Maintaining Overseas Subsidiaries' Sales Ratio Above 60%

Strong Sales in China, Vietnam, Russia, etc.

Strengthening Local Facility Investments

Chunjeol and Tet Holiday Demand Fully Reflected from Q4

Orion is aiming to join the '3 trillion won club' in annual sales, a benchmark for large companies in the food industry. This is because its overseas business, which accounts for more than 60% of total sales, is offsetting the sluggish domestic market performance. With its main markets, China and Vietnam, likely to see increased demand for gift confectionery from the end of this year ahead of the New Year holidays, and some products expanding into Europe, annual sales are expected to rise.

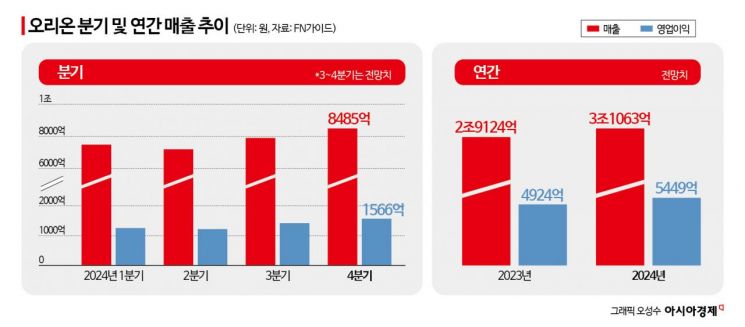

According to related industries and financial information firm FnGuide on the 24th, Orion's consensus for the third quarter performance this year (market average forecast) is sales of 790.1 billion won, up 3.1% from the same period last year, and operating profit of 141.5 billion won, up 0.6%. Reflecting this, cumulative sales up to September are expected to be 2.2578 trillion won, with operating profit of 388.3 billion won.

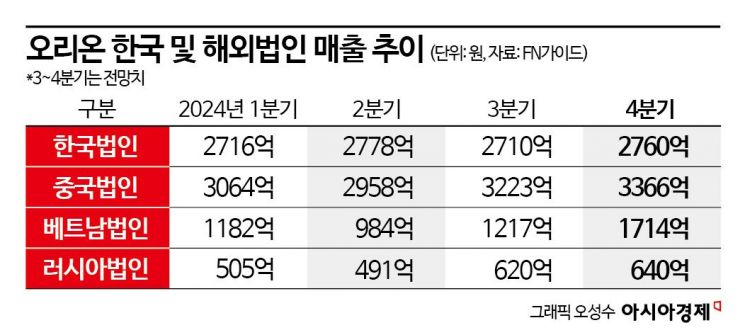

In the securities industry, considering Orion's past trend of traditionally higher fourth-quarter performance, it is expected to enter the 3 trillion won range in annual sales for the first time this year. The annual expected sales amount is 3.1063 trillion won. The rebound was led by overseas subsidiaries in China, Vietnam, and Russia. Sales of these overseas subsidiaries accounted for 1.4244 trillion won, or 63.1% of the total, up to the third quarter. Since transitioning to a holding company structure in 2017, Orion has maintained an overseas sales ratio of around 65% annually.

Investment in overseas subsidiaries is also being strengthened. In July, Orion invested 20 billion won to install a new production line for potato flakes, the raw material for products such as Oh! Gamja, Yegam, and Goraebab, which account for about 40% of the total sales of the China subsidiary, at the Shenyang factory near the directly managed potato farm in Inner Mongolia. The Vietnam subsidiary plans to expand and extend the Yen Phong factory in Hanoi within the year and secure sites for new factory construction in Hanoi and Ho Chi Minh City. The Russian subsidiary has also increased production as the Choco Pie line, expanded at the end of last year, began operation.

The securities industry expects that overseas subsidiary sales will be fully reflected in Orion's sales from the fourth quarter this year, ahead of the Lunar New Year celebrations such as the Chinese Spring Festival and the Vietnamese Tet holiday. During this period, sales of the Korean subsidiary are expected to decrease by 0.2% year-on-year to 276 billion won, while the China subsidiary is forecast to increase by 17% to 336.6 billion won, the Vietnam subsidiary by 9.2% to 171.4 billion won, and the Russian subsidiary by 23.1% to 64 billion won. An Orion official said, "Since demand for the Chinese and Vietnamese holidays is usually reflected from November, we expect overseas sales to increase in the fourth quarter."

Orion is also focusing on expanding markets in new subsidiaries such as India and the United States. The India subsidiary introduced new products tailored to local tastes based on an additional pie production line established at the end of last year. The U.S. subsidiary plans to consider establishing a local production plant if annual sales of the single product Kkobuk Chip exceed 40 billion won. Kkobuk Chip officially entered Europe last month by supplying initial quantities to 31 Costco stores in the UK, Sweden, and Iceland. It is currently exported to more than 20 countries including the U.S., Australia, and Canada. Launched in 2017, this product has accumulated global sales of 500 billion won over seven years.

Meanwhile, as of last year, nine food companies have joined the 3 trillion won club in annual sales: CJ CheilJedang (29 trillion won), Dongwon F&B (4.3608 trillion won), Daesang (4.1075 trillion won), Lotte Wellfood (4.0664 trillion won), Ottogi (3.4545 trillion won), SPC Samlip (3.4333 trillion won), Nongshim (3.4106 trillion won), Lotte Chilsung Beverage (3.2247 trillion won), and CJ Freshway (3.0742 trillion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.