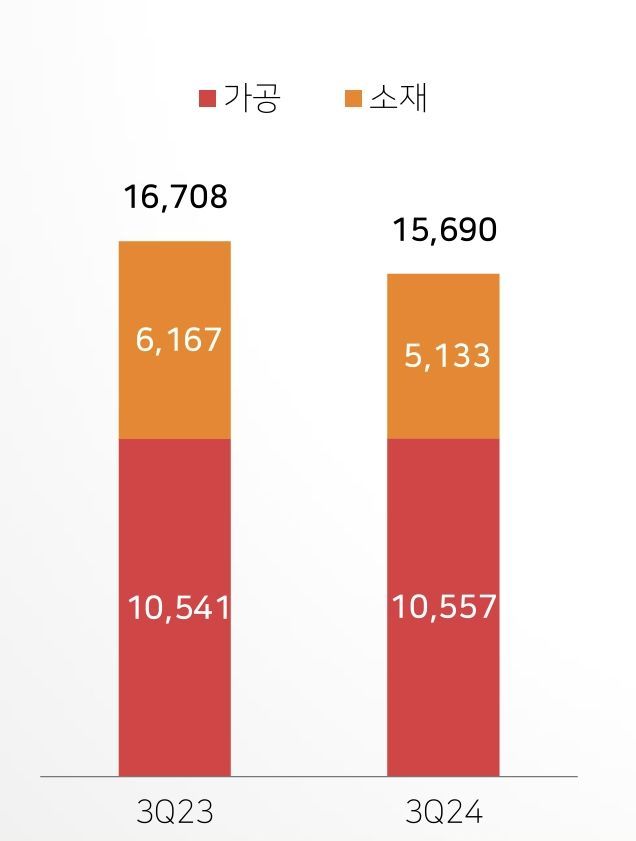

The core food business faced significant difficulties due to domestic demand slump in the third quarter. Operating profit dropped sharply by 31.1% year-on-year to 161.3 billion KRW. Sales also decreased by 1.1% to 2.9721 trillion KRW.

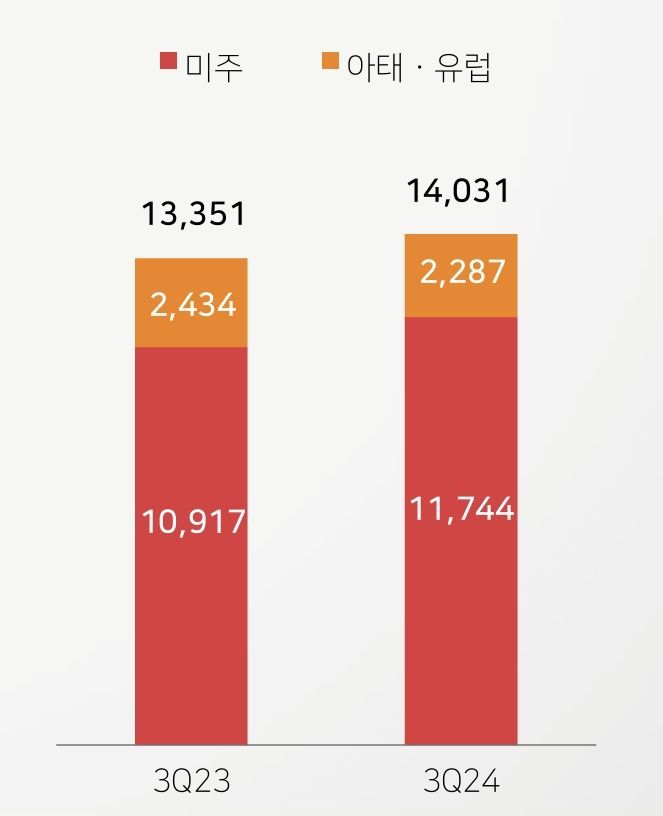

CJ CheilJedang successfully expanded the K-food territory rapidly in overseas markets in the third quarter. Overseas food business sales increased by 5% year-on-year to 1.4031 trillion KRW. Despite sales stagnation in China and Japan, sales in Europe?where the company is focusing on business expansion this year in countries such as Germany, France, the UK, and the Netherlands?increased by 40%. Sales in Oceania also rose by 24%, driven by expanded sales of Bibigo dumplings in large supermarket chains in Australia and New Zealand.

In North America, sales of core products dumplings (+14%) and pizza (+11%) grew significantly more than competitors, solidifying the number one position. Notably, from January to September this year, the sales growth rate of ‘Bibigo Dumplings’ was 33%, more than double the growth rate of the entire U.S. dumpling market (based on B2C in large supermarkets) at 15% during the same period.

However, the effect of K-food territory expansion was overshadowed by severe domestic demand stagnation. Domestic food business sales dropped 6% year-on-year to 1.569 trillion KRW. A CJ CheilJedang official explained, "Despite growth in overseas markets, domestic food business faced setbacks due to sluggish domestic consumption and cost burdens."

Bio business sales increased by 1.1% year-on-year to 1.0694 trillion KRW, and operating profit grew 74.9% to 82.4 billion KRW during the same period. Increased sales of high-margin products such as tryptophan (+21%), feed-grade arginine (+35%), and Taste&Rich (+35%) contributed to improved profitability. The sales proportion of high value-added specialty amino acids such as valine, isoleucine, and histidine also reached 22%.

Feed and livestock independent corporation CJ Feed&Care recorded sales of 578.9 billion KRW and operating profit of 32.7 billion KRW. Although sales slightly declined due to lower feed prices and sales volume in major business countries, operating profit remained positive for consecutive quarters through business structure and productivity improvements.

CJ CheilJedang plans to focus on expanding the K-food territory further by enhancing Bibigo brand awareness through collaborations with various global content in the fourth quarter. The strategy includes increasing the number of newly entered countries in Europe and Oceania and diversifying product listings. Domestically, the company aims to improve performance through new product launches, early shipment effects of Lunar New Year gift sets, and the resumption of direct transactions with Coupang. CJ CheilJedang, which had cut ties with Coupang over pricing conflicts for Hetbahn, decided to reconcile in August after about 1 year and 8 months. It is reported that both CJ CheilJedang, struggling with domestic demand slump, and Coupang, facing intensified competition from Chinese e-commerce, agreed on the need to collaborate for growth.

Jang Ji-hye, a researcher at DS Investment & Securities, said, "Improvement in performance across all business sectors of CJ CheilJedang is expected in the fourth quarter," adding, "Although concerns about domestic demand slump remain, recovery in consumption is anticipated due to Coupang’s re-entry and inventory clearance, and the bio sector will benefit positively from price recovery and easing raw material cost burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.