Manual Posted on the Financial Supervisory Service Website

On the 6th, the Financial Supervisory Service (FSS) announced that it has prepared an internal model approval application manual to facilitate the management of insurance companies' solvency ratio (K-ICS·K-ICS).

K-ICS is financial information that indicates whether an insurance company can pay insurance claims to policyholders on time. It is calculated by dividing available capital by required capital. Under the Insurance Business Act, insurance companies can calculate required capital using not only the standard model presented by the FSS but also their own internally developed models. This is because the standard model is convenient for comparisons between companies but does not adequately reflect the characteristics of individual insurance companies.

Since the early stages of applying the K-ICS system, the FSS has been preparing to introduce an internal model approval system to establish a foundation for insurance companies to utilize internal models in managing K-ICS. This time, the FSS created an internal model approval application manual and posted it on the FSS website. Required capital consists of life and long-term non-life insurance risk, general non-life insurance risk, market risk, credit risk, and operational risk, among which the internal model approval system for 'life and long-term non-life insurance risk' was prioritized. It plans to expand to other risks in the future.

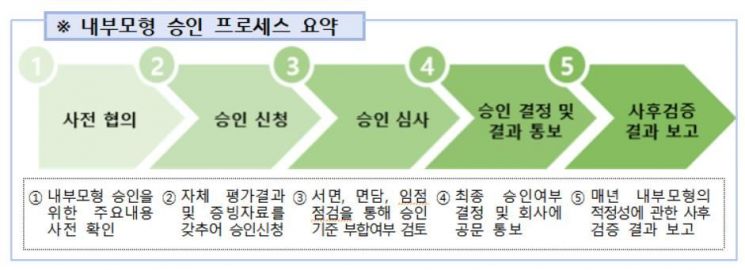

Insurance companies' Solvency Capital Requirement (K-ICS) internal model approval process. Provided by the Financial Supervisory Service

Insurance companies' Solvency Capital Requirement (K-ICS) internal model approval process. Provided by the Financial Supervisory Service

The manual shows that the internal model approval process consists of five steps: preliminary consultation, approval application, approval review, approval decision and result notification, and post-verification and result reporting.

Preliminary consultation is a stage before receiving the approval application, where the insurance company’s preparation status for adopting the internal model is checked in advance and specific schedules are discussed.

At the approval application stage, insurance companies must submit the approval application form, self-assessment results, and supporting documents to the FSS at least three months before the planned date of internal model use.

During the approval review process, the FSS examines whether the internal model meets the approval criteria through the approval application form, supporting documents, interviews with responsible personnel, and on-site inspections. The FSS plans to form a review committee including external experts for the review.

The approval decision and result notification stage involves deciding on the approval within three months from the application date after the review and notifying the insurance company of the result via official letter.

Finally, in the post-verification and result reporting stage, insurance companies must conduct annual post-verification of the appropriateness of the approved internal model and report the results to the FSS within three months from the end of each year.

The manual also includes internal model inspection items and evaluation criteria. These contain five evaluation elements regarding qualitative and quantitative standards that insurance companies must have to apply for internal model approval, such as internal model operation, control structure and monitoring, internal model utilization, self-risk and solvency evaluation system, and calculation criteria for life and long-term non-life insurance risk amount (including shock levels).

An FSS official said, "Through this manual, insurance companies will be able to self-assess their preparation status before applying for internal model approval and use it to predict future improvement directions and approval outcomes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)