Driven by Improvement in Non-Interest Income Including Securities Valuation Gains

The third-quarter earnings of regional financial holding companies (BNK, DGB, JB) improved compared to the third quarter of last year, driven by an increase in non-interest income. However, in the case of DGB Financial, net profit declined due to the continued impact of provisions for real estate project financing (PF) by its affiliates.

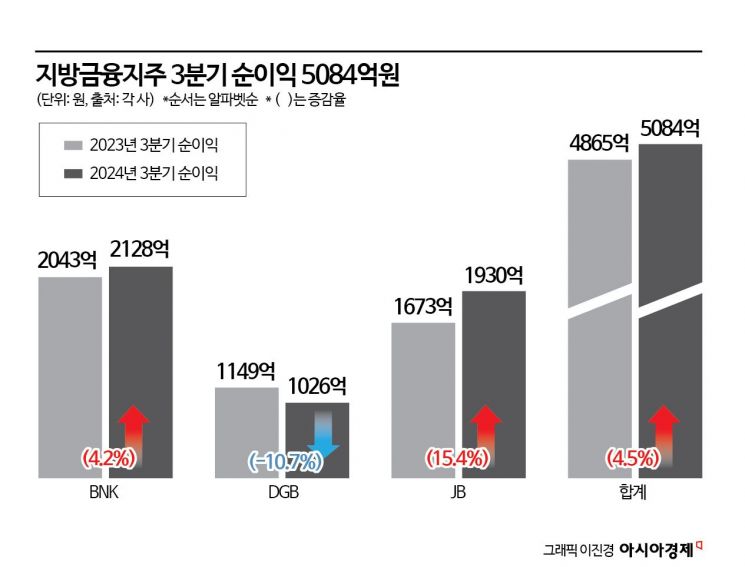

According to the financial sector on the 30th, the combined net profit of regional financial holding companies for the third quarter of this year was 508.4 billion KRW, a 4.5% increase from 486.5 billion KRW in the third quarter of last year. Both interest income and non-interest income grew, with non-interest income increasing significantly. The combined interest income of the three companies was 1.6568 trillion KRW in the third quarter, up 1.37% from 1.6344 trillion KRW in the third quarter of last year. Non-interest income recorded 200.3 billion KRW, a 10.8% increase from 180.8 billion KRW in the third quarter of last year.

Notably, the improvement in non-interest income among the five regional banks under the regional financial holding companies (Busan, Gyeongnam, iM, Jeonbuk, Gwangju) stands out. The combined non-interest income of these five regional banks was 51.8 billion KRW in the third quarter of this year, a 204.7% increase from 17.0 billion KRW in the third quarter of last year. A regional financial holding company official explained that this was due to a significant increase in gains related to marketable securities. The gains from marketable securities fluctuate greatly depending on market conditions. Compared to the third quarter of last year, the evaluation gains on marketable securities held by the holding companies’ affiliates increased due to reasons such as interest rate declines and exchange rates. In fact, the marketable securities-related gains of iM Bank, Gwangju Bank, and Jeonbuk Bank were 5.9 billion KRW, 5.7 billion KRW, and 2.9 billion KRW respectively in the third quarter of last year, but rose sharply to 24.2 billion KRW, 23.4 billion KRW, and 18.0 billion KRW in the third quarter of this year.

Looking at each holding company, the one with the largest increase in net profit was JB Financial Group. JB Financial’s net profit rose 15.4% from 167.3 billion KRW to 193.0 billion KRW. Following that, BNK Financial Group recorded 212.8 billion KRW, a 4.2% increase from 204.3 billion KRW in the same period last year. On the other hand, DGB Financial’s net profit decreased from 114.9 billion KRW in the third quarter of last year to 102.6 billion KRW in the third quarter of this year, a 10.7% decline.

The reason DGB Financial Group alone experienced negative growth is that its affiliate, iM Securities, continues to post losses due to provisions for real estate PF. iM Securities recorded a net loss of 34.6 billion KRW in the third quarter of this year. It has posted net losses for three consecutive quarters starting from the first quarter of this year. iM Securities set aside 187.4 billion KRW in provisions for real estate PF in the first half of this year and additionally reserved 61.3 billion KRW in the third quarter. A DGB Financial Group official stated, “Considering that iM Securities’ real estate PF exposure is managed within 50% of its equity capital and that approximately 500 billion KRW in loan loss provisions have been recognized over the past three years, we expect the securities company’s performance to recover substantially starting next year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.