'General Investment' Stocks Halved in One Year... Lowest Level Ever

In the 'Bear Market' of the Domestic Stock Market, Focus on Returns Over Shareholder Rights Exercise

Defensive Trading Yields 3.78% Annual Return, Asset Size Also Increases by 2 Trillion Won+

This year, the number of 'general investment' stocks (with a shareholding ratio of 5% or more) held by the National Pension Service (NPS) has sharply decreased to about half. This appears to be the result of focusing on returns rather than exercising shareholder rights.

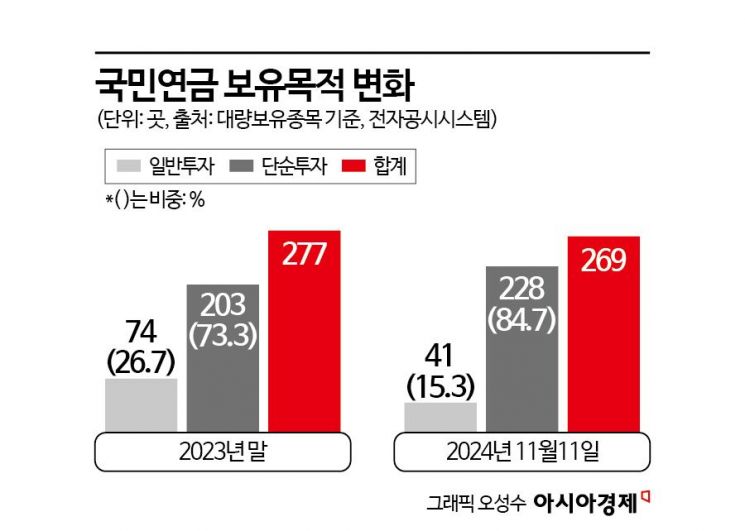

According to the electronic disclosure system on the 12th, as of the previous day, the NPS held a total of 269 large-shareholding stocks. Among them, 41 were general investments (15.3%) and 228 were simple investments (84.7%). At the end of last year, there were 74 general investments (26.7%) and 203 simple investments (73.3%). The number of general investment stocks decreased by 45%, and their proportion of the total also dropped by more than 10 percentage points. This occurred in less than a year.

Focus on 'defending' returns... holding up well despite index retreat

The NPS discloses the purpose of holding for large-shareholding stocks. Depending on the scope of shareholder rights exercise, it is divided into three stages: simple investment, general investment, and management participation. General investment is a concept newly introduced after the Stewardship Code (guidelines for institutional investors' voting rights) was implemented in 2018. Simple investment is a passive form of investment where voting rights are exercised only on agenda items at shareholders' meetings, whereas general investment can also demand changes to articles of incorporation, dividend increases, and dismissal of executives. A large number of general investment companies can be interpreted as actively exercising shareholder rights.

During the Moon Jae-in administration, the number of general investment companies exceeded 100, drawing criticism of 'pension socialism.' However, the current administration has changed its stance. This year, the number has returned to the lowest level since the introduction of the Stewardship Code. An investment banking (IB) industry official said, "If shareholder rights are not actively exercised, the holding purpose is changed from general investment to simple investment after a certain period," adding, "This is interpreted as focusing on profitability such as capital gains rather than shareholder rights exercise in the domestic stock market."

It is also analyzed to be related to the sluggish KOSPI and KOSDAQ markets, unlike the booming global stock markets. In fact, the NPS is struggling to defend returns rather than exercising shareholder rights. During the first to third quarters, it has continued a defensive trading strategy, including net selling of KRW 528.4 billion in domestic stocks. As a result, it recorded a 3.78% return on domestic stocks this year (as of August). During this period, active 'rebalancing' increased the size of domestic stock assets by about KRW 2 trillion to KRW 150 trillion. Considering that the domestic stock market has a negative annual growth rate and that the NPS is the largest institutional investor in Korea, it is performing well.

October 'Pension Picks' are Bio, Construction, and Securities

Meanwhile, the NPS disclosed that the shareholding ratios of nine held stocks changed in October. Seven stocks increased their shares, while two decreased. In particular, holdings of pharmaceutical/bio, construction, and securities stocks, which are classified as beneficiaries of interest rate cuts, increased.

Specifically, holdings slightly increased for pharmaceutical/bio stocks Hanmi Pharm (9.99%→10.02%) and HanAll Biopharma (9.98%→10.02%), construction stock HDC Hyundai Development Company (12.14%→12.33%), and securities stock Samsung Securities (12.94%→13.06%). The shareholding of STX Engine, which produces ship engines and others, also rose from 8.25% to 8.67%, an increase of 0.42 percentage points. This was an increase made before the shipbuilding industry gained attention after Trump's election. On the other hand, the shareholding in CJ Logistics (10.79%→10.46%) decreased. The courier industry is one of the sectors experiencing a slowdown after COVID-19.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.