One Year Since Dummy-sik Dumplings Launch... Sales Share Stays in the High 1% Range

"Short-Term Top Ranking Leap" Ambition Unfulfilled

Stagnant Domestic Market, Limitations of Relying Solely on Domestic Sales

Harim has yet to achieve significant results in the frozen dumpling market, where it ambitiously threw down the gauntlet. Contrary to its aspiration to capture a 10% market share within a year and rise to the top ranks in the related field, its sales share remained at the 1% level. Unlike major manufacturers who are seeking new opportunities by targeting overseas markets, Harim is competing solely in the domestic market, and with sales volume also stagnating, a challenging path is anticipated.

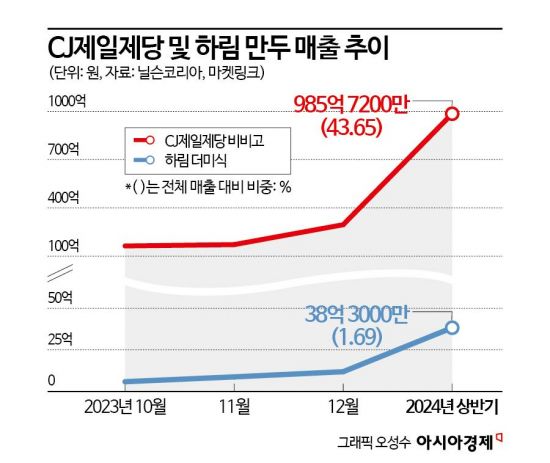

According to market research firms Nielsen Korea and Market Link on the 1st, Harim Industry's 'The Meatsik Dumplings,' launched in October last year, recorded sales of 3.83 billion KRW in the first half of this year based on domestic retail stores. During the same period, the total sales of the domestic convenience frozen dumpling market amounted to 225.821 billion KRW, making The Meatsik Dumplings' sales share about 1.69%. Except for November last year when the sales share reached 2.38%, the product has consistently stayed in the high 1% range and has been gradually declining. If a similar trend continues in the second half, the annual sales are expected to be around 8 billion KRW. This places it around the 10th position in the domestic frozen dumpling market, which was valued at 450 billion KRW last year.

The Meatsik Dumplings were launched with nine product lines, including gyoza, handmade dumplings, and pan-fried dumplings, emphasizing juiciness as a differentiating point. Harim stated that according to its own survey, 25% of frozen dumpling consumers tend to prefer dumplings full of juice, and it aimed to focus on targeting the relatively small juiciness dumpling market compared to demand. The product price was set 10-20% higher than competing brands on the market, adopting a premium strategy. Harim also presented a concrete goal to lead the juiciness dumpling trend and capture a 10% market share within a year, rising to the 2nd to 4th position in the industry.

One year has passed, but the company’s first-year sales target of 45 billion KRW is far from being met. It has also failed to significantly impact the upper ranks of the domestic frozen dumpling market. The industry leader CJ CheilJedang’s Bibigo maintained a market share of around 45%, with sales of 100.1 billion KRW in the second half of last year and 98.6 billion KRW in the first half of this year. Following that, representative products from other manufacturers such as Haitai, Pulmuone, Dongwon F&B, and Ottogi occupy the top five with half-year sales ranging from 10 billion to 20 billion KRW.

As the domestic frozen dumpling market continues to shrink, the space for The Meatsik Dumplings, which rely on the domestic market, is expected to become much narrower. The related market sales, which were 588.6 billion KRW in 2020, decreased by more than 22% to 458.1 billion KRW last year. Because of this, leading companies consider the domestic market saturated and are strengthening their overseas businesses. For example, CJ CheilJedang earns about 70% of the annual sales of over 1 trillion KRW from Bibigo dumplings overseas, including the United States and China.

Harim plans to actively promote the overseas expansion of its food brands in the future, but securing a foothold in the domestic market is urgent. The Meatsik ramen, introduced in 2021 with a premium focus, also had a negligible market share of less than 1% in the domestic ramen market, which was worth 2.4 trillion KRW last year. An industry insider said, "The domestic market structure for dumplings and ramen is already clear, and except for some top companies, most have difficulty exceeding single-digit market shares. In a situation where companies are rushing to enter overseas markets, it will not be easy for Harim, as a latecomer in these categories, to compete both domestically and internationally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)