Insurance Research Institute "Compensation-Centered Practices Lead to National Health Insurance Financial Deterioration"

"Must Shift to Universally Valid Treatment Focus"

An analysis has emerged suggesting that, to prevent leakage of automobile insurance payouts, universal and reasonable treatment standards should be established and applied to minor injury patients, similar to Japan.

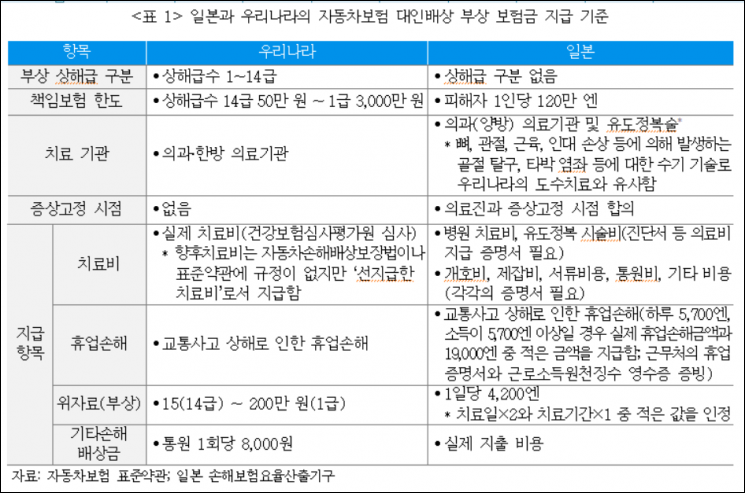

According to the report titled 'Comparison and Implications of Automobile Insurance Bodily Injury Compensation between Korea and Japan' published by the Korea Insurance Research Institute on the 10th, Korea's automobile insurance system is mostly designed based on criteria for severe injury patients. However, minor injury patients classified between injury grades 12 to 14 account for as much as 85% of treatment costs as of 2019.

In automobile insurance, bodily injury compensation covers damages caused to others in traffic accidents. It is divided into compulsory insurance and voluntary insurance. If the insurance payout exceeds the compulsory insurance limit, the voluntary insurance (unlimited) covers the excess. This structure of automobile insurance is similar in both Korea and Japan. However, the cost of bodily injury compensation per policyholder was 223,000 KRW in Korea in 2019, compared to only 75,000 KRW in Japan. This is because Korea lacks sufficient measures to prevent moral hazard among minor injury patients, unlike Japan.

The median number of outpatient visits for minor injury patients in Korea is 1 to 2 days longer than in Japan. Regarding treatment costs, the variance between the upper and lower groups is even greater, indicating higher volatility in treatment costs compared to Japan. The treatment cost for the lower group of insurance payouts is 220,000 KRW in Japan, which is higher than Korea's 96,000 KRW. In the upper group, Korea's treatment costs exceed Japan's by 270,000 KRW.

The difference in settlement amounts between the upper and lower groups was also significant. The median settlement amount in Korea (including future treatment costs, consolation money, lost income, and other damages) is around 900,000 KRW, whereas Japan's median settlement amount (consolation money and lost income) is about 280,000 KRW, making Korea's median settlement roughly three times higher.

In Korea, the absence of universal and reasonable treatment standards is pointed out as causing a burden on the premiums of good-faith insurance policyholders. In fact, Korean policyholders bear bodily injury compensation costs 2.5 times higher than those in Japan. The differences between the Korean and Japanese automobile insurance systems lie in traditional Korean medicine treatments and the timing of settlements. In Japan, accidents must be mandatorily reported to the police, and settlements occur after treatment ends based on the physician's medical opinion. However, in Korea, the structure prioritizes settlement with the victim first through a lump-sum payment.

Jeon Yong-sik, Senior Research Fellow at the Korea Insurance Research Institute, stated, "In Korea's automobile insurance, minor injury patients tend to prioritize settlement money over treatment," adding, "The compensation-centered practice for minor injury patients in automobile insurance could lead to deterioration of the National Health Insurance finances, so it is necessary to shift from compensation to universal and reasonable treatment-centered approaches."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.