Display Industry Association 'Key Statistics of the Display Industry'

Lee Dong-wook "Full Support from Chinese Government... Still Unfavorable Competition"

The world's first wireless and transparent OLED TV, 'LG SIGNATURE OLED T'. Provided by LG Electronics

The world's first wireless and transparent OLED TV, 'LG SIGNATURE OLED T'. Provided by LG Electronics

In the first half of this year, domestic display companies in Korea achieved sales exceeding last year's by more than 10%, leveraging advanced technology, but they continue to face tough competition due to aggressive pursuit by China and increased adoption of domestic components in China.

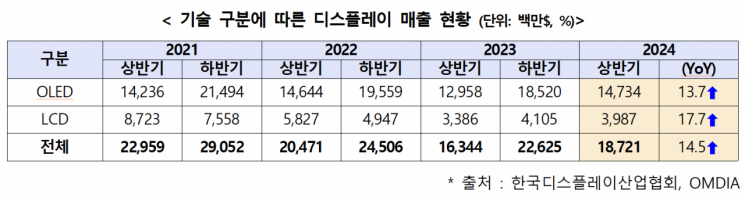

The Korea Display Industry Association announced the 'Key Statistics of the Display Industry' on the 6th. Sales of domestic display companies in the first half of this year were approximately $18.7 billion (about 26.1 trillion KRW), a 14.6% increase compared to the previous year.

Among these, OLED sales increased by 13.7% to $14.7 billion (about 20.5 trillion KRW), and LCD sales rose by 17.7% to $4.0 billion (about 5.6 trillion KRW). OLED sales recorded the highest ever for the first half of the year. The previous record was $14.6 billion (about 20.38 trillion KRW) in the first half of 2022.

The increase in high value-added OLED demand in IT and TV sectors is interpreted as a positive impact of the technological superiority of domestic companies on their performance. In the first half of this year, sales of IT products such as tablets and laptops in the medium-to-large size segment reached approximately $4.6 billion (about 6.4 trillion KRW), a 79% increase. OLED sales for TV also increased by 30.6%, totaling about $2.4 billion (3.3 trillion KRW).

Smartphone panel sales decreased by 2.3% compared to the previous year, but sales of LTPO panels, which maximize power efficiency, increased by 24% to $6.5 billion (about 9 trillion KRW). This indicates that the development of high-performance technologies tailored to consumer demands such as energy saving is yielding results.

China Expands Adoption of Domestic Components... Korean Companies' Supply Share Declines

However, China is significantly increasing the use of domestic components, reducing the market presence of Korean companies in the display panel market.

In the Chinese laptop OLED market, the market share of Korean products, which was 98.6% last year, dropped to 44% in just six months. The Chinese domestic share in the first half of this year was 56%.

For smartphone OLED panels in China, the supply share of Korean panels in the first half of this year was only 13.9%, while Chinese panels accounted for 86.1%. Until 2020, Korean OLED panels held a 76.8% share in China, but this dropped to the 10% range within three years and worsened further this year.

China is also rapidly expanding its market share in emerging markets such as India and Africa. Although Chinese OLED panels still lag behind domestic products in technological level, they are solidifying their position in emerging markets through low-price strategies.

To secure market share globally, Korean companies are adjusting their strategies to focus on high value-added products centered in North America and Europe, excluding China. They are strengthening high-performance, low-power OLED technologies to enhance competitiveness domestically.

Domestic Companies Expected to Benefit from the Spread of High-Performance OLED Products in 2025

As the structure of the display industry rapidly shifts to OLED-centered, domestic companies are expecting continuous growth potential.

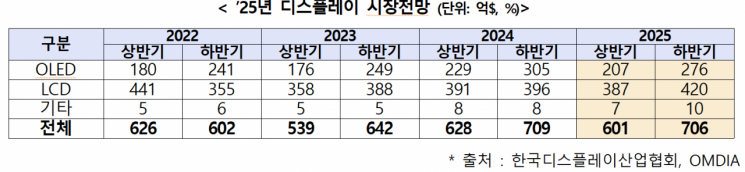

The association forecasts the OLED market to grow by 5.4% to about $48.3 billion (about 67.3 trillion KRW) in 2025. The LCD market is expected to increase by 5.6% to $80.7 billion (about 112.5 trillion KRW), bringing the total market size to approximately $130.7 billion (about 182.13 trillion KRW). In terms of shipment volume, OLED is expected to record about 1.1 billion units, a 4.4% increase from the previous year, while LCD is expected to decline by 0.6% to 2.3 billion units, indicating that OLED will rapidly replace LCD.

The spread of high value-added OLED products increases the likelihood that Korean companies will be major beneficiaries. If LTPO panels are applied to all models of the iPhone 17 series in 2025, Korean companies supplying these panels are expected to secure a supply volume advantage.

Additionally, shipments of OLED-based iPad Pro are expected to increase by 30%, from about 6.1 million units in 2024 to about 7.5 million units in 2025. In these product groups requiring advanced technology, Korean companies can expect continuous benefits based on cutting-edge technologies such as LTPO and two-stack tandem OLED.

Intensifying US-China Trade Dispute... Significant Impact on Display Materials and Components Companies

The intensifying US-China trade conflict is expected to have a considerable impact on the display industry. The association stated, "Since both Republican and Democratic presidential candidates commonly mention strengthening tariffs against China and protectionism, the US-China trade dispute is expected to escalate further," adding, "Display materials and components companies, which have a high export ratio to China, need to carefully examine how the intensifying dispute will affect them."

Lee Dong-wook, Vice Chairman of the Korea Display Industry Association, said, "Despite China's patriotic consumption and domestic component adoption, domestic companies have recorded over 83% supply dominance in global markets excluding China," and added, "With Apple's adoption of OLED for the iPad Pro this year and full LTPO adoption for the iPhone 17 to be released next year, domestic companies' leadership in the OLED market will continue."

Lee also said, "Although the domestic display industry is designated as a national strategic technology and receives government support, it still faces unfavorable competition compared to China's full-scale support," and noted, "Apple, the largest demand source for displays, leads eco-friendly policies such as decarbonization and RE100, but competitor China disregards World Trade Organization (WTO) norms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.