Samsung Electronics, Samsung SDI, Samsung Electro-Mechanics, Hotel Shilla All Hit 52-Week Lows

Samsung Electronics Falls Below 56,000 Won for First Time Since January Last Year

Foreign and Institutional Selling Continue Amid Poor Earnings, Dragging Stock Prices Down

Recovery in Earnings Unlikely This Year, Stock Price Rebound Also Uncertain

Samsung Group stocks have consecutively hit new 52-week lows, causing the group's market capitalization to evaporate by nearly 13 trillion won in a single day. The continued foreign selling pressure on the flagship Samsung Electronics has led to a weak stock price trend, and other group stocks with disappointing earnings have also shown sluggish price movements, resulting in an overall depressed atmosphere across the group stocks.

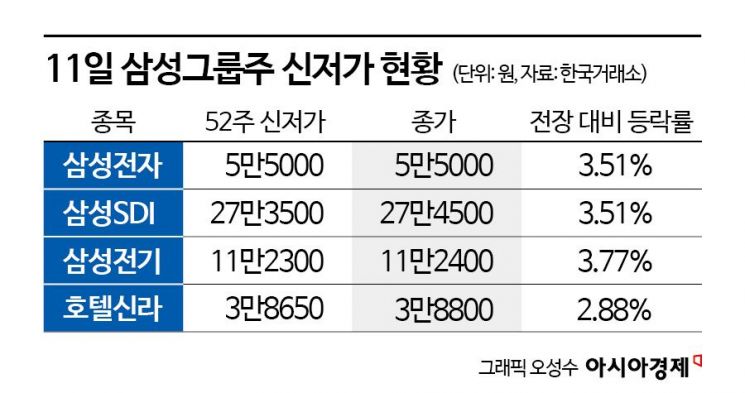

According to the Korea Exchange on the 12th, Samsung Group stocks simultaneously recorded new 52-week lows during the trading session. Samsung Electronics closed at 55,000 won, down 3.51% from the previous session. This marks the first time since January last year that Samsung Electronics' stock price has fallen below the 56,000 won level, hitting a 52-week low. Samsung SDI also dropped 3.51%, reaching an intraday low of 273,000 won, setting a new 52-week low. Samsung Electro-Mechanics recorded a decline of over 3%, hitting 112,300 won intraday, marking a 52-week low. Samsung Electro-Mechanics' stock price, which has been declining for four consecutive days, has steadily dropped from the 120,000 won range at the end of last month to the low 110,000 won range this month. Hotel Shilla also fell 2.75%, reaching an intraday low of 38,650 won, setting a new 52-week low again. After breaking below the 40,000 won level on the 8th, Hotel Shilla's stock price continued to weaken, falling into the 38,000 won range on this day as well.

The simultaneous new lows among group stocks have also reduced the group's market capitalization. The combined market capitalization of 17 Samsung Group stocks stands at 525.8187 trillion won, down 12.7365 trillion won compared to the 8th.

The sluggish performance of Samsung Group stocks is attributed to selling pressure from foreigners and institutions. Foreign investors had continuously net sold Samsung Electronics for 33 consecutive trading days from September 3 to October 25, briefly switched to buying to break the consecutive net selling streak, but after two days of buying, they reverted to selling and have continued a nine-day consecutive net selling streak up to the previous day. Foreign investors have also net sold Samsung SDI for six consecutive days recently. From the beginning of this month to the previous day, foreign investors net sold Samsung Electronics by 1.2378 trillion won and Samsung SDI by 250.7 billion won, ranking first and second in net selling. Additionally, foreign investors net sold Hotel Shilla by 6.8 billion won and Samsung Electro-Mechanics by 5.2 billion won during the same period.

Institutions have also sold Samsung SDI and Samsung Electronics the most this month. Institutions net sold Samsung SDI by 139.9 billion won and Samsung Electronics by 136.4 billion won from the beginning of this month to the previous day. Institutions have also net sold Samsung Electro-Mechanics for seven consecutive trading days recently.

The fundamental reason behind the continued selling pressure from major investors on Samsung Group stocks is poor earnings performance. Samsung Electronics, Samsung SDI, Samsung Electro-Mechanics, and Hotel Shilla all reported third-quarter earnings below market expectations. Samsung Electronics recorded an 'earnings shock' with third-quarter operating profit falling below 10 trillion won. Samsung SDI's third-quarter operating profit dropped 72.1% year-on-year, and Hotel Shilla posted an operating loss of 17 billion won, turning to a deficit. Samsung Electro-Mechanics' third-quarter operating profit was 224.9 billion won, a 19.5% increase year-on-year, but it fell short of the consensus estimate of 236.2 billion won.

These stocks are expected to find it difficult to recover earnings within this year, lowering expectations for stock price recovery within the year. Lee Kyu-ha, a researcher at NH Investment & Securities, said, "Samsung SDI's fourth-quarter sales are expected to decrease by 26% year-on-year to 4.1 trillion won, and operating profit is forecasted to drop 61% to 120.6 billion won, significantly missing consensus estimates." He added, "The deficit will deepen due to a slowdown in small battery sales, and profitability of automotive batteries will further decline due to inventory adjustments." He continued, "Although poor earnings in the second half are inevitable due to inventory adjustments caused by weak electric vehicle demand, the key variable for the stock price is whether it will start to recover from next year or not."

Lee Min-hee, a researcher at BNK Investment & Securities, commented on Samsung Electro-Mechanics, saying, "Global smartphone manufacturers' semiconductor inventory adjustments are expected to continue until the end of the year, so Samsung Electro-Mechanics' fourth-quarter sales and operating profit are expected to decrease by 9% and 28% respectively from the previous quarter, to 2.37 trillion won and 161.4 billion won." She added, "However, in the first half of next year, the MLCC (multilayer ceramic capacitor) market is expected to stabilize again due to supply-demand improvements, although the package segment may be somewhat sluggish due to server inventory adjustments."

Cho Sang-hoon, a researcher at Shinhan Investment Corp., said about Hotel Shilla, "Concerns include the fundamental decline in the attractiveness of the duty-free channel, changes in cosmetics consumption trends, and prolonged downturn in Chinese consumption, which lowers earnings visibility." He added, "A conservative approach is necessary for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)