Satellite and Launch Vehicle Stocks 'Strong'

US Government-Led Space Development, Expectation of Private Sector Expansion

"Warmth Will Spread to Domestic Space Companies"

There is growing interest in whether the aerospace theme will emerge as a leading industry. In the market, expectations are rising that Donald Trump, elected as the 47th President of the United States, will actively promote space technology development and commercialization, leading to hopes that domestic companies within the related value chain could benefit.

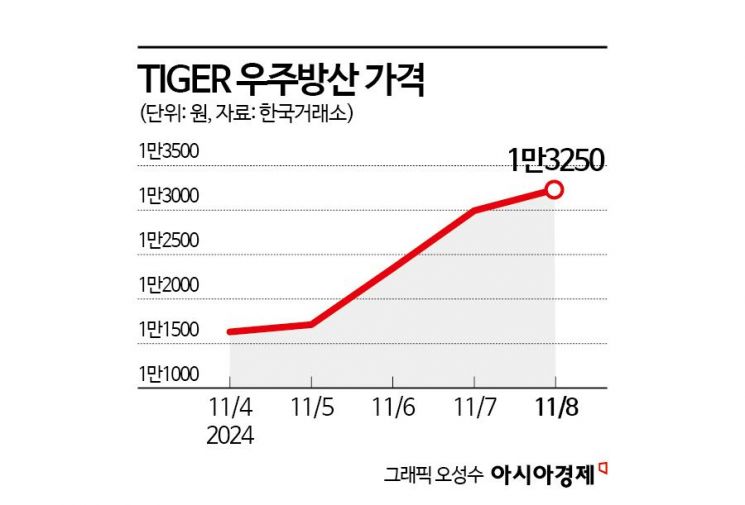

According to the Korea Exchange on the 11th, the 'TIGER Aerospace & Defense' exchange-traded fund (ETF), which invests in aerospace companies, closed at 13,250 won, up 250 won (1.92%) from the previous day’s close. Since November 6, when Trump’s U.S. presidential victory became certain, the ETF has surged 12.96%. During the same period, constituent companies of the ETF such as AP Satellite (39.32%), Hanwha Systems (27.68%), Innospace (20.54%), Satrec Initiative (18.66%), Hanwha Aerospace (11.46%), and Intellian Technologies (5.45%) each rose. The buying momentum is interpreted as driven by expectations that Trump, who is likely to implement policies favorable to Elon Musk, CEO of aerospace company SpaceX, will improve space industry regulations and accelerate the commercialization of space technology.

The securities industry points out that the aerospace sector is at the center of a government-led technological hegemony war. KB Securities researcher Hainhwan Ha said, "In the R&D flow for the technological hegemony war, it is very important to observe the investment direction through the U.S. Defense Advanced Research Projects Agency (DARPA). The U.S. has been significantly increasing its budget for aerospace for two consecutive years, expanding investments," adding, "In line with this trend, the Korean government has also significantly increased its budget for the space sector this year, including the establishment of the Korea Aerospace Agency. From the perspective that the government is leading investments, long-term interest in aerospace is necessary."

Additionally, the researcher emphasized the need to pay attention to the fact that Elon Musk, leader of Tesla, a frontrunner in autonomous vehicles, is also conducting business in the aerospace sector. He explained, "Tesla has declared it will fully launch robo-taxi and autonomous driving businesses, but there are many challenges to overcome. Along with regulatory improvements, the prerequisite for autonomous driving is communication infrastructure," and added, "We must not forget that Elon Musk manages not only Tesla but also SpaceX. Tesla’s autonomous driving will face challenges that require the prior deployment of space communication infrastructure rather than just the technology itself."

Especially at this point when the space industry is beginning to blossom, there is analysis that the satellite and launch vehicle manufacturing sectors will benefit. Eugene Investment & Securities researcher Jeong Eehun said, "The space industry can be broadly divided into the upstream sector, which involves creating and sending things into space, and the downstream sector, which includes ground equipment and services derived from it. Currently, the global space industry, including Korea, is focused on building infrastructure through multiple satellite launches, i.e., the upstream sector," and added, "Until last year, domestic space companies showed similar stock price trends, but now momentum differences will emerge within the space industry value chain. Currently, the benefits are clearer for upstream-related stocks." He further noted, "In satellite manufacturing, there are Satrec Initiative, Hanwha Systems, and Korea Aerospace Industries, while in launch vehicles, Hanwha Aerospace can be mentioned."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)