Han&Co Confirms Acquisition of Namyang Dairy Products After Over 2 Years

Secures Investment and Exit Opportunities by Taking Over SK Group's Business Restructuring Assets

Ssangyong C&E Delisted Following Tender Offer, Paving Way for Sale

Successful Formation of Korea's 4th Largest Blind Fund with 4.7 Trillion KRW Investment

Han & Company (Han & Co) has quietly achieved remarkable results in both investments and exits this year. As activist strategies are increasingly adopted by not only activist funds but also private equity and hedge funds to enhance returns, Han & Co is being recognized for quietly finding substantial gains.

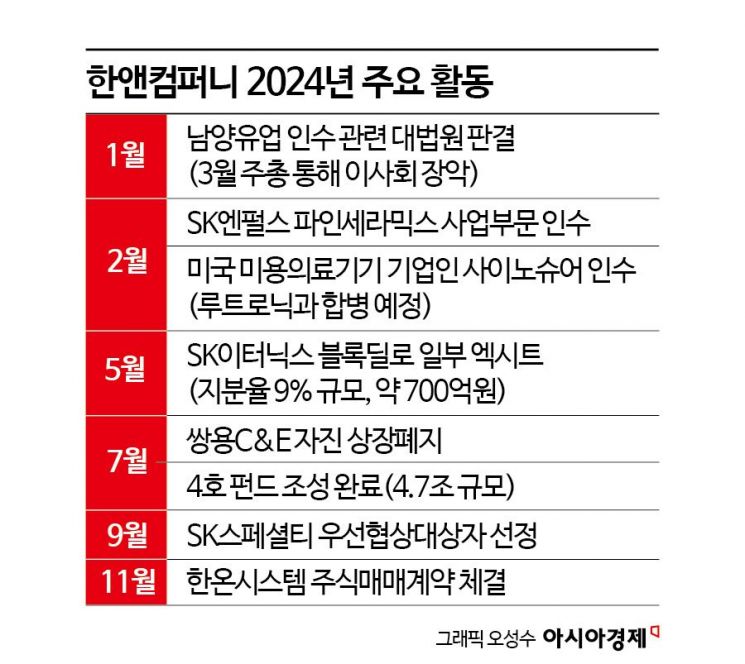

According to the investment banking (IB) industry on the 5th, Han & Co completed 4 investments and 2 exits this year. They conducted two suspension operations, including taking control of investee company boards and delisting, and finalized the raising of their 4th fund, which approaches 5 trillion KRW.

This year, Han & Co confirmed the acquisition of Namyang Dairy Products. The legal battle between Han & Co and Hong Won-sik, chairman of Namyang Dairy Products, was resolved in Han & Co’s favor through a Supreme Court ruling. At the March shareholders' meeting, Han & Co succeeded in taking control of Namyang Dairy Products' board. Four Han & Co personnel, including Chairman Yoon Yeo-eul, were appointed as new directors, while the previous board members, including former Namyang Dairy Products CEO Hong Won-sik who had been an inside director until then, stepped down. This brought an end to the management dispute over two years between Han & Co and the Namyang Dairy Products owner family, including former chairman Hong.

Han & Co notably secured a large volume of SK Group’s business restructuring assets. In February, they completed the acquisition of the Fine Ceramics division of SK Enpulse, a subsidiary of SKC. The acquired division, purchased for 360 billion KRW, was renamed Solmix. Solmix manufactures components such as silicon, quartz, and alumina used in etching processes that chemically smooth semiconductor surfaces. They possess technology that supplies materials with improved electrical properties and durability compared to conventional ceramic materials through high-purity inorganic compounds. In September, Han & Co was selected as the preferred bidder for the sale of SK Specialty, a 100% subsidiary of SK Corporation. SK Specialty, considered a key subsidiary of SK Corporation, produces specialty gases used in semiconductor and display panel manufacturing processes, holding the world’s number one market share and technology in the production of nitrogen trifluoride (NF3) and tungsten hexafluoride (WF6).

Han & Co also proceeded with the establishment of a joint venture (JV) between SK Microworks and Kolon Industries. The JV’s shareholding structure is 18% Kolon Industries and 82% SK Microworks. SK Microworks is the original business of SKC, acquired by Han & Co the year before last, and develops and commercializes various film materials. The JV was established to strengthen competitiveness in the industrial film sector and solidify their position in the global market.

An IB industry insider said, "Han & Co conducted various deals this year through close collaboration with domestic strategic investors (SIs)."

In addition to SK Group assets, Han & Co acquired Cynosure, a U.S. medical device company known for its skin regeneration medical device brand 'PicoSure.' They also laid out a blueprint to grow it into a global comprehensive medical device company by merging it with Lutronic, which they acquired last year. Cynosure develops and manufactures various key medical devices for hair removal, skin regeneration, scar reduction, and gynecological treatments. Through the acquisition of Cynosure and the merger with Lutronic, Han & Co plans to transform the merged entity into a medical aesthetic system company with sales networks in over 130 countries.

Han & Co also executed exits from existing investee companies. In May, Han & Co sold 9% of its stake in SK Eteonics through an off-market block trade, cashing out approximately 69 billion KRW. Han & Co’s stake decreased from 31% to 22%. SK Eteonics was established in March after SK D&D spun off its renewable energy business. As SK Eteonics’ stock price rose post-spin-off, Han & Co, as a financial investor, recovered part of its investment. In November, Han & Co sold Hanon Systems to Hankook Tire & Technology. Hankook Tire acquired about 23% of Hanon Systems shares held by Han & Co. In addition to the secondary share transaction, Hankook Tire will participate in a 600 billion KRW third-party allotment capital increase of Hanon Systems. Upon completion, Han & Co, currently the largest shareholder of Hanon Systems, will become the second-largest shareholder, while Hankook Tire, currently the second-largest shareholder, will become the largest shareholder. Hankook Tire’s stake will increase to 54.77%.

Han & Co also completed fundraising for new investments in July. The fund, dedicated to Korean investments, is the largest ever at 3.4 billion USD (approximately 4.7 trillion KRW). Han & Co’s 4th blind fund exceeded its initial target of 3.2 billion USD. The limited partners (LPs) are globally distributed with 35% from Asia, 30% from North America, and 20% from the Middle East. Ninety-three percent of LPs who invested over 100 million USD in the 3rd fund reinvested. The 3rd fund, established by Han & Co in 2019, has recorded a distribution to paid-in capital (DPI) and internal rate of return (IRR) exceeding 30%.

Meanwhile, Han & Co delisted its investee company Ssangyong C&E from the Korea Exchange. Han & Co increased its stake in Ssangyong C&E to 93% through a tender offer. Subsequently, through on-market purchases and comprehensive stock swaps, it became a 100% subsidiary. With the delisting confirmed, there is widespread speculation that Han & Co will begin behind-the-scenes preparations for a sale within this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.