Government Announces Response Measures to Revised Tax Revenue Estimates

Transfer Tax and Grants Expected to be Reduced by 6.5 Trillion Won

Budget Unused Funds Estimated at 7 to 9 Trillion Won

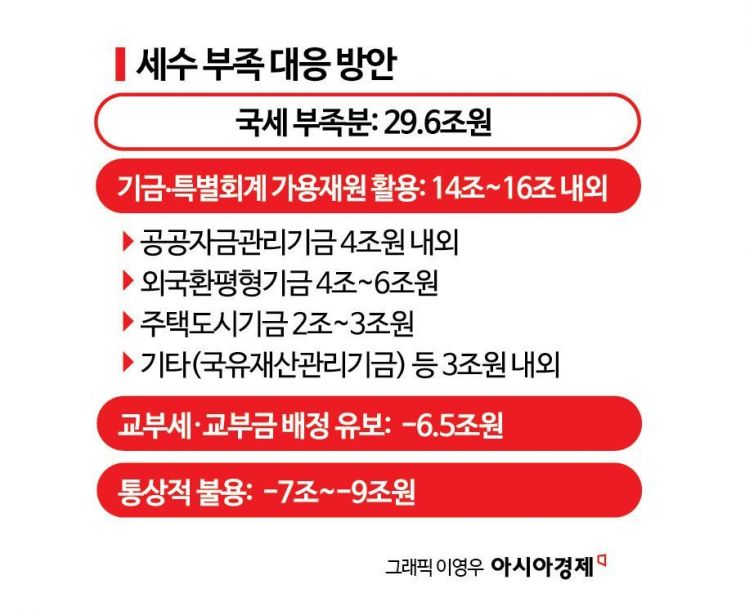

The government plans to mobilize all available funds to cover the expected tax revenue shortfall of 29.6 trillion won this year, while also reducing the local allocation tax and local finance education grants distributed to local governments. In particular, it will once again utilize the Foreign Exchange Equalization Fund (Oepyeong Fund) following last year, and also make use of the Housing and Urban Fund resources, which are financed by subscription savings.

On the 28th, the Ministry of Economy and Finance announced the "Fiscal Response Plan According to the 2024 Tax Revenue Re-estimation" containing these details. As previously declared, the government decided to cover the tax revenue shortfall without preparing a supplementary budget by fully mobilizing surplus funds from various funds. The government stated it will utilize surplus government funds such as the Public Fund Management Fund (Gongjag Fund, around 4 trillion won), the Oepyeong Fund (4 to 6 trillion won), and the Housing and Urban Fund (2 to 3 trillion won). Along with a reduction of 6.5 trillion won in local taxes and dues due to the decrease in national taxes, the unused budget this year is expected to be between 7 trillion and 9 trillion won.

The government decided to reuse the Oepyeong Fund, which was used as a relief measure to cover last year's tax revenue shortfall. This year, it will reduce the deposit amount transferred from the Gongjag Fund to the Oepyeong Fund by about 4 to 6 trillion won. Last year, the government early repaid nearly 20 trillion won from the Oepyeong Fund to the Gongjag Fund and transferred it to the general account to cover the tax revenue deficit.

The government explained that the reason for reusing the Oepyeong Fund is to reduce the scale of cuts in local allocation tax and grants. Approximately 40% of domestic taxes are automatically allocated to local allocation tax (19.24%) and grants (20.79%), which are calculated based on revenue. When national taxes decrease more than expected, the grants are adjusted downward accordingly. Ryu Jung-jae, Director of the Treasury Division at the Ministry of Economy and Finance, said, "There were significant concerns about local allocation tax and grants during the recent national audit," adding, "Originally, local allocation tax and grants should have been reduced by 9.7 trillion won, but to minimize this reduction, funds were needed, making it unavoidable to utilize the Oepyeong Fund."

The Oepyeong Fund was established to stabilize the foreign exchange market and is used to mitigate exchange rate volatility. Last year, the government decided to use 38 trillion won from the Oepyeong Fund for the general account this year, and this plan adds an additional 4 to 6 trillion won. Concerns have been raised that using the Oepyeong Fund for two consecutive years may weaken its function to stabilize the exchange rate. In response, the Ministry of Economy and Finance explained that the stability of the Oepyeong Fund is sufficiently secured. Kim Hee-jae, Director of the Foreign Currency Fund Division at the Ministry, emphasized, "The total assets of the Oepyeong Fund, combining Korean won and foreign currencies, amounted to 274 trillion won as of last year's year-end settlement," and added, "There is no shortage in the capacity to respond using the Oepyeong Fund."

The government will also utilize 2 to 3 trillion won of surplus resources from the Housing and Urban Fund. The Housing and Urban Fund supports the construction of public rental housing and financing for low-income housing, and is managed by the Housing and Urban Guarantee Corporation (HUG). Subscription savings, which are a qualification condition for pre-sale participation, are a representative source of funds. Kim Kyung-guk, Director of the Budget Policy Division at the Ministry of Economy and Finance, said, "Starting next month, the recognized monthly payment for public sale will be increased from the existing 100,000 won to 250,000 won, and the interest rate on subscription savings accounts will be raised by 30 basis points (1bp = 0.01 percentage points), so there are sufficient surplus resources," adding, "Expanding deposits to the Gongjag Fund by about 2 to 3 trillion won will not significantly affect soundness."

Additionally, the government plans to secure about 3 trillion won from other funds such as the National Property Management Fund (around 300 billion won). The estimated amount of deferred allocation for local allocation tax and grants is about 6.5 trillion won. The government explained that this estimate comprehensively considers the availability of funds such as the Fiscal Stabilization Fund and the expansion of local consumption tax and other local tax revenue situations. The government believes that local governments have about 7 trillion won in available resources, including the Integrated Fiscal Stabilization Fund, and that local tax revenue is showing a stabilization trend, so there is no problem with funding. Furthermore, the unused budget this year is expected to be between 7 trillion and 9 trillion won, which is within the usual range.

This measure does not affect the national debt scale as it utilizes internal government funds without issuing government bonds. However, the quality of debt may deteriorate. This is because financial debt may be converted into deficit debt during the process of utilizing the Oepyeong Fund. Director Ryu said, "There may be a change in the ratio where financial debt decreases and deficit debt increases," but added, "However, considering that if surplus resources are not utilized, issuing treasury bonds could cause a net increase in deficit debt."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.