Utilizing All Legal Authorities for Review, Investigation, Inspection, and Audit

Decision to Request Correction Report Within 10 Days

Unfair Trade Investigation Takes More Time

Severe Disciplinary Action Warned for Shinhan Investment Corp

The Financial Supervisory Service (FSS) is exercising its authority comprehensively regarding the management rights dispute at Korea Zinc and its rights offering. The FSS has stated its position to respond strictly to illegal activities such as the review of securities registration statements, investigations into unfair trading, inspections of rights offering underwriters, and accounting audits. In particular, if criminal issues are identified, the FSS plans to refer the cases to the prosecution.

On the afternoon of the 31st, Ham Yong-il, Deputy Governor of the Capital Markets and Accounting Division at the FSS, held a press briefing in Yeouido and said, "We have a firm stance that falsehoods, neglect, and manipulative acts will never be tolerated in our capital market, and we are maximizing the use of our legal authority in reviews, investigations, inspections, and audits," emphasizing this approach.

Review of Request to Amend Rights Offering Securities Registration Statement... Inspection of Mirae Asset Securities Also Underway

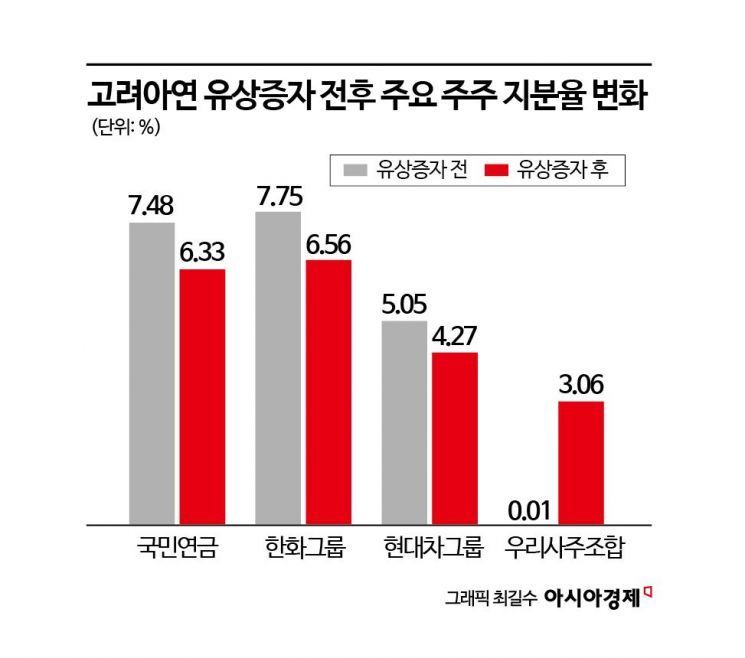

The FSS is expected to request an amendment to the rights offering securities registration statement submitted by Korea Zinc as early as next week. On the 30th, Korea Zinc announced that it would newly issue approximately 20% of its outstanding shares (3,732,650 shares) at 670,000 KRW per share through a public offering. The raised amount is 2.5 trillion KRW, of which 2.3 trillion KRW will be used to repay borrowings.

Following the announcement of the rights offering, critical voices emerged in the market. There are concerns that the company is borrowing money to gain a majority stake in the management rights dispute, and that shareholders will end up repaying the debt. Currently, the FSS's Disclosure Review Office is examining the securities registration statement. At the same time, an on-site investigation has begun into Mirae Asset Securities, the tender offer underwriter and rights offering lead manager.

Deputy Governor Ham explained, "We will check whether there are contradictions between the tender offer registration statement and the rights offering registration statement, whether any omissions were made knowingly, and the future plans. The inspection will be conducted promptly, but the investigation will take time as it involves analyzing trading patterns."

Whether the Rights Offering Was Planned During the Counter Tender Offer Is Also Key... Possible Unfair Trading

There has been a particular issue raised that Korea Zinc planned the rights offering before the completion of its own share tender offer but did not properly disclose this. If confirmed, this would constitute false statements in the tender offer registration statement and unfair trading, violating the Capital Markets Act.

Regarding this, Deputy Governor Ham said, "If the Korea Zinc board of directors proceeded knowing the plan to acquire treasury shares through borrowing and then cancel them, followed by converting to a rights offering, it means a significant matter was omitted from the existing tender offer registration statement," adding, "This is highly likely to be unfair trading." However, he noted that since proof is required, the FSS will verify the facts through investigation.

The FSS showed a cautious stance regarding the '3% subscription limit.' Korea Zinc set the subscription limit at a maximum of 3% per shareholder (including related parties) in the rights offering disclosure. The market interpreted this as a strategy to gather friendly shareholders during the rights offering process to secure a majority stake.

Lee Seung-woo, Deputy Director of the Disclosure Investigation Division at the FSS, said, "Designating related parties and limiting them to 3% is necessary. While there have been cases limiting subscription per subscriber before, this case includes related parties, so it requires review."

The FSS expects the Korea Zinc management rights dispute to continue and emphasized that it will handle the matter swiftly, considering its seriousness. Deputy Governor Ham stated, "This is a case where all FSS authorities?review, inspection, investigation, and audit?are mobilized," adding, "If criminal issues are identified, referral to the prosecution may be the first step."

"Strong Measures Will Be Taken Regarding Shinhan Investment Corp.'s ETF Losses"

The FSS also announced strict disciplinary measures regarding the recent controversy over losses in Shinhan Investment Corp.'s Exchange-Traded Fund (ETF) operations. Previously, Shinhan Investment Corp. disclosed that an employee incurred losses amounting to 135.7 billion KRW through on-exchange futures trading unrelated to the original purpose during the ETF liquidity provider (LP) operations. The FSS immediately launched an on-site investigation.

Deputy Governor Ham said, "There were false document reports and very poor concealment methods," adding, "Since there are significant design and operational issues, we have no choice but to take strong measures on this matter as well."

He emphasized, "If the risk or compliance control functions did not operate, it means horizontal controls also failed. When both vertical and horizontal controls fail simultaneously, this should be seen as a fatal design and operational problem of the company," interpreting this as a critique not only of individual misconduct but also of internal organizational controls.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.