Korea Zinc Urgently Convenes Board Meeting... Discusses Revival of Voting Rights for 1.4% Existing Treasury Shares

MBK Claims "Support for Employee Stock Ownership Association to Defend Management Rights Is Illegal"

Amid Management Dispute, Korea Zinc Stock Surpasses 1.5 Million KRW, Ranks 10th in KOSPI Market Cap

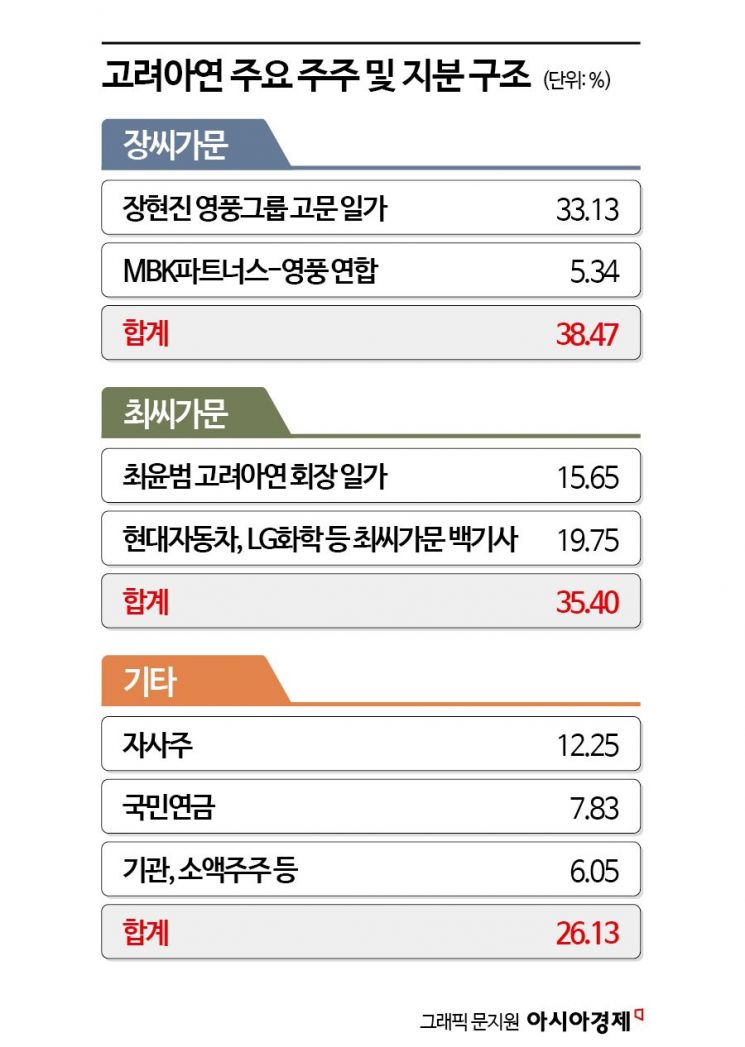

The management rights dispute at Korea Zinc has entered the second round, focusing on a showdown over voting rights shares at the shareholders' meeting, with both sides fiercely competing to increase their voting rights ratio even slightly.

According to the investment banking (IB) industry on the 30th, Chairman Choi Yoon-beom of Korea Zinc held an emergency board meeting on the same day to discuss measures to defend management rights. At this meeting, Korea Zinc decided to pursue a plan to transfer about 1.4% of its treasury shares to the employee stock ownership association to revive voting rights.

In May, Korea Zinc signed a trust contract for acquiring treasury shares and indirectly holds 289,703 shares of treasury stock (about 1.4%). Treasury shares do not have voting rights, but if these shares are transferred to the employee stock ownership association, the voting rights are restored.

Although all treasury shares acquired through this tender offer will be canceled, the strategy is to revive some of the previously held treasury shares (2.4%) to expand the voting rights stake. If this agenda passes the board meeting, Chairman Choi and his allies' voting rights stake will increase to 36.8%. This narrows the gap to MBK and Youngpoong's already secured stake (38.47%) to just 1.67 percentage points.

Korea Zinc's 1.4% treasury shares are worth about 430 billion KRW based on the closing price on the 29th. This amount is comparable to Korea Zinc's total annual labor costs. In response, MBK stated, "In the legal community, there are concerns that transferring treasury shares to the employee stock ownership association in this way could constitute breach of trust." They argued, "Supporting the employee stock ownership association to secure stable shareholders for the purpose of preserving the existing management's position during a management rights dispute is an illegal act." According to Supreme Court precedents, using employee stock ownership to maintain management rights by some executives in a shareholder stake competition situation is judged as breach of trust in the course of business, and this has already been firmly accepted as legal doctrine.

While asserting the illegality of Korea Zinc's treasury share voting rights revival strategy, MBK has also begun preparations for the proxy battle at the extraordinary shareholders' meeting by selecting proxy agencies to gather voting rights from other shareholders. An MBK representative said, "We are in the process of selecting proxy agencies and plan to select several." MBK also appears to be steadily purchasing shares circulating in the market. Looking at the top securities firms by purchase volume over the past five trading days, NH Investment & Securities ranks first with a trading volume of 100,000 shares. Previously, the MBK alliance conducted the Korea Zinc tender offer through NH Investment & Securities. Meanwhile, on the 29th, Korea Zinc closed at 1,543,000 KRW, up 242,000 KRW (18.6%) from the previous trading day on the KOSPI market. With a market capitalization of 31.9452 trillion KRW, it ranked 10th on the KOSPI.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)