Sales rose 40% to 3.2 trillion

"Impact of exchange rates and facility maintenance costs...

Performance expected to improve in Q4"

Korea Zinc posted operating profit in the third quarter similar to the same period last year despite an unfavorable external environment and the reflection of facility maintenance costs.

Korea Zinc announced on the 12th that its consolidated sales for the third quarter reached KRW 3.2066 trillion, and operating profit was KRW 149.9 billion. Sales increased by 39.8% (KRW 913.4 billion) compared to the same period last year, while operating profit decreased by 6.5% (KRW 10.4 billion) during the same period.

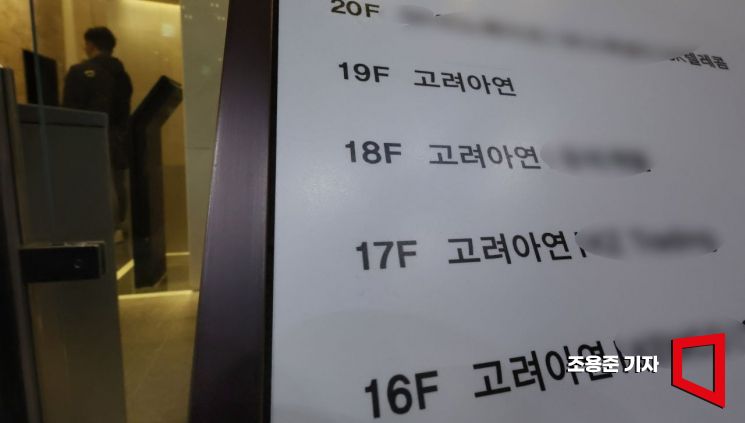

Korea Zinc, which is undergoing a management rights dispute, held an emergency board meeting at its headquarters in Jongno-gu, Seoul on the 30th of last month, and is expected to take measures regarding the Yeongpung-MBK Partners alliance's request to convene an extraordinary general meeting of shareholders. Photo by Jo Yongjun

Korea Zinc, which is undergoing a management rights dispute, held an emergency board meeting at its headquarters in Jongno-gu, Seoul on the 30th of last month, and is expected to take measures regarding the Yeongpung-MBK Partners alliance's request to convene an extraordinary general meeting of shareholders. Photo by Jo Yongjun

The decline in profitability in the third quarter despite increased sales is attributed to exchange rates and a drop in London Metal Exchange (LME) metal prices. The price of lead, which accounts for the second largest portion of Korea Zinc’s sales, averaged $2,038 per ton in the third quarter, down more than $130 compared to the same period last year.

The reflection of maintenance costs at the Onsan smelter in the third quarter also impacted profitability. In the previous second quarter, due to delays in zinc concentrate supply making production adjustment inevitable, Korea Zinc advanced the facility maintenance work and reflected the related costs in the third quarter after the work was completed.

A Korea Zinc official said, "In the fourth quarter, exchange rates and LME prices are showing positive trends, and with the advanced maintenance completed, full capacity production is possible, so performance improvement is expected in the fourth quarter."

He added, "Despite hostile mergers and acquisitions (M&A), all employees are doing their best in their respective positions to achieve the sales targets set at the beginning of this year. We will protect shareholders’ interests by enhancing corporate value through increased sales and profits, and also achieve long-term profitability improvement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.