Lotte Construction Enters Restructuring Mode for Unstarted Projects

Daejeon Doan Officetel and Jeonju Daehan Bangjik Site Development

Accepts Losses and Forfeits Construction Rights

Bridge Loan Maturity Extension Fails

Major Lending Financial Institutions Face Worsening Bad Debt

It has been confirmed that Lotte Construction recently gave up the construction rights for the Daejeon Doan District officetel development project, following the Jeonju Daehan Textile factory site development project. The financial companies that provided bridge loans (loans for land purchase funds before project permits) for the development project failed to extend the maturity, resulting in the loan entering a loss of benefit of term (EOD: default event) situation. Although efforts are being made to normalize the project through negotiations with the lending consortium, losses are inevitable if the negotiations do not proceed properly.

With Vice Chairman (CEO) Park Hyun-chul leading the restructuring of unstarted project financing (PF) projects, financial companies are on high alert. This is because, following Lotte Construction and Lotte Chemical, the overall group, including Lotte Shopping, is experiencing worsening performance and credit ratings, which is expected to accelerate restructuring of PF projects.

Abandonment of Daejeon Doan 35 Block Officetel Development Project

According to the investment banking (IB) industry on the 5th, Lotte Construction recently gave up the construction rights for the 35BL site within the special planning zone of Daejeon Doan District. This was a project where Lotte Construction, together with the developer Doan Mirae Holdings, planned to develop and sell 1,041 officetel units and living facilities from basement level 4 to ground level 47. The contract amount related to this construction order was approximately 280 billion KRW.

It is known that Lotte Construction provided guarantees for subordinated loans worth between 30 billion and 40 billion KRW during the process of securing land for the Doan 35BL project site. Doan Mirae Holdings took out a bridge loan of about 100 billion KRW in 2021 to purchase the land. However, due to the downturn in local development projects, the project could not be converted to project financing (PF), and the maturity of the existing bridge loan was continuously extended. Recently, the loan maturity came due again, and refinancing was pursued as before, but with Lotte Construction abandoning the project, the maturity extension was not achieved.

Financial companies such as Shinhan Capital, which lent land purchase funds to the developer, are in a difficult situation. As Lotte Construction withdrew from the project even by giving up subordinated loans worth 30 billion to 40 billion KRW, the entire bridge loan has entered an EOD situation. Without Lotte Construction's support, the lending consortium must either inject additional funds to extend the bridge loan maturity or auction off the land held as collateral. Extending the loan means providing additional loans to a distressed project site, and even if auctioned, it is uncertain whether the land can be sold at a fair price amid the development project downturn.

A PF industry insider said, "While negotiating the extension of the matured bridge loan, Lotte Construction refused to inject additional funds and gave up on recovering the subordinated loan, resulting in loan delinquency." The insider added, "The lending consortium is seeking solutions through negotiations, but which financial company would inject additional funds into a project site without Lotte Construction's participation?" expressing concerns that "the project is likely to lead to failure."

Financial Companies Fear Chain Defaults on Lotte’s Unstarted Project Bridge Loans

The Jeonju Daehan Textile site development project, also contracted to Lotte Construction, is in a similar situation. The lending consortium that provided bridge loans has given up on converting to PF and started recovering funds, putting the project at risk of halting. Lotte Construction, as the contractor, stopped the development project even after fulfilling a 100 billion KRW capital supplementation agreement (guarantee obligation). Lotte Construction repaid 100 billion KRW in debt to IBK Investment & Securities and others who lent money to the developer ‘Jagwang’ according to the guarantee contract. Instead of converting to PF and proceeding with the project normally, they chose to liquidate the project site. Lotte Construction is expected to exercise collateral rights to recover the 100 billion KRW guarantee obligation burden.

As Lotte Construction undertakes consecutive project liquidations despite incurring losses, financial companies that provided bridge loans to Lotte’s unstarted projects are also on high alert. With increasing loan EODs, the burden of provisions related to PF non-performing loans is rising, and future loan recovery may become difficult.

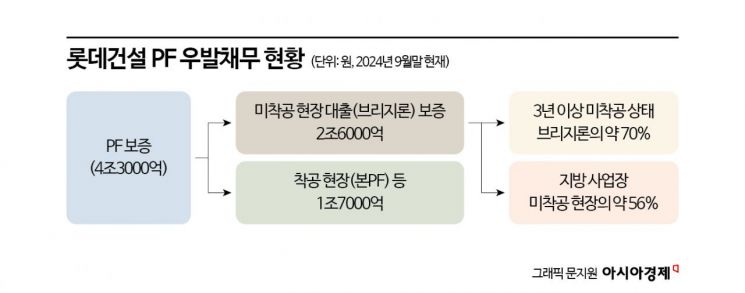

A financial company official said, "Lotte Construction is extending the maturity of bridge loans for unstarted development projects with a total of 2.8 trillion KRW, including 2.3 trillion KRW borrowed from the four major financial holding companies through affiliate support and a 500 billion KRW limit from Meritz Securities, but it seems that some less viable local projects are entering liquidation stages." The official added, "Financial companies are deeply worried about the possibility of loan defaults due to Lotte’s restructuring."

Worsening Financial Capacity of Lotte Chemical and Others Triggers PF Restructuring

The weakening financial capacity of major group affiliates such as Lotte Chemical is also cited as a background triggering PF project restructuring. Lotte Chemical, the parent company and strong supporter of Lotte Construction, is facing increased financial burdens due to accumulated losses from poor petrochemical business performance. Recently, Lotte Shopping, which played the role of the group’s cash cow, is also experiencing deteriorating performance due to sluggish retail business.

As a result, the entire group’s affiliates are suffering from credit rating deterioration. The credit rating outlooks for Lotte Chemical (AA), Lotte Holdings (AA-), Lotte Property & Development (AA-), Lotte Capital (AA-), and Lotte Rental (AA-) changed from 'stable' to 'negative' in the first half of this year. If the performance decline continues through this year, a downgrade of the affiliates’ credit ratings is inevitable.

An IB industry insider said, "In a situation where there is no affiliate to serve as a strong pillar for the group, it is difficult for Lotte Construction to bear all low viability PF projects or receive additional support from affiliates." The insider added, "There is a risk that the tail may wag the dog, so restructuring of PF projects is absolutely necessary."

A PF industry insider said, "I agree that restructuring of Lotte’s development projects is necessary," but added, "I am concerned that it might negatively affect even the normal PF project sites."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.