Cancellation Rate of Non-Cancellable Insurance Presented with 'Principle Model'

Strict Conditions When Insurers Follow Their Own 'Different Models'

Guidelines Established Including Additional Short-Term Whole Life Cancellation Rates

Financial authorities will improve assumptions for lapse rates of no-surrender and low-surrender insurance products to be more conservative than before. This is due to concerns that insurers have been arbitrarily and optimistically assuming lapse rates, inflating performance and shifting risks to the future, causing side effects. It is expected that insurers' financial soundness will deteriorate and premiums for no-surrender and low-surrender insurance products will inevitably increase.

Financial Services Commission Proposes 'Principled Model' for No-Surrender Insurance Lapse Rate Assumptions

On the 7th, the Financial Services Commission presented a 'principled model' (log-linear model) regarding lapse rates for no-surrender insurance products through the 'International Financial Reporting Standards (IFRS17) Key Actuarial Assumptions Guideline.' No-surrender insurance products offer lower premiums but provide little or no refund to policyholders upon early termination. Under IFRS17, companies can assume future cash flows by reflecting empirical statistics such as company-specific risk rates and lapse rates. These assumptions are used to calculate the insurance contract margin (CSM), a core profitability indicator for insurers. However, there have been repeated criticisms that insurers have optimistically assumed lapse rates for no-surrender insurance, which has limited empirical data due to short sales periods, thereby inflating performance. In response, authorities have issued a kind of standard for lapse rate assumptions.

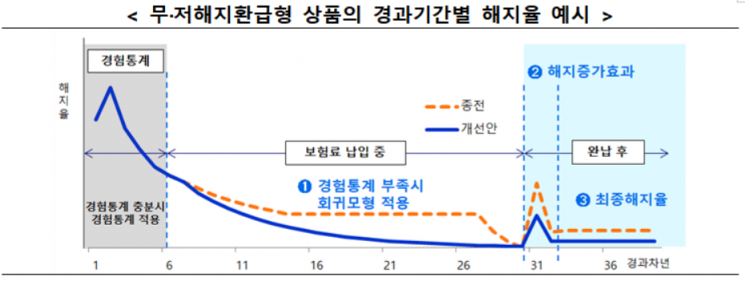

No-surrender insurance benefits insurers when lapse rates are high because they do not have to refund policyholders upon early termination, and future insurance payments decrease accordingly. This is why insurers tend to assume higher lapse rates. The authorities' principled model assumes a faster decline of lapse rates toward 0% as the insurance contract duration increases compared to previous models used by insurers. This reflects a conservative assumption that lapse rates will be lower than in existing models. Applying the principled model to lower lapse rates means insurers must reserve more funds to pay future claims to customers. This increases insurance liabilities and leads to a decrease in solvency ratios (K-ICS) due to reduced available capital.

The authorities conducted a financial impact assessment of insurers by comprehensively reflecting the K-ICS lapse risk refinement announced on the 4th, the lapse rate principled model announced on this day, and recent market interest rate declines. Based on a 3% yield on 10-year government bonds, the average K-ICS for insurers is estimated to decrease by about 20 percentage points compared to the end of the first half of this year (217.3%). Ko Young-ho, head of the Insurance Division at the Financial Services Commission, said, "(Despite the K-ICS decline) there is no problem with the overall soundness of the industry," adding, "Although K-ICS falls in the short term, the main opinion at the Insurance Reform Committee is that the timing of the institutional improvement plan is appropriate from the perspectives of consumer protection and sustainability."

Example graph of lapse rates over time for non-cancellation insurance products. Provided by the Financial Services Commission

Example graph of lapse rates over time for non-cancellation insurance products. Provided by the Financial Services Commission

Insurers Must Undergo Strict Verification When Choosing 'Alternative Models'

However, not all insurers are required to follow the principled model proposed by the authorities. The authorities have left open the option for insurers to apply alternative models due to the unique characteristics of their own empirical statistics. During prior discussions between the authorities and the industry, ten non-life insurers submitted a joint statement opposing the authorities' no-surrender insurance lapse rate reform plan as excessively conservative and unrealistic, suggesting that some degree of autonomy was granted.

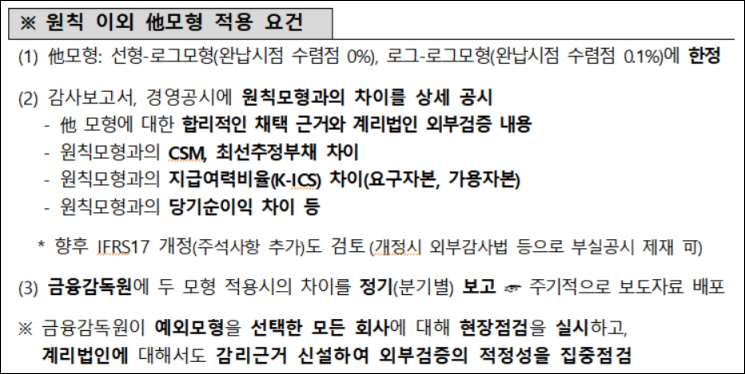

Nonetheless, if insurers choose to apply alternative models, they must satisfy strict conditions set by the Financial Supervisory Service (FSS). First, the model must be one of two types: a 'linear-log model' with a lapse rate convergence point of 0% at the premium payment completion, or a 'log-log model' with a convergence point of 0.1%. The authorities believe the lapse rate at the premium completion point should approach 0% because policyholders are unlikely to lapse after fully paying premiums, even borrowing money if necessary, since refunds are available after full payment. Additionally, insurers selecting alternative models must disclose special grounds for model selection and differences from the principled model in terms of CSM, K-ICS, and net income in audit reports and management disclosures. The FSS plans to intensively inspect the appropriateness of external verification through on-site inspections and newly established audit grounds for actuarial firms. Ko said, "If insurers choose alternative models, they must provide statistically clear reasons," adding, "Regardless of the model chosen, the rationality of assumptions will improve."

Conditions for applying insurers' unique 'alternative models' besides the 'principle model' presented by financial authorities when assuming cancellation rates for non-cancellation and non-surrender insurance. Provided by the Financial Services Commission

Conditions for applying insurers' unique 'alternative models' besides the 'principle model' presented by financial authorities when assuming cancellation rates for non-cancellation and non-surrender insurance. Provided by the Financial Services Commission

Insurers: "Worst Case Avoided... Premium Increases Inevitable"

Within the insurance industry, while some say "the worst case has been avoided," there is overall criticism of the frequent changes in insurance accounting. A representative from Insurer A said, "The basic principle of IFRS17 is actuarial autonomy, but the principled model presentation contradicts this," adding, "Since strict standards and sanctions are prepared for choosing alternative models, it is practically forcing the principled model." A representative from Insurer B said, "The worst-case scenario was avoided," but also pointed out, "The fact that guidelines are issued every year after IFRS17 implementation is causing market confusion and loss of trust, which the authorities should definitely recognize."

There are also concerns that premiums for no-surrender and low-surrender insurance products will rise. A representative from Insurer C said, "This reform plan reduces benefits from the consumer's perspective," predicting, "Coverage may regress somewhat, and cost increases due to unnecessary capital expansion will lead to premium hikes." The authorities also acknowledged the possibility of premium increases. Lee Taegi, director of the Insurance Risk Management Bureau at the FSS, explained, "Since insurers have optimistically assumed lapse rates and kept premiums low, the opposite will cause premium increases," adding, "However, pricing factors comprehensively consider loss ratios, operating expenses, interest costs, and others."

There were also positive views on the improvement plan. A representative from Insurer D said, "It is seen as an appropriate measure to correct bad industry practices."

Increase in Lapse Rates for Short-Payment Whole Life Insurance, Application of Age Differentiation to Insurance Liability Loss Ratio Assumptions

The authorities also prepared a plan to additionally set lapse rates for short-payment whole life insurance in this guideline. Short-payment whole life insurance has a short premium payment period of about 5 to 7 years but saw refund rates soar to the 130% range at the 10-year mark due to bonuses. The authorities believe consumers perceive short-payment whole life insurance as a savings-type insurance, so there is a strong incentive to lapse contracts upon receiving bonuses, and thus lapse rates reflecting this should be applied.

The authorities require that lapse rates for short-payment whole life insurance be back-calculated using the cumulative retention rate of general whole life insurance or set at a minimum of 30%. The 30% benchmark was calculated considering that the 11th-year lapse rate for bancassurance (bank-sold insurance) single-premium savings insurance, when refund rates surge due to tax exemption conditions, has averaged 29.4?30.2% over the past 10 years in industry statistics.

The guideline also proposes applying age differentiation to loss ratio assumptions when calculating insurance liabilities, in addition to differentiating by elapsed period and coverage type. Previously, loss ratios were calculated as an overall average without age differentiation, causing underestimation of loss ratios for elderly policyholders. This resulted in insurers' insurance liabilities and CSM appearing better than they actually are.

The authorities require that for coverages with sufficient empirical statistics and statistically significant age differentiation, loss ratios be calculated by age group going forward. If insurers have sufficient statistics, they must directly calculate loss ratios by elapsed period and age. If direct calculation is difficult, they should indirectly calculate using elapsed period-based age-combined loss ratios and age-relative factors.

This actuarial assumption guideline will be applied from this year's year-end closing. However, since system modifications are needed for age differentiation of loss ratios, the reflection period will be extended until the first quarter of next year. A Financial Services Commission official said, "If necessary, we plan to pursue revisions to supervisory administration or insurance supervision enforcement rules."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)