Production down 0.3%... Decline in Manufacturing and Service Industries

Semiconductors Adjust Production Through Inventory Sales

Retail Sales Down 0.4% Due to Decrease in Non-Durables

Facility Investment Recovers While Construction Output Falls 0.1%

Q3 Total Industry Production and Consumption Also Decline

"Downside Risks to Economy Increased Compared to Early Year"

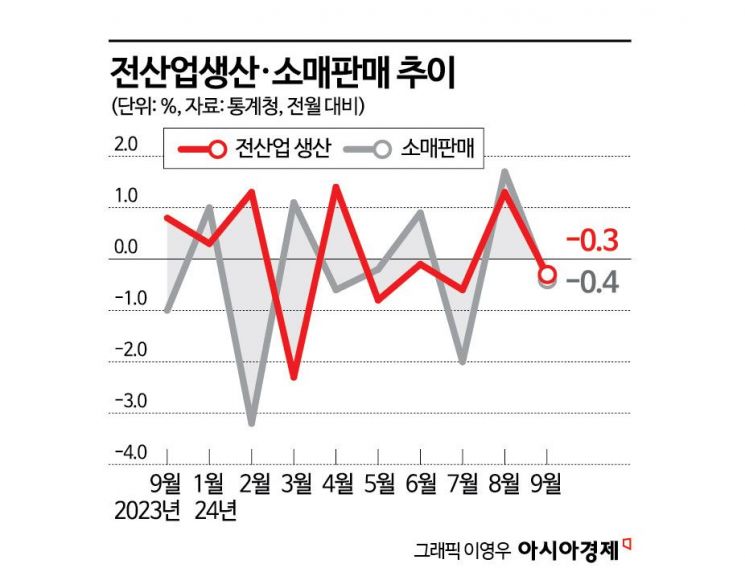

Last month, production and consumption both returned to a declining trend after a month. Total industrial production showed negative trends across manufacturing, construction, and services sectors, with semiconductor production decreasing. Facility investment recovered with an increase rate in the 8% range, but construction investment continued to show sluggish performance. The government has decided to respond actively, citing increased downside risks to the economy due to domestic and international uncertainties.

According to the 'September Industrial Activity Trends' released by Statistics Korea on the 31st, total industrial production last month decreased by 0.3% compared to the previous month. It had consecutively declined in May (-0.8%), June (-0.1%), and July (-0.6%), rebounded in August (1.3%), but then returned to a declining trend. This was due to reduced production in the services, manufacturing, and construction sectors.

Manufacturing production has fluctuated between increases and decreases this year. It increased in August (4.4%) but decreased last month (-0.2%). Construction production decreased by 0.1%, continuing a negative trend for five consecutive months since May (-4.6%). Service sector production had shown three consecutive months of growth since June (0.3%) but experienced a relatively large decline last month (-0.7%).

In manufacturing, production increased in machinery and equipment (6.4%), but decreased in semiconductors (-2.6%) and non-metallic minerals (-9.6%). Semiconductor production has fluctuated after a significant increase in June (8.0%), followed by decreases in July (-8.5%) and an increase in August (6.7%). In the service sector, production increased in wholesale and retail trade (0.9%) but decreased in health and social welfare (-1.9%) and professional, scientific, and technical services (-1.8%).

Gong Mi-sook, Director of Economic Trend Statistics at Statistics Korea, said, "Although production volume decreased in system semiconductors and silicon wafers, demand for high-spec memory semiconductors remains strong, and the growth level itself is satisfactory." Kim Gwi-beom, Director of Economic Analysis at the Ministry of Economy and Finance, explained, "There was high production in August, and in September, production was adjusted as shipments were made along with inventory."

Retail sales, which reflect consumption trends, decreased by 0.4% last month compared to the previous month. Retail sales have fluctuated monthly, recording the largest increase in 18 months in August (1.7%), but declined again last month. This was due to increased sales of durable goods such as passenger cars (6.3%), while sales of non-durable goods like food and beverages (-2.5%) and semi-durable goods such as clothing (-3.2%) decreased.

Investment showed mixed results by sector. Facility investment increased by 8.4% last month. It had increased in June (3.5%) and July (9.7%), dropped in August (-5.1%), and then recovered. Investment in transportation equipment decreased (-15.1%), but investment in machinery such as semiconductor manufacturing equipment increased (17.0%). Director Kim evaluated, "It appears that delayed investments from the first half of the year are being executed, showing a strong trend."

On the other hand, construction output continued its decline since May (-4.6%). However, last month (-0.1%) showed a smaller decrease compared to August (-1.9%). Construction output increased in civil engineering (9.9%) but decreased in building construction (-3.7%), including residential and non-residential buildings, resulting in an overall negative trend. Construction orders increased by 2.5% year-on-year but showed a slower growth rate compared to August (25.6%).

The coincident composite index's cyclical component fell by 0.1 points from the previous month to 98.1, due to decreases in construction output and retail sales indices. The leading index's cyclical component remained steady at 100.6.

For the entire third quarter, total industrial production decreased by 0.2% compared to the previous quarter, and the retail sales index declined by 0.5%. Facility investment increased by 10.1%, while construction output decreased by 4.2%. The Ministry of Economy and Finance assessed this as generally consistent with the third quarter's gross domestic product (GDP) trends. They explained that while total industry and manufacturing showed growth, facility investment and services rebounded, and construction declined.

Director Kim stated, "There was a temporary production shock due to the automobile strike in July, followed by a rebound in August to compensate for the shock, and normalization after the rebound in September." He added, "Although industrial activity trends and GDP figures are not identical, the overall trends are similar." Regarding the recent economic situation, he said, "Downside risks to the economy have increased compared to the beginning of the year due to domestic and international uncertainties," adding, "There is a high possibility that the growth rate will be lower than initially forecasted."

The government plans to closely monitor sectoral trends and respond actively while paying attention to domestic and international uncertainties such as the U.S. presidential election, major countries' economies, Middle East situations, and the business conditions of key industries. They will support key items such as semiconductors, petrochemicals, and secondary batteries, increase public investment in the second half of the year, and finalize plans to rationalize public construction costs within the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)