Independent Judgment on Tender Offers and Paid-in Capital Increases Must Be Accepted

Unlimited Amendments to Correction Reports Allowed

Delays in Paid-in Capital Increases Render Vote Contests Meaningless

The Financial Supervisory Service (FSS) appears to be effectively blocking Korea Zinc's planned rights offering related to its management rights dispute. The FSS has stated that if the explanations for the correction requests are not sufficiently logical, it will demand further corrections.

On the 7th, a senior FSS official said, "Korea Zinc must provide sufficient explanations regarding the correction requests for the securities registration statement for the rights offering," adding, "If logical explanations about the background of the rights offering, the decision-making process, and the differences from the tender offer registration statement are not provided, it will be of no use."

This is interpreted as a demand to clarify whether the controversial tender offer and the decision to proceed with the rights offering were made independently. The FSS, through its correction request on the securities registration statement the previous day, pointed out that the description of the rights offering’s background, decision-making process, due diligence progress by the underwriter, and differences from the tender offer registration statement were insufficient, and requested Korea Zinc to submit a corrected registration statement.

When a company submits a securities registration statement for a rights offering and receives a correction request, it must revise and resubmit the document within three months. The revised registration statement takes about 10 days to become effective again. But it does not end there.

The FSS can demand unlimited corrections if it judges the revisions to the registration statement to be insufficient. Previously, the FSS requested corrected registration statements twice regarding the merger of Doosan Robotics and Doosan Bobcat. Ultimately, Doosan withdrew the merger.

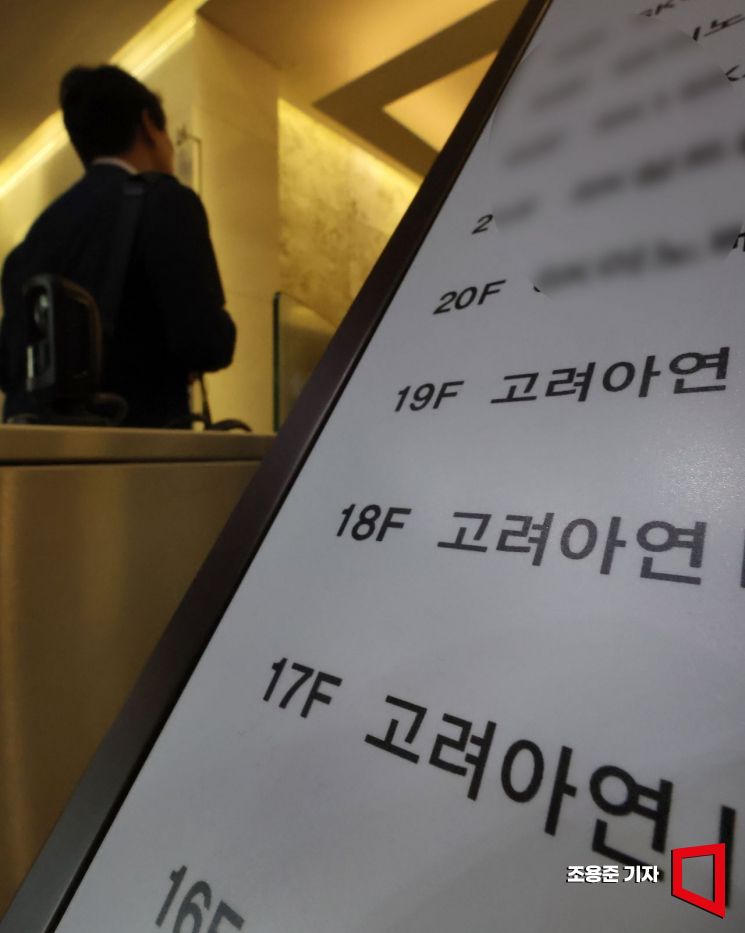

Korea Zinc, which is undergoing a management rights dispute, held an emergency board meeting at its headquarters in Jongno-gu, Seoul on the 30th, and is expected to take measures regarding the request by the Yeongpung-MBK Partners alliance to convene an extraordinary general meeting of shareholders. Photo by Jo Yong-jun

Korea Zinc, which is undergoing a management rights dispute, held an emergency board meeting at its headquarters in Jongno-gu, Seoul on the 30th, and is expected to take measures regarding the request by the Yeongpung-MBK Partners alliance to convene an extraordinary general meeting of shareholders. Photo by Jo Yong-jun

The FSS is suspicious of Korea Zinc’s decision-making process for the rights offering. On the 1st, Ham Yong-il, Deputy Governor of the FSS, pointed out, "If the Korea Zinc board of directors proceeded knowing the entire plan to acquire treasury shares through borrowing, cancel them, and then repay the borrowings through a rights offering, it means that significant information was omitted from the tender offer registration statement." If Korea Zinc fails to prove that the tender offer and the rights offering decisions were made independently, approval of the securities registration statement will be difficult.

Some speculate that Korea Zinc may withdraw the rights offering procedure. One reason Korea Zinc decided on the rights offering was to secure the shareholder registry. Currently, Korea Zinc’s shareholding ratio (35.40%) is lower than that of Youngpoong-MBK Partners (38.47%). Only shareholders holding shares as of December 31 this year can exercise voting rights at next year’s regular shareholders’ meeting. If the rights offering procedure is delayed due to the FSS’s intervention, it will be meaningless.

Meanwhile, Youngpoong-MBK Partners has applied to the Seoul Central District Court for permission to convene an extraordinary shareholders’ meeting to appoint 14 new directors. If the court grants permission, a proxy battle may ensue in January next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.