Global Competitiveness Symposium by the Korean Academy of Management on the 1st

China's Electric Vehicle Ecosystem and Competitiveness, What is Korea's Strategy?

Mobility experts, including Hyundai Motor Company, cited price competitiveness, a strong electric vehicle ecosystem, and software capabilities as the reasons behind the rapid rise of Chinese electric vehicles. Amid aggressive overseas factory investments by Chinese automakers, there is also analysis suggesting that higher overseas labor costs compared to China could become an obstacle.

On the 1st, the Korean Academy of Leadership and Management (KALM) held a Global Competitiveness Forum at the Seoul Metropolitan Council Annex in Jung-gu, Seoul. The theme of the forum was "Chinese Electric Vehicle Ecosystem and Competitiveness, and Korea's Response Strategy." Attendees included Yang Jin-soo, Head of Hyundai Motor Mobility Industry Research Lab; Lim Eun-young, Senior Researcher at Samsung Securities; Park Jae-beom, Senior Researcher at POSCO Research Institute; and Park Jung-kyu, Adjunct Professor at KAIST Graduate School of Technology Management.

Yang, the first presenter, stated, "From Hyundai Motor's perspective, while the dominance of Chinese companies in the Chinese market is important, their overseas expansion based on this is an even greater threat." Last year, China surpassed Japan to become the world's top automobile exporting country. According to Hyundai Motor Mobility Industry Research Lab, the number of Chinese finished vehicles sold overseas is expected to reach 6.2 million units this year, a growth of more than six times in four years.

Yang added, "Due to the US-China trade conflict, it will not be easy for Chinese companies to enter the North American market, but they are highly likely to focus investments on localizing supply chains in ASEAN countries such as Thailand, Vietnam, and Indonesia."

There is also a view that in emerging markets like ASEAN, where electric vehicle infrastructure is not yet established, it will be difficult for Chinese electric vehicles to rapidly increase their penetration rate. Regarding this, Yang said, "Companies like BYD are competitive even in PHEVs. Chinese companies can penetrate the market without necessarily relying solely on pure electric vehicles."

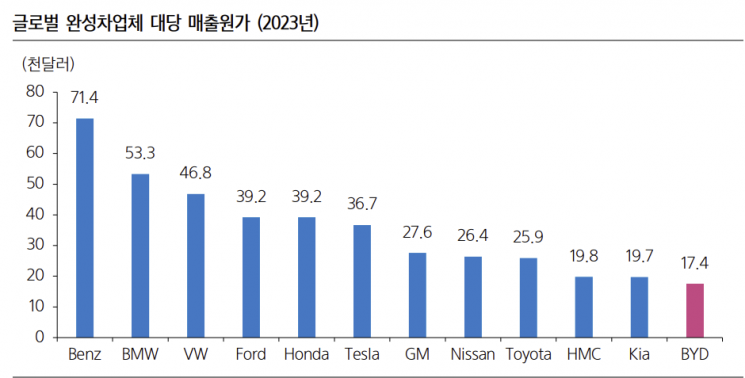

The second presenter, Researcher Lim, also focused on BYD's cost reduction strategy through parts internalization. According to Bloomberg's analysis of last year's global automakers' sales cost per vehicle, BYD recorded the lowest at $17,400 per unit among 12 automakers.

Compared to the highest, Mercedes-Benz ($71,400), it is about one-quarter. Among companies other than BYD, Kia ($19,700) and Hyundai Motor ($19,800) recorded relatively low sales costs. Researcher Lim said, "BYD's material costs are incredibly low because it internalizes and produces almost all parts, including batteries, engines, and power semiconductors."

However, there is a flaw in BYD's cost reduction strategy. While producing in China allows maintaining low cost rates due to cheap labor, expanding overseas production will increase local labor costs, making it difficult to maintain the current cost levels.

Lim said, "Last year, BYD had about 700,000 employees, while Kia had about 54,000. It is difficult for BYD to hire overseas workers at wages comparable to those in China." He added, "Also, BYD's payment terms to parts suppliers exceeding one year can be a burden for suppliers with weak liquidity. I think BYD might face significant difficulties as it expands overseas."

Meanwhile, mobility experts agreed that the smartization of Chinese electric vehicles and their software development capabilities pose a threat to Korean automakers. Yang said, "Chinese IT companies like Huawei and Xiaomi are rapidly growing by creating an ecosystem based on active partnerships." He added, "Chinese companies are growing through intense survival competition. Ultimately, the companies that survive will take the lead in electrification and SDV (software-defined vehicles)."

There was also an argument that Korean automakers, who excel in hardware (HW) technology, should learn from Chinese companies in software (SW) technology. Researcher Lim said, "It is difficult for Korea to catch up with China in SW technology. We could consider acquiring good Chinese SW companies and combining them with Korea's excellent HW to export."

On the 1st, participants attending the Korea Management Scholars Association Global Competitiveness Forum (China's Electric Vehicle Ecosystem and Competitiveness, Korea's Response Strategy) held at the Seoul Metropolitan Council Annex in Jung-gu, Seoul, are taking a commemorative photo.

On the 1st, participants attending the Korea Management Scholars Association Global Competitiveness Forum (China's Electric Vehicle Ecosystem and Competitiveness, Korea's Response Strategy) held at the Seoul Metropolitan Council Annex in Jung-gu, Seoul, are taking a commemorative photo. [Photo by Korea Management Scholars Association]

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)