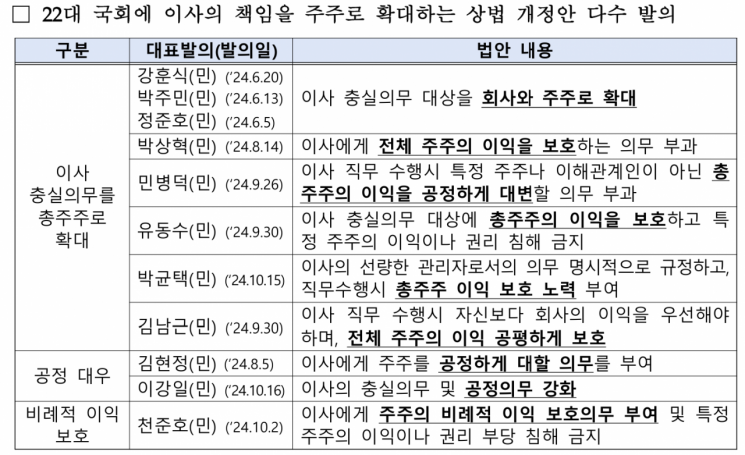

Opposition to Amendment of Commercial Act on Duty of Loyalty 'Company → Shareholders·Company'

"No Significant Benefit to Shareholders and Concern over Decline in Corporate Value"

The Korea Economic Association announced on the 4th that numerous amendments to the Commercial Act, which strengthen directors' duties to protect shareholder interests, have been proposed in the National Assembly, and voices expressing concern over the increased burden on Korean corporate management based on U.S. cases are growing. It is feared that if the amendments pass, there will be a flood of lawsuits by disgruntled shareholders against corporate management during mergers and acquisitions (M&A) or restructuring processes.

On the same day, the Korea Economic Association released a report titled "U.S. M&A Shareholder Derivative Suits and Directors' Fiduciary Duties." The report analyzed U.S. corporate law, precedents, and M&A litigation cases, warning of potential corporate damages if the Anglo-American fiduciary duty doctrine were introduced into Korean Commercial Act.

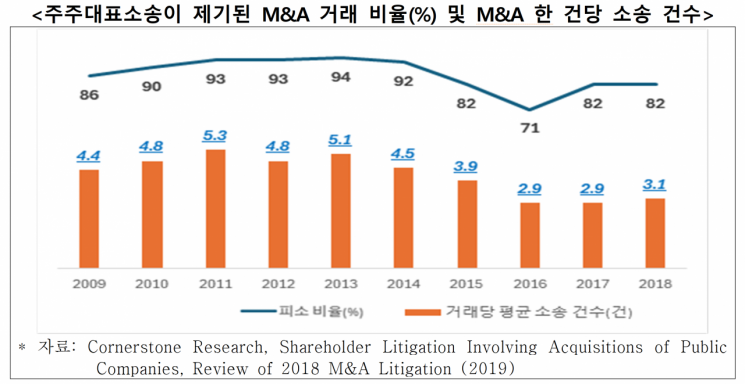

The report stated, "Even in the business-friendly U.S., an average of 3 to 5 shareholder derivative suits are filed per M&A case, with most lawsuits alleging breaches of directors' fiduciary duties to shareholders."

The fiduciary duty doctrine means that company directors or executives have a legal responsibility to prioritize the company's interests above all else. Directors and executives must make honest and fair judgments when making important company decisions and must not act for their personal gain.

The report explained that in the U.S., shareholders often file lawsuits after the announcement of corporate M&A plans, claiming that disclosed information is insufficient or that important matters were omitted. The proportion of shareholder derivative suits related to U.S. listed company M&As (over $100 million) was 86% in 2009 and reached a peak of 94% in 2013.

To avoid lawsuits, companies mainly settled with plaintiffs by providing additional disclosures or adjusting merger consideration. In this process, large attorney fees were paid, effectively acting as a kind of "transaction tax" on M&A deals. Ultimately, shareholders gained little beyond the additional disclosures.

Percentage of M&A transactions subject to shareholder derivative lawsuits (%) and number of lawsuits per M&A case [Image source=Hankyung Association]

Percentage of M&A transactions subject to shareholder derivative lawsuits (%) and number of lawsuits per M&A case [Image source=Hankyung Association]

The Delaware Court issued the "Trulia ruling" in 2016 to curb the proliferation of lawsuits. However, a balloon effect occurred, with federal courts and other state courts seeing a surge in lawsuits afterward. In fact, the proportion of M&A-related lawsuits, which had dropped to 71% in 2016, rose again to 82% the following year.

Moreover, the percentage of M&A-related shareholder derivative suits filed in federal courts was an average of 26% annually before the Trulia ruling (2009?2015), but surged to 91% in 2018. The Korea Economic Association analyzed this as lawyers engaging in "forum shopping" to find jurisdictions favorable to litigation.

The U.S. limits directors' liability under the "Business Judgment Rule." Delaware corporate law includes a director liability exemption clause, guaranteeing directors a defense right in lawsuits concerning business judgments.

In contrast, Korea's Commercial Act has a director liability exemption provision, but it requires unanimous shareholder consent, making it difficult to apply in large listed companies with many shareholders.

Lee Sang-ho, head of the Economic and Industrial Headquarters at the Korea Economic Association, stated, "Our Commercial Act sets director liability based on civil law agency contracts, so directly applying the U.S.-style fiduciary duty doctrine does not fit our legal system. Since companies are likely to suffer value declines due to litigation and shareholders gain no substantial benefits, we oppose amendments to the Commercial Act that expand directors' duties of loyalty to shareholders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)