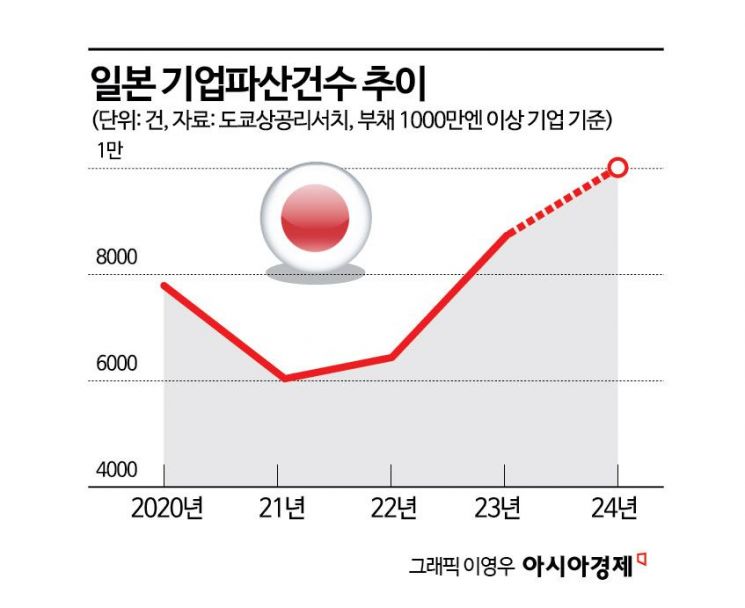

A wave of bankruptcies among so-called 'zombie companies' that have long survived on low-interest loans in Japan is becoming a reality. The number of corporate bankruptcies exceeded 5,000 for the first time in 10 years in the first half of this year, and it is expected to surpass 10,000 on an annual basis.

The so-called "zombie companies" in Japan, which have long survived through low-interest loans, are now facing a wave of liquidation. [Image source=Getty Images]

The so-called "zombie companies" in Japan, which have long survived through low-interest loans, are now facing a wave of liquidation. [Image source=Getty Images]

On the 21st (local time), Bloomberg News reported, citing a Tokyo Shoko Research report, that corporate bankruptcies centered on zombie companies are rapidly increasing in Japan, which ended its negative interest rate policy earlier this year. According to the report, corporate bankruptcies in the first half of fiscal year 2024 (April to September) reached 5,095 cases (with debts exceeding 10 million yen), a 17.8% increase compared to the same period last year. Surpassing 5,000 cases is the first time since the first half of 2014 (5,049 cases).

The problem is that corporate bankruptcies are expected to continue increasing. Tokyo Shoko Research forecasts that if the current trend continues, the annual number of corporate bankruptcies will exceed 10,000 for the first time in 11 years since 2013 (10,855 cases). This represents a double-digit increase compared to last year (8,690 cases). The report expressed concern, stating, "The end of the year is a period when corporate funding demand becomes active. Companies with slow performance recovery, as well as those unable to secure new funds, may face the reality of profitable bankruptcies."

In Japan, there have been ongoing expectations that the end of the Bank of Japan's (BOJ) negative interest rate policy in March and the start of a full-fledged rate hike cycle could lead to a wave of bankruptcies among zombie companies. As companies face increased cost burdens, zombie companies that cannot even cover bank interest are expected to eventually reach their limits.

Tokyo Shoko Research also stated in another report that "if the benchmark interest rate rises by 0.1 percentage points, the proportion of zombie companies could increase from 15.35% to 17.18%," adding, "Although a slight rate hike does not immediately force companies out of the market, even a small increase in interest rates can have serious repercussions." The BOJ, which kept rates steady last month, is expected to implement additional rate hikes of up to 0.5 percentage points between January and March next year.

However, there is also analysis suggesting that the bankruptcy of zombie companies could play a positive role in the Japanese economy. Nicholas Smith, strategist at CLSA Securities Japan, told Bloomberg News, "The cleanup of zombie companies is not such a bad thing. It can open new paths for healthy companies." Naoki Hatori, chief economist at Mizuho Research & Technology, also stated, "An increase in bankruptcies is inevitable." Currently, about 14% of listed companies in Japan are identified as zombie companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)