Kang Seung-hyeop Appointed New CEO of Shinsegae Food

Financial Expert Including Head of Shinsegae Property Support Division

Focus on Core Business Strategies Like No Brand Burger and Better Meat

Expect Accelerated Restructuring Amid Sales Slump in Food Service Brands

Shinsegae Food, the food business affiliate of Shinsegae Group, has welcomed a financial expert as its new head. It is expected to accelerate its transformation into a profitability-focused structure by reorganizing some underperforming dining businesses and emphasizing B2B (business-to-business) operations, No Brand Burger, and alternative foods.

On the 30th, Shinsegae Group announced through its regular executive appointments that Kang Seung-hyeop, head of the support division at Shinsegae Property, has been appointed as the new CEO of Shinsegae Food. Kang is regarded as a 'financial expert' within the group. He joined Shinsegae in 1995, served as head of the audit team at the group strategy office in 2015, then held positions such as assistant managing director in charge of support at Shinsegae Construction in 2016 and assistant managing director in charge of management at E-Mart in 2017.

From 2019, he served as managing director in charge of finance at E-Mart, and in 2020, he was head of the support division and managing director in charge of finance at E-Mart. In 2022, he was promoted to executive director and concurrently served as head of the support divisions at E-Mart and Gmarket. At Shinsegae Property, the developer and operator of Starfield, he also held the roles of head of support and finance, effectively acting as the chief financial officer (CFO).

Upon his promotion to CEO of Shinsegae Food, he is expected to focus on strengthening the core businesses that generate results. Previously, since the appointment of former CEO Song Hyun-seok in 2021, Shinsegae Food restructured its portfolio to seek a turnaround in performance. A representative example is the large-scale reorganization of dining businesses with declining competitiveness. Until then, the company had focused on dining by launching Bonobono in 2006, Johnny Rockets, a handmade burger specialty store, in 2011, Korean buffet Olban in 2014, ice cream specialty store Oslo in 2015, and acquiring domestic and Vietnam business rights of Smoothie King in 2015. However, during the COVID-19 period, struggling with sales declines, it sold off or closed brands. Smoothie King, which is still operating recently, is also expected to cease operations after its contract expires next year. Smoothie King's sales, which were around 20 billion KRW in 2016, dropped by more than half to 8.2 billion KRW in 2021 and fell further to 6.1 billion KRW last year.

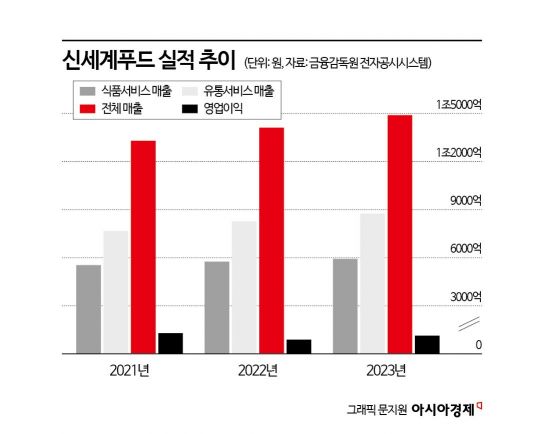

Instead, the food service sector, which accounts for about 40% of total sales including No Brand Burger and group catering, and the distribution service sector, which supplies bakery and food ingredients with about 60% sales dependency, maintain competitiveness. No Brand Burger, which has established itself as a cost-effective burger, started with 9 stores in 2019 and expanded to 198 stores nationwide last year. The distribution service sector, supplying home meal replacements (HMR) and bakery products to group companies such as Starbucks and E-Mart, has seen sales rise from 767.4 billion KRW in 2021 to 827.2 billion KRW in 2022 and 875.3 billion KRW in 2023. With sales reaching 472.3 billion KRW in the first half of this year, it is expected to surpass last year's annual performance if this trend continues.

Based on these businesses, Shinsegae Food's total sales over the past three years increased from 1.3293 trillion KRW in 2021 to 1.4113 trillion KRW in 2022 and 1.4889 trillion KRW in 2023. Operating profit fell from 30 billion KRW in 2021 to 20.6 billion KRW the following year due to COVID-19 but rebounded to 26.4 billion KRW last year.

The continuation of the alternative food business, which is being developed as a future growth engine, is also a point of interest. Shinsegae Food began research and development of alternative foods in 2016, launched the alternative meat brand 'Better Meat' in 2021, and introduced the plant-based alternative food brand 'You Are What You Eat' last year, entering related food manufacturing and dining operations. Although sales are still minimal, the company is focusing on expanding related menus and supply channels to capture the market. Recently, it agreed to collaborate with Korean Air C&D Service to provide in-flight meals using plant-based alternative foods for airlines.

An industry insider said, "This Shinsegae Group personnel reshuffle is characterized by executives who held key financial roles stepping forward to lead various affiliates." He added, "With the appointment of a financially savvy new CEO at Shinsegae Food, the company is expected to maximize profitability by concentrating capabilities on performing sectors and decisively reorganizing underperforming businesses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.