With Donald Trump, the 47th President of the United States and the Republican presidential candidate, being re-elected, a favorable outlook is expected for the domestic shipbuilding and construction industries.

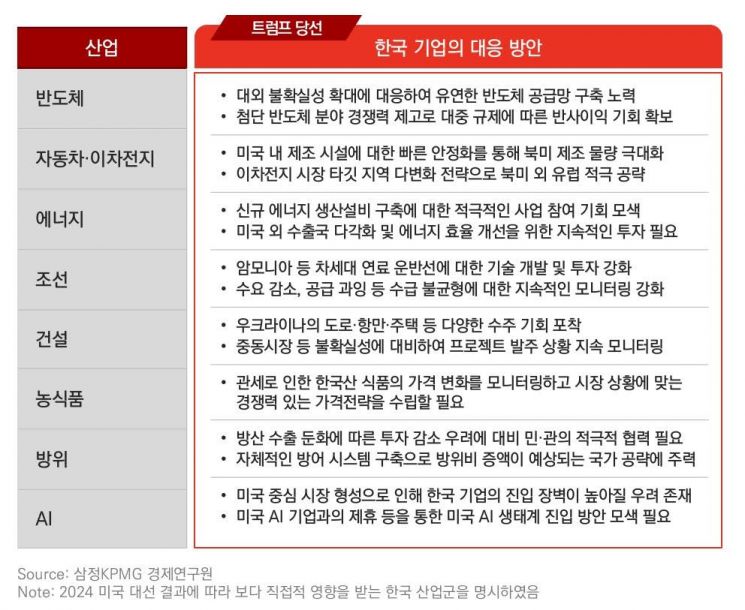

Samjong KPMG analyzed the impact of President-elect Trump's policies on major domestic industries such as ▲semiconductors ▲automobiles and secondary batteries ▲energy ▲shipbuilding ▲construction ▲agriculture and food ▲defense ▲AI (artificial intelligence) in a report published on the 7th.

The policy outlook was summarized as ‘T.R.U.M.P’. Under the Trump administration, significant changes are expected in trade policies (Trade and Tariffs), risk-taking (Risk Take), increased uncertainty due to unpredictable policy directions (Unpredictability), manufacturing strength (Manufacturing), and expectations and concerns regarding the pursuit of contradictory pledges (Paradox).

President-elect Trump has emphasized unilateralism and non-interventionism in diplomacy and security policies, including increasing the defense cost burden on allied countries. In security, he has pursued pro-Israel policies and announced strong trade responses such as imposing high tariffs on China, expanding protectionist measures, and a comprehensive decoupling strategy.

Regarding economic and trade policies, the focus is on protecting American workers and reducing trade deficits by imposing universal tariffs and strengthening bilateral trade agreements. On the supply chain front, efforts to separate the US and Chinese economies are underway, including plans to revoke China’s Most Favored Nation status, increase tariffs on China, and gradually eliminate imports of essential goods. The administration aims for manufacturing-centered economic growth through low-cost energy policies by easing environmental and energy regulations and has also announced plans for additional corporate tax cuts.

The semiconductor industry is expected to face intensified protectionism, including regulations targeting China. In particular, there is a possibility of amendments to the CHIPS Act, increasing uncertainty for the domestic semiconductor industry. Direct regulations on China may provide some spillover benefits to the Korean semiconductor sector.

The automobile and secondary battery industries may suffer direct impacts on exports to the US due to increased tariffs on finished vehicles and reductions in electric vehicle tax credits under the Inflation Reduction Act (IRA). The potential reduction of the Advanced Manufacturing Production Credit (AMPC) clause is also expected to negatively affect the profitability of Korean automobile and secondary battery companies.

The energy industry is expected to increase fossil fuel production and weaken pro-environment policies, including a possible re-withdrawal from the Paris Climate Agreement. While this may ease ESG (environmental, social, and governance) burdens for Korean companies, it could slow the pace of energy transition.

The shipbuilding industry is expected to benefit from increased demand for LNG and LPG. The Trump administration’s fossil fuel-centered policies are anticipated to create a positive environment for the domestic shipbuilding industry. In the construction industry, if the Russia-Ukraine war ends, reconstruction projects in Ukraine are expected to accelerate, increasing overseas business opportunities for Korean construction companies.

The defense industry is likely to pursue an America-first policy demanding allied countries share defense costs. Although some uncertainties are expected in Korea-US defense cooperation, the global trend toward strengthening autonomous national defense is expected to create export expansion opportunities for the Korean defense industry. Regarding the AI industry, President-elect Trump is predicted to expand support for US-centered AI industry growth and ease regulations that hinder it.

Samjong KPMG Economic Research Institute emphasized, “Protectionism and changes in US-China relations will be key variables,” and advised, “Korean companies should closely monitor policy changes and seek countermeasures such as building global supply chains, diversifying export markets, and strengthening pricing strategies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)