Korea Zinc Surpasses 1.5 Million KRW per Share

Breaks 1 Million KRW Mark in Just 3 Trading Days Since the 24th

Market Cap Ranking Jumps from 25th to 9th Early This Month

Steel ETF Returns Soar Alongside Korea Zinc Surge

The stock price of Korea Zinc, which has been soaring daily due to a management rights dispute, has surpassed 1.5 million KRW. The surge in stock price has also propelled its market capitalization ranking into the top 10. Despite the sluggish steel industry, the soaring stock price of Korea Zinc has led steel exchange-traded funds (ETFs) to also achieve high returns.

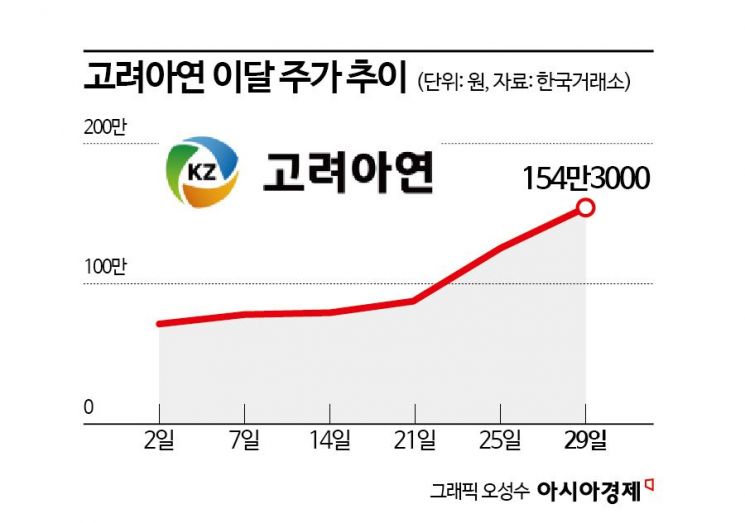

According to the Korea Exchange on the 30th, Korea Zinc closed at 1,543,000 KRW, up 18.6% from the previous session. This is an all-time high. Korea Zinc's stock price has been hitting record highs daily due to the management rights dispute. On the 24th, it hit the daily limit and surpassed 1 million KRW, and in just three days, it exceeded 1.5 million KRW.

The market capitalization ranking is also continuously rising along with the stock price surge. Korea Zinc, which was ranked 25th at the beginning of this month, has entered the top 10. On the 28th, it rose to 12th place, and in just one day, it jumped three spots to 9th place.

Korea Zinc's stock price has surged 124% this month. It is the second highest increase in the KOSPI market after YG Plus. Its market capitalization, which was 14.7 trillion KRW, has more than doubled to 31.9 trillion KRW.

The soaring stock price of Korea Zinc has also boosted steel ETFs. TIGER 200 Steel Materials has risen 33.6% this month through the previous day, recording the highest return among all ETFs. KODEX Steel followed with a 24.94% increase. Steel ETFs had shown a sluggish trend this year due to the continued downturn in the steel industry. Industry improvement is still distant. Moonseon Choi, a researcher at Korea Investment & Securities, said, "Global steel demand has been continuously declining since peaking in 2021," adding, "The decrease in demand from China, the largest steel consumer, is limiting global demand growth, and unlike suppressed demand, production remains steady, resulting in persistent oversupply. Unless there is artificial production reduction, the steel industry's oversupply will continue into next year."

The reason steel ETFs are soaring despite the bleak industry outlook is attributed to Korea Zinc. Both of these ETFs have a weighting of over 30% in Korea Zinc. In the case of TIGER 200 Steel Materials, Korea Zinc accounts for 31.73% of the market capitalization-based composition, and KODEX Steel accounts for 30.49%.

Although Korea Zinc was expected to be designated as an investment warning stock due to the rapid short-term price surge, the upward trend shows no signs of stopping. On the 28th, the Korea Exchange announced an investment warning designation for Korea Zinc, stating that its closing price on that day rose more than 45% compared to five days earlier, and designated it as an investment caution stock for two consecutive days on the 28th and 29th. If the rapid price increase continues, it may be designated as an investment warning stock, and if the upward trend persists, it could be designated as an investment risk stock. The Exchange's market alert system is divided into three stages: investment caution → investment warning → investment risk. Investment warning stocks cannot be purchased on margin loans, and 100% of the purchase margin must be paid when buying. If designated as an investment risk stock, trading will be suspended for one day on the day of designation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)