Strong Sales of Guaranteed Insurance Boost CSM↑

Digital Insurers Continue to Post Losses

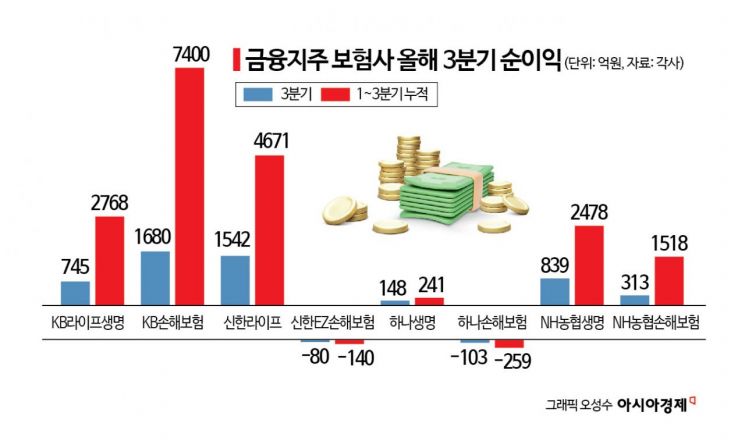

Insurance companies affiliated with domestic financial holding companies earned about 500 billion KRW in the third quarter of this year alone. However, digital insurance companies continued to incur losses.

According to the financial sector on the 31st, the combined net profit of eight insurance companies affiliated with the four major domestic financial holding companies (KB, Shinhan, Hana, NH Nonghyup) in the third quarter was 508.4 billion KRW, a 68.6% increase compared to the same period last year (301.4 billion KRW). This is the highest performance ever recorded for the third quarter. The cumulative net profit from the first to the third quarter reached 1.8677 trillion KRW.

The top net profit earner was KB Insurance, which earned 168 billion KRW in the third quarter alone. This is an 8.3% increase compared to the same period last year (155.1 billion KRW). KB Insurance's cumulative net profit from the first to the third quarter was 740 billion KRW, raising expectations for joining the 1 trillion KRW annual profit club this year. A KB Insurance official said, "Despite one-time costs due to voluntary retirement and an increase in automobile insurance accident rates, sales of long-term protection insurance increased due to the launch of competitive products," adding, "Net profit increased thanks to the overall improvement in loss ratios."

KB Life Insurance's net profit in the third quarter was 74.5 billion KRW, a 23.3% increase compared to the same period last year (60.4 billion KRW). The cumulative net profit from the first to the third quarter was 276.8 billion KRW, together with KB Insurance, another KB Financial Group-affiliated insurer, generating profits exceeding 1 trillion KRW. This accounts for 23% of KB Financial Group's net profit (4.3953 trillion KRW) for the first to third quarters this year. A KB Life Insurance official said, "The third quarter saw a sharp increase in new contract sales due to channel and product diversification strategies," adding, "The revision of protection products in major channels and the successful entry of dementia health insurance through the bancassurance channel expanded the sales proportion of protection insurance."

Shinhan Life Insurance posted a net profit of 154.2 billion KRW in the third quarter, a 33% increase compared to the same period last year (115.9 billion KRW). The cumulative net profit from the first to the third quarter was 467.1 billion KRW. Shinhan Life Insurance attributed the performance increase to company-wide business innovation. A Shinhan Life Insurance official stated, "As a result of the innovation strategies pursued since last year, the foundational strength of channels and the level of customer service are gradually improving."

Shinhan Financial Group's digital non-life insurer, Shinhan EZ Insurance, recorded a loss of 8 billion KRW in the third quarter. This loss widened from a 3.9 billion KRW loss in the third quarter of last year. The cumulative loss from the first to the third quarter this year was 14 billion KRW. Established in 2022, Shinhan EZ Insurance has continued to post losses every year, becoming a sore spot for Shinhan Financial Group.

Hana Life Insurance's net profit in the third quarter surged by 279.4% to 14.8 billion KRW compared to the same period last year (3.9 billion KRW). The cumulative net profit from the first to the third quarter was 24.1 billion KRW. The increase in sales of protection insurance was the main driver of the performance rise. A Hana Life Insurance official said, "In the fourth quarter, we will focus on developing new products and selling protection insurance to achieve stable growth."

On the other hand, Hana Financial Group's digital non-life insurer, Hana Insurance, posted a loss of 10.3 billion KRW in the third quarter. Compared to a loss of 18.9 billion KRW in the third quarter of last year, the loss decreased by 46%. The cumulative loss from the first to the third quarter this year was 25.9 billion KRW. Hana Insurance is making every effort to escape losses through portfolio improvement this year. It discontinued nearly half of its small-amount short-term insurance products, which are the main focus of digital insurance this year. Instead, it increased long-term protection insurance products that can raise the Contractual Service Margin (CSM).

NH Nonghyup Life Insurance's net profit in the third quarter was 83.9 billion KRW, a 139% increase compared to the same period last year (35.1 billion KRW). The cumulative net profit from the first to the third quarter was 247.8 billion KRW. Strong sales of protection insurance products such as 'Cancer Plus NH Treatment Insurance' and 'Treatment Cost Safety NH Health Insurance' led to the performance increase.

NH Nonghyup Non-life Insurance posted a net profit of 31.3 billion KRW in the third quarter, turning to profit from a loss of 46.2 billion KRW in the same period last year. The cumulative net profit from the first to the third quarter was 151.8 billion KRW. Improvements in general insurance business performance indicators, increased investment income, and better variance between expected and actual results contributed to the net profit increase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.