October Household Loan Growth of 5 Major Banks at 20% of September Level

Loan Demand Shifts to Secondary Financial Institutions like Saemaeul Geumgo...Possibility of Exceeding Regulatory Targets

Household Loan Growth "May Be Similar to September Level"

Loan Restrictions for Secondary Financial Institutions to Begin in November

Additional Measures for Major Banks Including Early Repayment Fee Waivers and Agent Handling Limits

As financial authorities urge the management of household loans by financial sectors on the principle of 'self-regulation,' the cumulative balance trend in November is expected to serve as a benchmark for evaluating the success or failure of various measures implemented so far. Until October, concerns about the 'balloon effect' grew as household loan demand shifted from commercial banks to other sectors. However, with the recent decision by the secondary financial sector, including Saemaeul Geumgo and the National Credit Union Federation of Korea, to consecutively implement measures such as restrictions on Mortgage Credit Insurance (MCI) products, a full-scale loan suppression movement is underway. The second phase of the stress Debt Service Ratio (DSR) measures has also entered its third month.

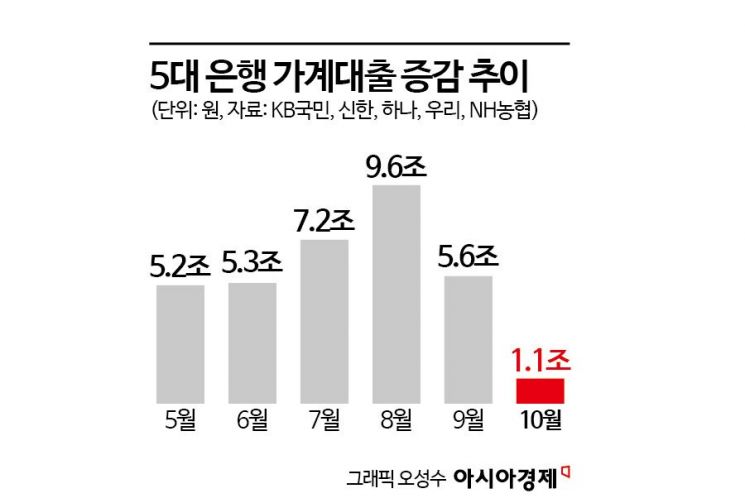

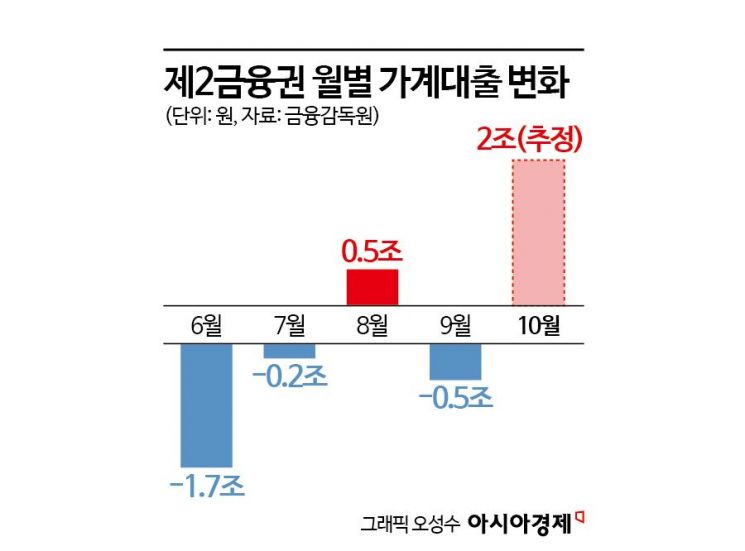

According to financial authorities and the financial sector on the 4th, the increase in household loan balances at the five major commercial banks in October dropped sharply to about 20% compared to September, while loans in the secondary financial sector are likely to exceed the management targets set by the authorities. There are also observations that when combining loan demand that moved to regional banks and internet-only banks, the trend could switch back to an increase. A financial authority official explained, "Although the increase in household loan balances at the five major banks in October decreased compared to September, household loans in regional banks, internet-only banks, and the secondary financial sector increased again," adding, "The overall increase in the financial sector could be similar to or exceed that of September."

At the end of October, the household loan balance at the five major banks was KRW 732.0812 trillion, an increase of KRW 1.1141 trillion from the end of September (KRW 730.9671 trillion). This increase is sharply reduced compared to KRW 9.6259 trillion in August and KRW 5.6029 trillion in September. The balance of mortgage loans, which had led the household loan increase trend, was KRW 575.6687 trillion, up KRW 1.0923 trillion from KRW 574.5764 trillion at the end of September. This increase is significantly smaller than KRW 8.9115 trillion in August and KRW 5.9148 trillion in September. The increase in jeonse loans was KRW 189.2 billion in October, down from KRW 212.7 billion in September.

Since September, with the rise in interest rates on personal loan products and the suspension of loan product handling, loan demand has shifted from the five major banks to regional banks, internet-only banks, and the secondary financial sector. The secondary financial sector estimates that the increase in household loan balances in October has already exceeded KRW 1 trillion. Considering the effect of bad debt write-offs, it approaches KRW 2 trillion, and including regional banks and internet-only banks, it could be higher than in September, according to some analyses. Kim Byung-hwan, Chairman of the Financial Services Commission, also said at a monthly press briefing on the 30th of last month, "We expect the increase in household loans in October to be slightly higher than in September."

Accordingly, financial authorities have been closely monitoring the November figures after convening working-level staff and executives from the secondary financial sector, regional banks, internet-only banks, and Saemaeul Geumgo at weekly intervals last month to urge self-management of cumulative household loan increases. This is because, as financial sectors including major commercial banks simultaneously begin to tighten household loans, it will be possible to gauge the effects of government policies and the financial sector's self-regulation.

Following the insurance sector's restriction on additional mortgage loans for multi-homeowners, the National Credit Union Federation of Korea plans to implement household loan stabilization measures starting from the 6th. The key points include limiting the loan amount for mortgage loans intended for living stabilization funds for multi-homeowners to KRW 100 million and restricting MCI-guaranteed loans for those owning more than one home to preemptively block mortgage loans for investment purposes. For multi-homeowners who have loans secured by houses located in the metropolitan area from financial institutions other than credit unions, credit unions will stop handling refinancing loans. Saemaeul Geumgo has also taken measures such as restricting mortgage loans for multi-homeowners, improving and strengthening management of loan brokerage corporations, reinforcing guidance against excessive interest rate competition, and pre-reviewing interim payment loans. Regional banks raised interest rates, which were formed in the high 3% range in October, to above 4%.

Additional measures by major banks have also been announced one after another. Shinhan, Woori, and Industrial Bank of Korea have introduced measures to reduce loan balances by encouraging loan repayments through waiving prepayment penalties. Hana Bank has set monthly new loan handling limits per loan broker to restrict the scale of loans individual brokers can attract from exceeding a certain level. Notably, Woori Bank has temporarily suspended the 'Group Head's Loan Interest Rate Approval Authority' at all branches from this month until the end of the year and decided to end the calculation of employees' key performance indicators (KPIs) related to loans as of the end of October.

A senior official from the financial sector said, "In November, as household loan management, which was centered on commercial banks, expands to other sectors and is implemented simultaneously, it will be possible to properly assess the effect of the financial sector's self-regulation," adding, "Additional measures by financial authorities are expected to be decided based on year-end trends." Meanwhile, the Financial Services Commission plans to hold a household debt inspection meeting next week to share the household debt management direction with each sector until the end of the year and discuss additional measures related to the rapid increase in household loans in the secondary financial sector.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.